Apple and Yahoo: Forget last quarter. What about this one?

Once again, it's not the past performance that investors want to know about. It's the future. What are companies doing to ride the economic storm and what will that mean to the current quarter, as well as the full year bottom line?

Today, the spotlight falls on two big names: Apple and Yahoo, who will be reporting earnings in a couple of hours.

As for Yahoo, no one seems to be expecting much - other than layoffs. But as Kara Swisher notes in a blog post this morning, "You can’t cut your way to growth and the innovation needed to remake Yahoo." The buzz is that Yahoo won't actually give a hard number (the general feeling is 1,500 jobs) but rather a percentage (get out the calculator). And a timeline to the cuts is unclear, as well, though some suspect it won't be a very jolly holiday season in Sunnyvale.

By the numbers, analysts are expecting revenue of $1.37 billion and an EPS of nine cents.

Previous coverage: No surprise. Yahoo expected to announce layoffs

Previous coverage: Apple earnings: An example of Citizen Wall Streetin’

An earnings preview by Forbes noted that Apple is not immune to the economic conditions and could be feeling the pinch as consumers place a tighter hold on their cash and lines of credit. The Forbes preview quotes a research note issued by BMO Capital Markets analyst Jung Pak earlier this month, highlighting discussions with Apple retailers who said sales have slowed. The reason? Consumer worries about the economy. In the preview, Pak said:

Over the past five years of checking Apple stores, we have received consistently steady and/or improving sales comments. This is the first time we have heard store reps describe slowing sales.

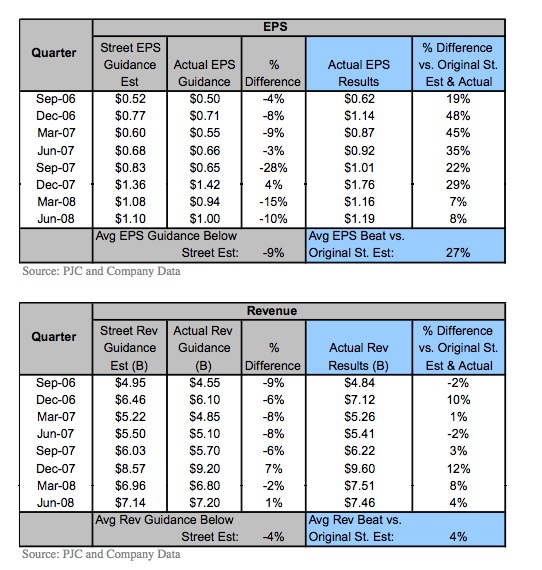

By the numbers: Apple has forecast revenue of $7.8 billion and EPS of $1. Wall Street is expecting $1.11 per share on $8.05 billion in revenue.

Both Apple and Yahoo report earnings after the close of the market today. Both companies will host conference calls with analysts at 2 p.m. PT.

Also see: Apple Q4 2008 earnings to be announced today (updated)