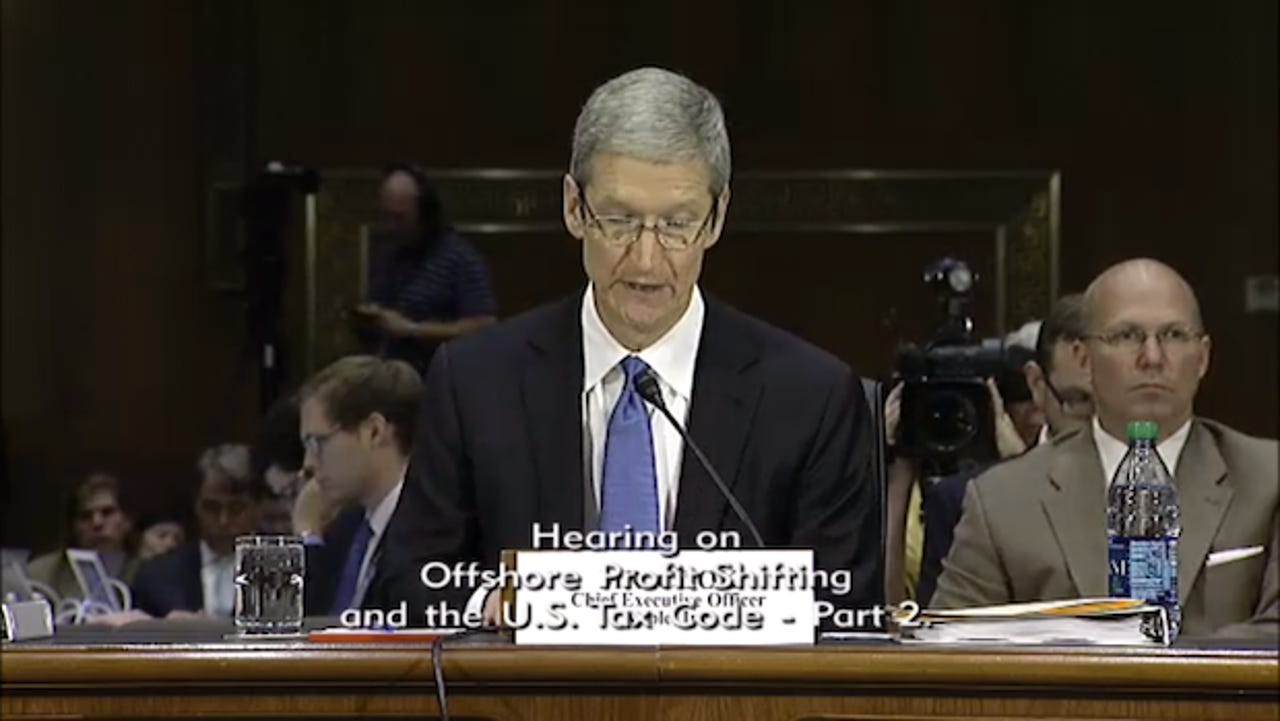

Apple, Congress spar over tax: Cook testifies, lawmakers unsatisfied

Apple chief executive Tim Cook will testify to the U.S. Senate Permanent Subcommittee on Investigations later on Tuesday, to explain how his company manages its tax arrangements.

While the iPhone and iPad maker claims it does not use "tax gimmicks" and pays roughly $6 billion into the U.S. kitty, Congress has accused the company of seeking out nefarious ways of avoiding paying the full amount of tax in the country its main headquarters are based.

Read this

The tech giant denies these claims, and actively welcomes tax reform in the United States.

Apple claimed it pays more taxes than any other company in the U.S., but investigators say Apple used shady methods to avoid paying taxes, such as creating a number of subsidiaries that contained no staff apart from top executives. Most companies that seek to avoid paying the full amount of tax open bank accounts in so-called tax "havens".

Much of the testimony today will be reeled out from a pre-prepared statement, which was published on Monday by Apple on its website. However, this will be an opportunity for lawmakers on the Hill to grill the Apple boss on its tax affairs.

Highlights from the hearing:

- Ireland's EU affairs minister Eamon Gilmore said that the Ireland was "not to blame" for Apple's low global tax payments.

- Sen. Carl Levin (D-MI), the committee's chair, says that Apple is "exploiting" a tax loophole, but it is important to note that Apple is not breaking the law via tax evasion -- but rather is employing methods to avoid tax on international sales.

- Apple is one of the biggest taxpayers in the United States, paying $6 billion in 2012 and expecting to pay $7 billion during this fiscal year. However, Levin believes that by shifting $36 billion away from American soil, the iPad and iPhone maker avoided an additional $9 billion -- making the firm one of the "biggest tax avoiders." Apple allegedly kept $44 billion in otherwise taxable offshore income away from the U.S. over the past four years.

- Both Apple and Sen. John McCain (R-AZ) believe the situation has come about due to a flawed corporate tax system; the former due to loopholes waiting to be exploited, the latter due to the 35 percent tax imposed on transferring funds to the U.S.

