Amazon, Netflix, Priceline: Are they really recession resistant?

With Google and eBay kicking off a round of Internet earnings this week analysts seem to be on a hunt to find the most recession resistant Web companies. The early line: Amazon, Netflix and Priceline appear to be able to weather the economic storm.

Amazon, which reports its fourth quarter Jan. 29, has been drawing a lot of optimism. Everyone knows retail was a disaster in the fourth quarter, but Amazon may have outperformed based on ComScore traffic stats. Think Equity analyst Edward Weller sums up the general Amazon theme:

It’s been a dreadfully competitive season… and we have assumed that Amazon must have been affected … at least some, but it may not have been by much. Retailers have been very promotional for many months and, as might be expected, have been especially aggressive marking down goods subject to seasonal and technological spoilage. Though the category includes Video Games, hardware and software, “Media” is subject to very little seasonal clearance pressure… and Media is still 60% of sales.

So perhaps Amazon's fourth quarter--analysts are expecting earnings of 40 cents a share--will deliver a big surprise.

Citi analyst Mark Mahaney is also on the Amazon bandwagon, but also notes that Netflix may be the most recession proof of the lot. In fact, Netflix may be the Net's most defensive stock pick. Go figure. Here's his rationale:

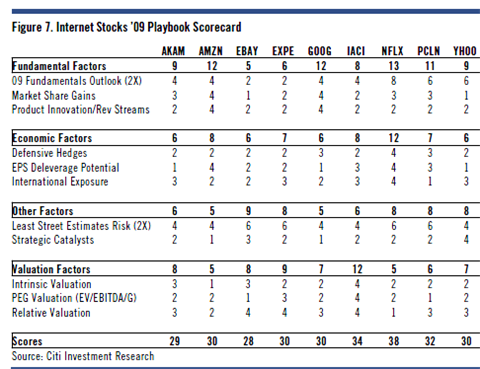

Our Top '09 Stocks Based On Our Defensive/Economic Factors Are: Netflix (NFLX) (far and away), then Amazon (AMZN) & IAC (IACI). NFLX ranks # 1 because it offers a low cost/high value subscription model in a segment (Filmed Entertainment) that is more “hitical” than cyclical, and has no International Exposure (near-term a positive, long-term a negative) and a low Contribution Margin biz model. AMZN, as a low Contribution Margin business, is also least likely to suffer EPS Deleverage, which helps makes AMZN, surprisingly, something of a defensive stock. The weakest stocks on our ’09 Defensive/Economic Factors Outlook are: Akamai, eBay, Google and Yahoo – either because of potential EPS Deleverage given high fixed cost structures, and/or significant International Exposure (FX headwinds), and/or lack of business model Defensive Hedges (e.g. eBay’s significant exposure to the used car market).

Translation: Google's earnings estimates are likely to come down. That's why Mahaney is off that bandwagon a bit--even though Mahaney recommends Google.

Here's his chart looking at the top picks for 2009:

- Amazon will gain share on retailers--Circuit City anyone?--and its Web services business adds a potential innovation-fueled revenue stream in the future.

- Netflix is pulling away from the field in its niche and Mahaney is betting that the service is like cable--it's the last thing to be cut in an downturn.

- Google has a strong position, but there's risk. Why? Google already has a big market share and has done nothing but hit earnings home runs. Even if Google hits earnings triples it'll be a disappointment.

- eBay faces numerous risks--retail exposure, an auction format and exposure to the used car market.

- Priceline is apparently benefiting because travelers are staying domestic instead of going abroad. Meanwhile, the name your own price model is appealing in a recession.

Overall, Mahaney's note is interesting. We'll see how the prognostications play out through 2009.