AMD aims to be China server player via joint venture

AMD is betting that the Chinese server market and a joint venture with a local tech firm can provide growth for years to come.

The chip company, which has faced numerous restructurings and tough sledding in multiple markets, reported better-than-expected first quarter results.

However, AMD still reported a net loss of $109 million, or 14 cents a share, on revenue of $832 million. On a non-GAAP basis, AMD reported a loss of 12 cents a share. It's worth noting that AMD had revenue of $1.03 billion in the first quarter a year ago.

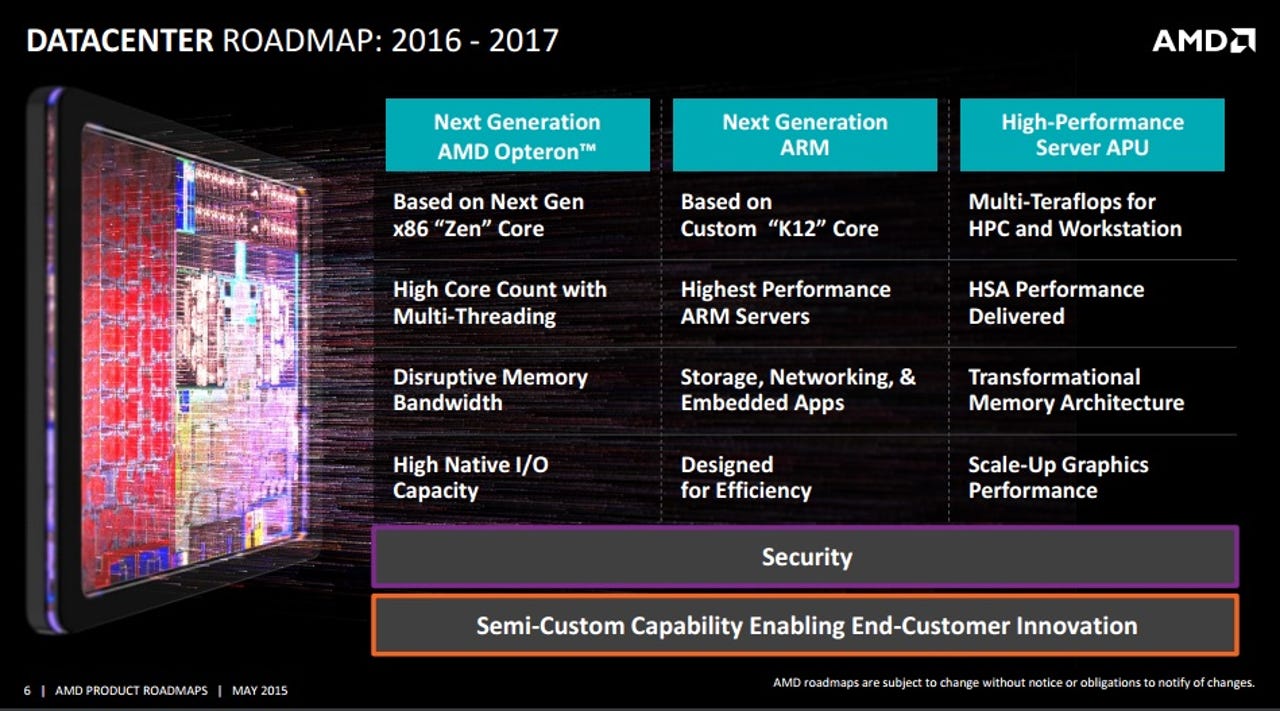

Also see: Will Zen save AMD, or might Apple? | A closer look at AMD's Polaris graphics | AMD launching new 64-bit ARM chip for data centers

CEO Lisa Su said AMD is gaining strength and looking to take graphics and computing chip share. While that dogfight in the PC market is interesting, the real headliner was a joint venture and licensing deal with THATIC (Tianjin Haiguang Advanced Technology Investment Co., Ltd.

The deal with THATIC is worth $293 million paid over multiple years. AMD and THATIC will develop systems on a chip for the Chinese server market. The THATIC venture doesn't cover graphics processors.

"We expect the strong customer interest in AMD's data center offerings will result in new design wins that can deliver profitable revenue growth in 2017 and beyond," said Su.

In addition, the THATIC-AMD venture will manufacture x86 chips for the server market. The deal isn't exclusive and AMD sees similar deals on tap. AMD is betting its Zen x86 chip can be a server player.

Su's bet is that AMD has the technology to gain server share in China, but needed a local partner.

She said:

I think we believe that there is a large opportunity in the data center market across the board. That is why we are investing so much in Zen and its follow ons. As it relates to the China JV that we are doing with THATIC, I think there is a -- certainly a benefit to having someone local that has experience in the market and knowledge of the market. And THATIC is an investment consortium that is partially led by the Chinese Academy of Sciences. So we think that both from a technical and a commercial standpoint, they will be a value-added partner in this joint venture.