- Sen. Rand Paul (R-KY) called Apple "one of America's biggest success stories," highlighting the fact nothing illegal has been committed. The Senator suggests that the current 35 percent tax markup be reduced to five percent.

- Expert witness J. Richard Harvey said he suspects what Apple has done is "within the bounds of the international tax law." Stephen E. Shay with the Harvard Law School, believes allowing such tax avoidance to continue undermines public confidence in the system.

- Apple CEO Tim Cook said that Apple is absolutely an American firm. "We pay all the tax we owe. Every single dollar." Cook does not believe the company's financial practices are unfair to smaller companies that cannot use the same loopholes.

- Cook said Apple could support a "reasonable tax rate" which would bring back capital to the U.S.

- Sen. Rob Portman said Apple and Samsung pay "effectively the same tax rate" globally. Oppenheimer suggested that while Samsung is able to bring its funds back to South Korea, Apple "cannot" due to high taxation.

- Cook denies telling Levin's staff that Apple will refuse to bring funds home unless tax rates are changed. However, Cook "has no current plan" to do so.

- Levin commended Cook on his company's success, but remained unsatisfied -- saying that "It's not right."

Live blog of the hearing:

Editor's note at 1:32 p.m.: That's the end of Cook, Oppenheimer and Bullocks' testimony. Thanks for tuning in.

1:31 p.m.: "Folks, it's not right. That's not right," Levin said talking about Apple's 2008-2009 decision. "I know it's your intention — I applaud your constructive view — but it's important for us to write the laws, and it's important for Cook et al for us to also fix those laws."

"I want to commend your company for all the work that it does," Levin added. Cook concluded: "Thank you, Mr. Chairman."

1:30 p.m.: "From the bottom of my heart, we cannot continue a system where a multinational company can make a decision sitting down in 2008-2009, as to where the profits are going to flow," Levin said. Citing the benefits of living in the U.S., research and development credits and patent protection, "the profits shifted away from the reach of the U.S. tax man," Levin reiterated.

1:26 p.m.: Levin holds up his iPhone. "95 percent intellectual property is in the U.S., but most of the company's profits are in Ireland." Cook said: "We're proud that our research and development is in California."

1:24 p.m.: "But you didn't have to continue that agreement. You were in control. Your company. It was your decision. But don't kid us over the implications over what this means to America's revenue," Levin went on. "You made that decision in 2008-2009 to continue that arrangement."

Oppenheimer defended the move, saying that this was how Apple was created. Levin said as a result of continuing that led to most of the company's profits are now in three Irish companies.

1:22 p.m.: Levin isn't letting the 2008-2009 agreement go. "Three Apple employees signed that agreement. It shifted the economic rights to three Irish companies, under Apple Inc.'s control, that don't pay taxes in the U.S."

"I respectfully disagree with that," Oppenheimer said. Levin is not letting this go. "It was the same rights that continued an earlier arrangement over the past 30 years."

1:19 p.m.: The chairman said Cook told Levin's staff that Apple will not bring the cash home unless the tax rates are changed. "I don't remember saying that," Cook said. Levin elaborated, and Cook further explained: "I have no current plan to bring [that cash] back under the current tax rates."

1:17 p.m.: Levin says 75 percent of sales earned by these three Irish subsidiaries. "Bring it home," he said. "You do this with Mexico and Canada. It's your decision, your judgment, not to bring those profits home. $100 billion dollars plus stashed in those three Irish companies."

"Will you bring [the profits home]?" Levin asked.

1:11 p.m.: Levin denies Cook's bid to add some "comments" on the shifting of economic rights — the intellectual property rights — signed by subsidiaries that are owned by Apple. Bullock "disagrees with the categorization."

Facts first, context later, said Levin. Cook signed the agreement that signed over its intellectual property overseas to three Irish companies.

1:11 p.m.: Levin starts talking. Starts immediately with a sense of being less optimistic about the company's tax system, unlike others, it seems. "You've shifted that golden goose [intellectual property] in Ireland," he asked.

1:09 p.m.: "It would not be helpful," said Oppenheimer. "Not good," said Cook, regarding changing the tax system without changing the corporate tax rate.

1:03 p.m.: Sen. Rob Portman (R-OH), describing himself as a "recovering lawyer," is speaking about tax reform. Cook confirmed that Samsung was a "major competitor." Apple and Samsung pay "effectively the same tax rate" globally, Portman said.

"Samsung is able to freely move its capital back to Korea," Oppenheimer said. He agreed that it was "worse for Apple" because the company can't bring it back to the U.S.

12:58 p.m.: Talking about intellectual property protection, particularly in China, Cook said: "We've faced significant issues in countries other than China." He paused then added: "The U.S. courts system is currently structured in such a way that it's very difficult to give the protection a technology company needs. The cycles are very fast. Foreign competitors or even those in the U.S. can quickly take intellectual property, and they move on before the court rules."

"We require more work on intellectual property in the U.S.," he added, noting that countries should speak to each other to work on a global solution.

