Alibaba's $1 billion IPO: The numbers to know

Tech IPOs continue to crop up (and stall) this year, but Alibaba is going for the big money anyway with its latest paperwork.

After confirming its intent to go public in the U.S. market back in March, the Chinese e-commerce giant filed its F-1 with the U.S. Securities and Exchange Commission after the bell on Tuesday.

In what many analysts and media organizations are already projecting to be one of the biggest public debuts ever regardless of industry, the IPO looks to be worth roughly $1 billion with predictions that figure could climb as high as $20 billion.

Bloomberg reported that Alibaba's market value is $168 billion, which would make it the most valuable Internet company after Google, according to the news agency's calculations.

Underwriters include Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan, Morgan Stanley, and Citigroup.

There were a few information gaps in the form, namely a ticker symbol or the intended Wall Street exchange.

In the last month, Alibaba has made a number of moves to bolster its bottom line while courting Wall Street as well as Silicon Valley, from stocking up on patents to opening the doors to a new cloud data center in Beijing.

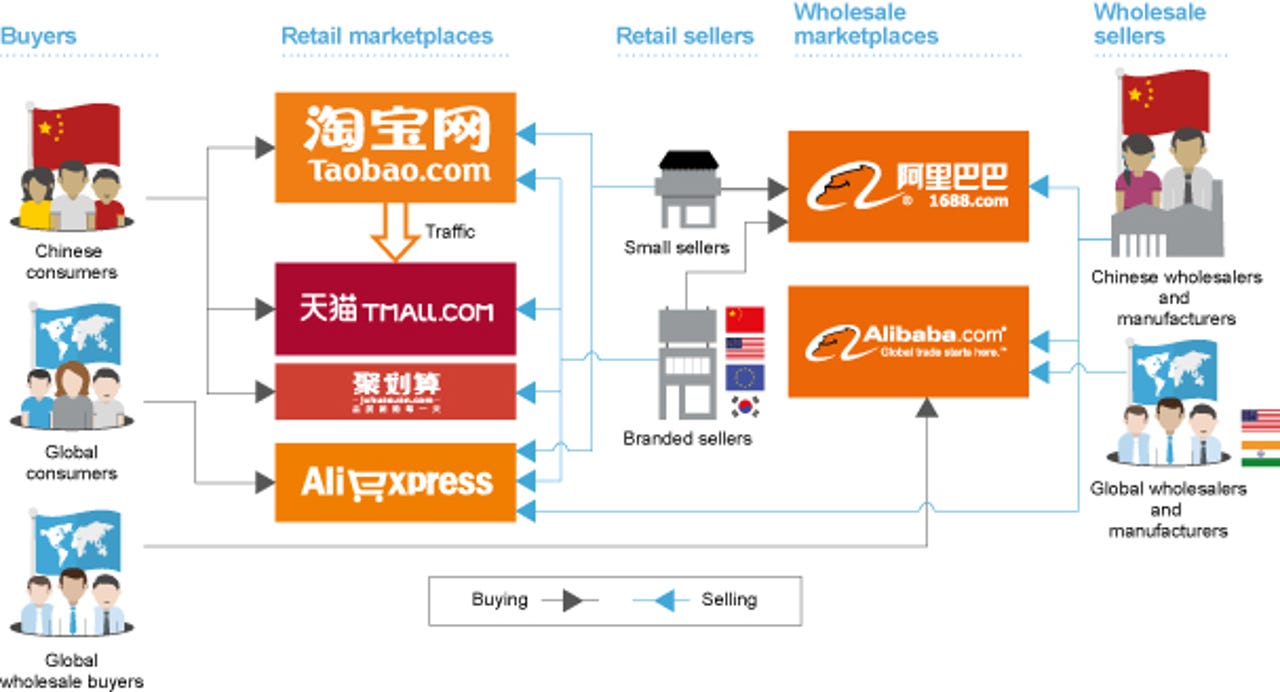

Known in the U.S. primarily for its association with Yahoo, Alibaba is an eBay-meets-Amazon and then some kind of business.

Alibaba owns Taobao Marketplace, China’s largest online shopping business, as well as Tmall, the country's largest third-party platform for brands and retailers. As boasted by the company itself in the F-1, "Alibaba is synonymous with e-commerce in China."

Most of Alibaba's revenue derives from online marketing and ads. Other revenue streams include membership and transaction fees, value-added services, and cloud services.

To further introduce itself to the American audience, Alibaba included a number of stats -- many of which aim to trounce stateside competitors right out of the gates.

Here are some of the big numbers to know:

- Alibaba processed $5.8 billion USD in transactions and 254 million orders on Singles Day 2013 (China's equivalent of Cyber Monday).

- Alibaba's logistics network delivered approximately five billion packages generated from Alibaba-owned marketplaces in 2013.

- Alibaba sees an average of 11.3 billion orders annually with 231 million active buyers. That translates to an average of 49 orders per buyer annually.

- Like most other Internet properties these days, Alibaba is keen on developing its mobile base, which stands at 136 million monthly active users as of December 2013. (By comparison, Alibaba cited China has 500 active mobile Internet users at large.)

- Alibaba posted $238 billion in gross merchandise volume across its Chinese online marketplaces last year with $37 billion alone from mobile GMV.

- Softbank boasts the largest stake in Alibaba with 34.4 percent of the pie, followed by Yahoo with 22.6 percent. Alibaba founder and executive chairman Jack Yun owns 8.9 percent.

- For the nine-month period ending December 31, 2013, Alibaba churned $6.5 billion USD in revenue with a net income of $2.9 billion. (Alibaba's fiscal year ended on March 31.)

Images via Alibaba/SEC F-1 form