AMD bets ARM, server chip experience means market gains

AMD on Tuesday outlined its server roadmap and plans to sample 64-bit ARM processors for data centers in the first quarter of 2014.

For AMD, the move is a bet that it can continue to be a player in the x86 server market as an Intel alternative while building out an ARM line-up that it can pair with its Sea Micro systems, which will technically be agnostic on processors.

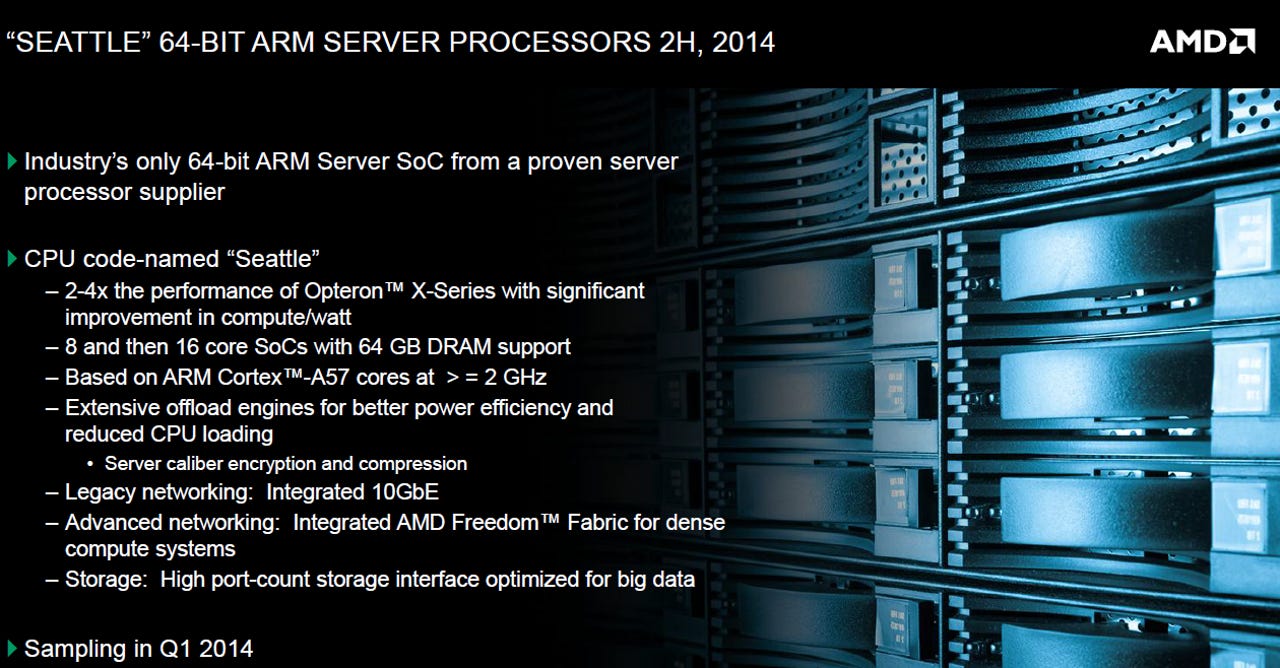

The 64-bit ARM server processor is currently code-named Seattle. AMD said it will have 2 times to 4 times the performance of its Opteron X-Series with improvements in compute per watt. AMD will offer 8 core and then 16 core systems on a chip with 64GB DRAM support.

AMD's Andrew Feldman, vice president of the company's server business unit, made the case that the company can win with ARM chips. Feldman acknowledged that other vendors have more ARM experience, but when it comes to servers AMD understands the market, the systems and integration.

To date, Nvidia has been the largest ARM chip player actively seeking the server market. Feldman said that he anticipates that Samsung will step up to deliver ARM server chips and potentially Qualcomm because of the profit margins. "Historically, the margins have been a whole lot fatter on server parts than phone parts," said Feldman.

The game plan here is fairly obvious. Intel is sticking with its x86 architecture and betting that its Atom processor can win in the mobile and hyperscale server space. Indeed, HP's Moonshot server, which is focused on the hyperscale market, started with Atom, but will offer ARM too.

"We believe ARM will win out in the long run," said Feldman. "In 2016 and 2017 ARM will have double digit market share. That's huge gains in a short period of time." Feldman said that 2014 will be an ARM server pilot year with a large data center going to a full port to ARM. That move will create a snowball effect in 2015.

AMD's argument that smaller, cheap, high-volume CPUs have always won in the market. This first enterprise encroachment of ARM in the server market will kick off in 2014 and then accelerate in the years ahead.

Feldman noted that there is some concern that ARM will cannibalize its own x86-based businesses, but the opportunity is too hard to ignore. "We think it will cannibalize x86 and we plan to be a leader in ARM," said Feldman. Why ARM? Apple showed you can do a lot of computing with ARM processors and the iPad, said Feldman. "It's not about a faster processor. It's about the interaction," he said.

In the meantime, AMD is plotting new AMD Opteron X-Series processors focused on Web hosting, big data and multimedia. These so-called small-core chips are designed to take on workloads that need to save on power.

AMD's two-pronged server chip approach in 2014 revolves around traditional IT tasks such as virtualization, mail and messaging, collaboration and adds cloud, big data and faster growing uses. "Traditional IT business is big but not growing," said Feldman, who noted that the company is thinking cloud and hyperscale will provide growth in the future.

On the x86 processor front, AMD is planning the following:

- Berlin processor line designed to target the hyperscale market with improved compute/watt ratios, integrated graphics processing and easy to program interfaces. Berlin will double the Kyoto platform that became generally available in late May. These processors will be available the first half of 2014. Berlin is the x86 cousin of the ARM-based Seattle effort.

- Warsaw is a server processor designed for private and public cloud uses and high performance computing. In a nutshell, Warsaw is AMD's traditional effort against Intel in the server market and known as a large core chip. Warsaw is optimized for two and four socket servers and touts an easy migration from AMD's Opteron 6300 series. Warsaw will be available in the first quarter of 2014.

In the end, it's pretty clear that AMD's best hope to be a better alternative to Intel revolves around the ARM architecture and fast growing use cases. If ARM makes server headway, AMD can use its experience to notch a few wins. The big question is how long it will take for ARM to gain enterprise traction. After all, AMD's x86 roadmap is answered by Intel, which has the manufacturing expertise to improve performance at a rapid clip.

Related:

- AMD announces more Richland chips, demonstrates Kaveri processor

- AMD unveils plans to support Android and Chrome OS

- AMD unveils Opteron X 'Kyoto' processors

- Intel's Haswell launch may take backseat to Atom vs. ARM