Adobe makes cloud turn goes well in Q4, outlook light

Adobe's fourth quarter results highlighted how the company has managed a transitioning to cloud and services subscriptions well, but its outlook was lower than expectations.

The company on Friday reported fourth quarter earnings of $65.32 million, or 13 cents a share, on revenue of $1.04 billion. Non-GAAP earnings for the quarter were 32 cents a share.

Wall Street was looking for fourth quarter earnings of 32 cents a share on revenue of $1.03 billion.

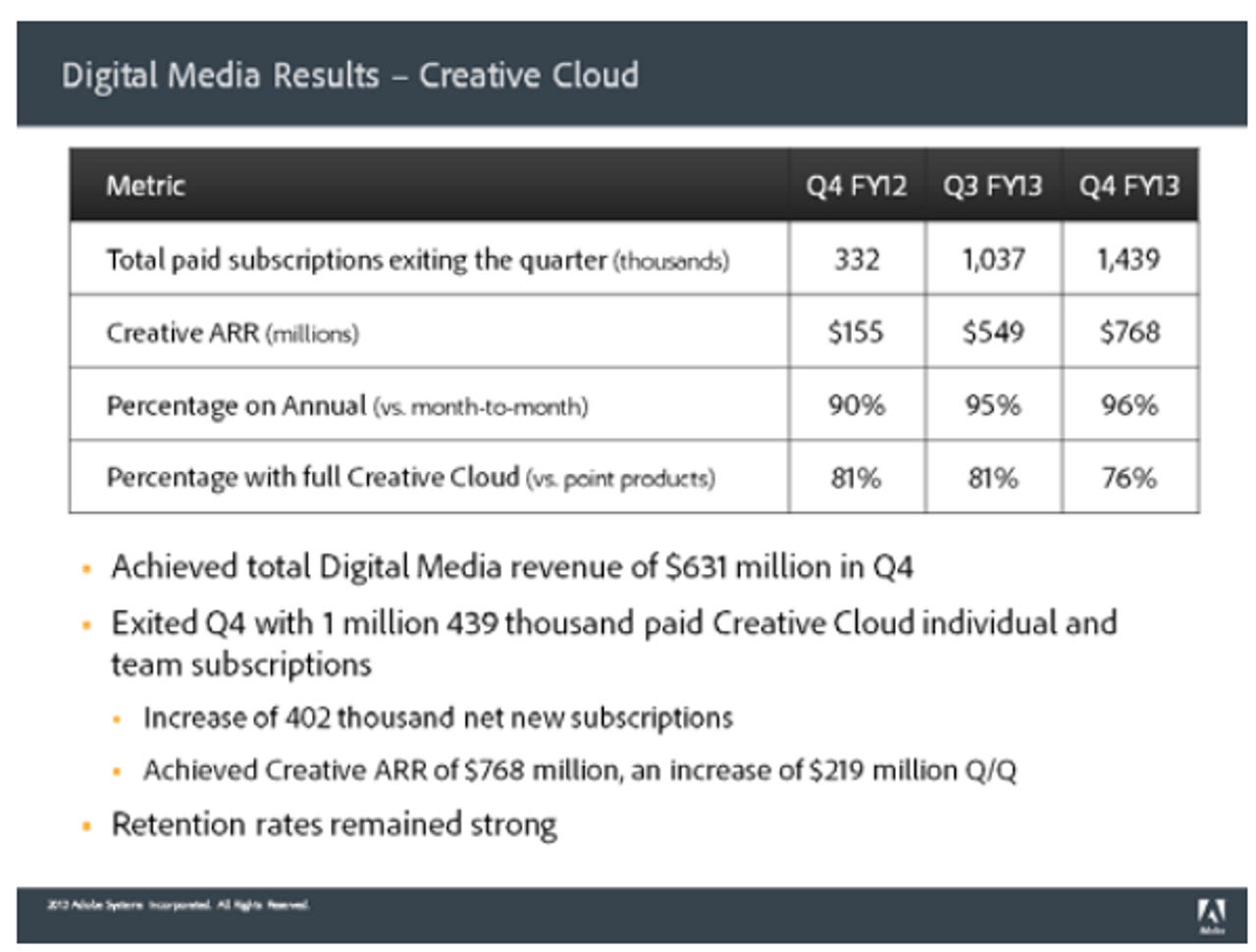

In the fourth quarter, Adobe ended with 1.44 million Creative Cloud subscriptions, up 402,000 from the third quarter. Enterprises continue to tap into Adobe's subscriptions.

For the year, Adobe grew Creative Cloud subscriptions by 1.1 million. The company reported fiscal 2013 revenue of $4.05 billion, down from $4.4 billion in fiscal 2012. Adobe reported an annual profit of $290 million, or 56 cents a share, down from $832.78 million, or $1.66 a share, in 2012.

Research and development spending in fiscal 2013 was $826.6 million, up from $742.8 million a year ago.

Those figures highlight the cloud transition to some degree. Adobe is holding the fort on revenue, but as its dependence on licensing revenue wanes so does its big bang revenue potential.

Here's Adobe's outlook in depth:

The problem is that those expectations are below projections. Adobe projected first quarter revenue of $950 million to $1 billion with earnings of 22 cents a share to 28 cents a share. Wall Street was looking for 33 cents a share in earnings for the first quarter.

The Evolution of Enterprise Software

In prepared remarks, Adobe CEO Shantanu Narayen said that the company's marketing cloud revenue topped $1 billion.

CFO Mark Garrett explained that Adobe is trading booked revenue for annualized recurring revenue, which indicates more of a subscription based model. Garrett said:

Given the transition to subscription with Creative Cloud has gone more quickly than anticipated, we expect more ARR and less perpetual revenue in FY14 than we last forecast. We now expect FY14 will be the last year of any meaningful Creative perpetual revenue, and Creative reported revenue will decline year-over-year as we grow Creative ARR to $1.6 billion. Our Creative ARR target is based on growing Creative Cloud subscriptions to 3 million by year end, and includes DPS. We also expect to overachieve the 4 million subscription target we had originally set for the end of FY15.