Are operators ready to handle LTE?

Transaction management firm Openet's research surveyed 200 worldwide operators on the future of mobile data billing.

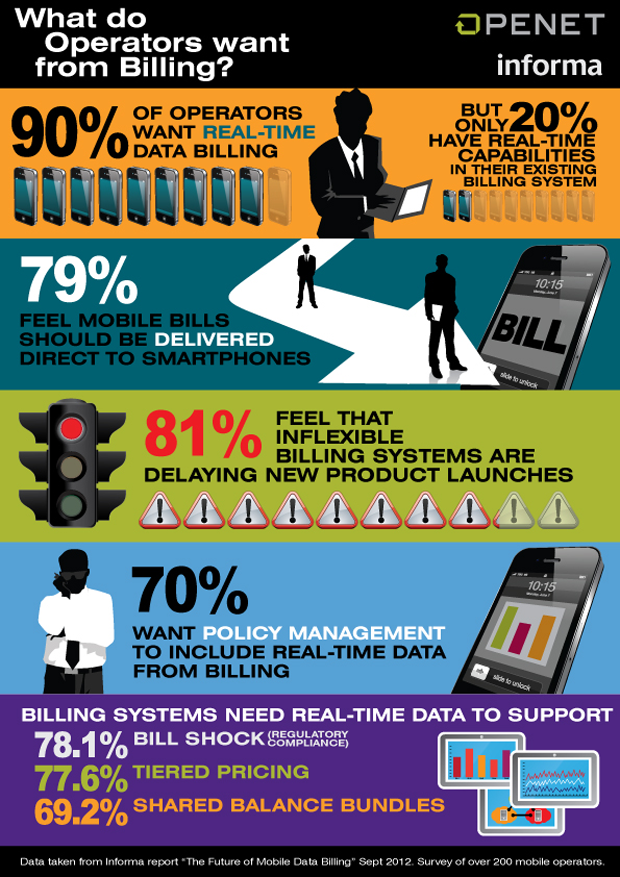

Mobile operators reported that in order to maximize revenue from data services, more sophisticated pricing and billing systems and system are necessary. A key problem revealed by the research is that 90 percent of respondents feel they need a real-time approach to mobile data billing, whereas only 20 percent of operators currently have the facility.

94 percent felt that the availability of real-time data is "important" or "very important" in order to apply network controls, especially as the industry moves towards LTE -- networks designed for data rather than voice services.

LTE has long been considered more efficient than its predecessors, as it offers lower data transport costs, but revenue streams are unlikely to exceed 3G. Therefore, operators need real-time data not only to adhere to consumer demand, but to find ways to make LTE pay.

Mobile operators reported that maximizing revenue from data service requires more sophisticated pricing and billing systems and strategies. Almost 80 percent of respondents indicated their existing post-paid billing system did not provide real-time data collection and rating capabilities. Nearly 90 percent said these capabilities were important, especially as operators would like to offer time-sensitive deals to consumers -- opening a new revenue stream in the process.

Operators said that their LTE networks are ready, but respondents were "unsure" how best to generate revenue streams from the technology -- and are not full prepared to deal with subscriber billing efficiently. 81 percent said that current, non LTE-ready billing systems are delaying product launches, and 78 percent wanted new billing systems to prevent "bill shock" -- the painful experience at the end of the month when a customer has gone past their allowance.

In addition, the survey found:

- 69 percent want to upgrade to support shared data packages;

- 70 percent want policies to include real-time data from billing;

- 65 percent of operators said it "should be possible" to treat a subscriber as prepaid or post-paid depending on the service.

Not only would real-time data give marketing departments more opportunity to drive offers, but it would put consumers in better control of their data consumption. However, paper billing would need to evolve with new systems, and while many operators offer internet sites to manage bills, 79 percent feel bills should be sent directly to mobile devices via an application or portal.

Determining how to price and bill data services is a pressing issue for operators at the moment as LTE picks up speed. However, this can't be effective unless real-time data is integrated with policy infrastructure, so not only are consumers aware of how much data they are using, but operators can maximize any revenue stream the network offers.