A crypto-currency primer: Bitcoin vs. Litecoin

In my previous post on How to mine Bitcoin on your Mac I discussed how to mine crypto-gold on your Mac. Before diving in, I wanted to lay down a framework on the basics of Bitcoin (BTC) and its easier-to-mine competitor, Litecoin (LTC).

Since investing in dedicated Bitcoin mining hardware (ASICs) I've mostly ignored other competing crypto-currencies until now. Although Bitcoin is the media darling, Litecoin is a better option for the average user wanting to get into crypto-currency mining.

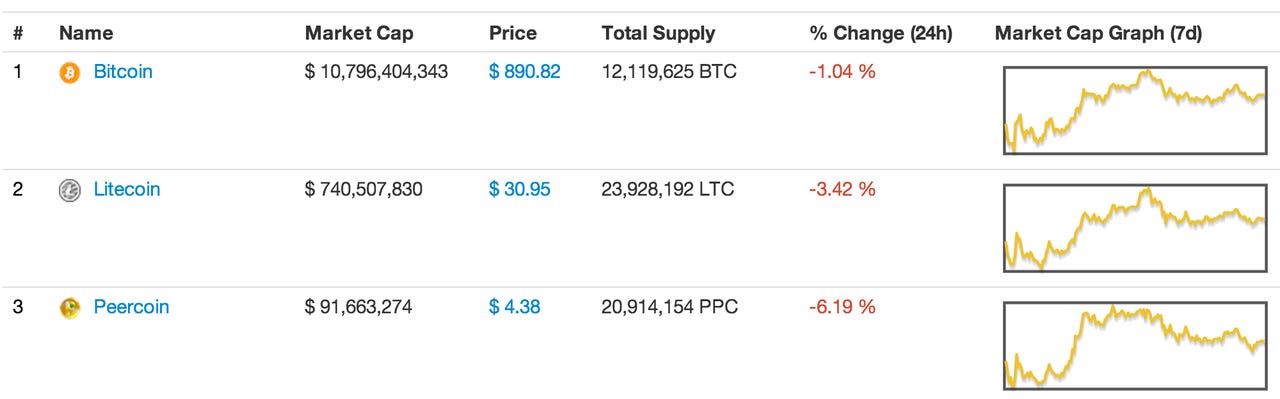

As I mention in my mining post, Bitcoin mining isn't cost effective without expensive, dedicated mining hardware. However Litecoin, the second largest crypto-currency by market cap, is exponentially easier to mine with the Mac that you're reading this on right now. And at around US$30/LTC, it's more affordable to outright purchase too.

Bitcoin

Before I get into Litecoin a brief history of Bitcoin (BTC) is in order. For background I recommend the original paper (PDF) by Satoshi Nakamoto proposing Bitcoin.

Bitcoin was revolutionary when it was created. The idea behind "mining" coins as a way to validate transactions and at the same time reward early adopters was brilliant. It quickly strengthened the network and took care of distributing coins to interested parties. Mined coins on the network are distributed to whomever presents the solution first. As soon as it got competitive, people started mining pools whereby the pool instead presents the winning solution to the network, receives the reward, and redistributes to everyone in the pool. Most people prefer this since they'll at least receive something.

For Bitcoin mining, if your computer can do this calculation faster than anyone else, you represent a greater share of the work going towards each solution. However, the rate of coins being distributed is roughly constant, so more people involved means less for everyone participating. (My Mac mining client of choice these days is Asteroid. It's lightweight, has a clean UI and MobileMiner support. More on Asteroid in a future post...

The particular algorithm chosen by the bitcoin developers was SHA-256. First CPUs were used to calculate it. Then someone found a way to execute this algorithm faster on GPUs. Then eventually, someone designed an application-specific-integrated-circuit (ASIC) that takes a specific input, calculates it, and spits out the result, repeatedly and forever. The latter is of course the most efficient, and is where we stand today.

Litecoin

A group of people saw this hardware race as detrimental, and sure enough we see the effects of it -- namely expensive/risky hardware on an quickly rising difficulty level. Thus it's very difficult to continue participating without large investments to stay ahead. This group of people proposed a new coin type -- Litecoin (LTC) -- that relied on an algorithm that would be resistant to a rapidly escalating hardware race, one that needed fast memory and lots of it. These components are more expensive and present a serious barrier to entry for a Litecoin ASIC that would be economical.

Update: The Fibonacci project is a Scrypt (Litecoin) ASIC project that's currently in development. It looks like Litecoin mining hardware is coming to market after all.

Litecoin also has four times as coins scheduled to be mined (84 million versus bitcoin's 21 million), which may make it more accessible to future participants. Perhaps not though, as both coin types can be subdivided to eight decimal places. Litecoin also does not have much of a point-of-sale market, nor online market, yet, outside of exchanges. But that said, it will be easy to accept Litecoin in a world that also accepts Bitcoin (since the technologies are nearly identical), so the ending on how this all plays out certainly hasn't been written yet.

Most Litecoiners interested in short-term gain will sell their coins on an exchange for BTC or USD. Long-term investors may be sitting on their coins for years before they consider spending them, to watch how/if their value changes and hoping for a Bitcoin-like rise.

After Bitcoin and Litecoin, there's a huge drop-off in quality. All of other crypto-currencies (a.k.a. "altcoins") are essentially tweaks to Bitcoin and Litecoin that use either one of those two mining algorithms. From an investment perspective, they're even riskier than BTC and LTC. Many people compare altcoins to penny stocks due to their very high volatility. There have even been a number pump-and-dump schemes on these coins lately to take advantage of people who may have invested in them.