12:57 p.m.: "We believe the tax code should be reformed for over a long period of time," Cook said. "A permanent change to me is materially better than a tax holiday."

12:54 p.m.: Sen. Kelly Ayyotte (R-NH) asked Cook about the rate of tax that should be imposed on cash being brought back to the U.S. from overseas. Cook said: "U.S. sales should be in the mid-20s, as all the expenditures are dropped down. Bringing back foreign earnings, to incentivize this, this should be in the single figures."

Cook added: "Many would be in a revenue neutral situation. It would be great for growth in this country." He also confirmed that overseas cash cannot be used to invest anything in the U.S.

"I put my whole weight of force behind it," talking about reforming the U.S. tax code. "All ships rise with the tide."

12:53 p.m.: Johnson asked Bullock about tax paid in foreign countries. "Apple paid over $900 million in income tax in fiscal 2012. It's significantly larger based on previous years," but said he didn't have those figures readily available. He said 50,000 out of Apple's 70,000 employees are in the U.S. "This is influenced by our retail stores. 260 retail stores are here [in the U.S.]"

12:51 p.m.: $AAPL stock has broken into the positive. It's now trading above its Tuesday opening price. Shareholders appear pleased.

12:48 p.m.: Cook passes the "who are its shareholders" question to Oppenheimer. "Our top 50 shareholders own about half the company, including public retirement systems, pension systems, and we also have individual retail shareholders," he says.

12:47 p.m.: Sen. Ron Johnson (R-WI) asked Bullock, noting that Apple "probably" has an IRS auditor "at all times." Bullock confirmed this is the case in the U.S., and that transfer prices and corporate structure for compliance. "They look at it in detail."

12:46 p.m.: Cook on its margins and international sales: "Apple's Mac business has larger sales in the U.S. than internationally. The iPhone became a larger international business than the U.S. The iPhone has higher gross margins. It's logical that the international margins are greater than the U.S. margins."

12:43 p.m.: McCaskill said there is a decision being made based on where the sale is versus where the intellectual property is. Cook said: "Today, everything that we sell in the U.S. is taxed in the U.S. In a foreign country, it's taxed in the local market, and then if it's one of the countries that is being sold by Ireland, it's served by an Irish subsidiary."

Bullock answered on Cook's behalf: "100 percent of the profits on any sale to a customer in the U.S. [...] is fully taxed in the U.S. There are no outbound payments going offshore."

12:40 p.m.: "The problem with repatriating cash is that it's at the 35 percent tax rate." Cook didn't say "zero tax," but said Apple could support a "reasonable tax rate" which would bring back capital to the U.S. and would be great for the economy.

McCaskill said, "what if Apple left California [and the U.S.]?" Cook said: "We're proud to be an American company. Most of our research and development in California." But, above all, he said, "it's who we are." He said it has "never entered our minds" to move out of the U.S.

12:37 p.m.: Sen. Claire McCaskill (D-MO) said Ireland gave Apple a 2 percent tax rate. Cook said in 1980, when Apple first went there, it was a fraction of the size. As a part of "recruiting" Apple, Ireland gave them a reduced tax rate. Since then, Apple has grown. "The skills of our people there is fundamental in understanding the European market," Cook added.

12:35 p.m.: Senate panel has reconvened. The lawmakers have taken their seats and Cook, Oppenheimer and Bullock have taken theirs.

12:14 p.m.: Cook on McCain's question: "This is a very complex topic. I'm glad we're having this discussion. But we don't see this as unfair. We're not unfair as a company. I don't see in that way." Jokingly, just before his time runs out, McCain said: "Why the hell do my apps on my iPhone keep updating all the time?"

12:11 p.m.: Cook also confirmed that its European/Irish subsidiaries "do not" have tax residency in any country, but isn't sure on the difference between "tax presence" and "tax residency."

12:10 p.m.: AOI is a "holding company," Cook confirmed. "It's nothing more than a company set up as a subsidiary set up to manage cash that has already been taxed." He stated: "AOI does not reduce our U.S. taxes at all."

12:07 p.m.: Cook: "Our tax rate is low outside the United States. But this is for products outside the United States, not within. There's no shifting going on."

12:06 p.m.: Cook confirms to McCain that he was not "dragged" to Congress. McCain asked if Apple has "legally taken advantage, internationally and domestic, of the tax code." But, could the conclusion be drawn that Apple has the advantage over smaller companies? Cook said: "No, that's not how I see it."

12:03 p.m.: Levin asked if its Irish subsidiaries, despite earning tens of billions, have not filed an income tax return. "That is correct. That is not subject to U.S. tax, under statute and regulation. Apple Inc. has paid on interest paid by AOE."

12:01 p.m.: Bullock on its European/Irish subsidiaries: "It does not have tax residency. U.S. taxes are paid in full on its interest in full." He's talking about the interest on the cash generated by its subsidiaries in Ireland. "ASI and AOE was subject to U.S. tax," said Bullock. He stumbled, but said "approximately yes" to 2 percent tax rate.

12 p.m. midday: $AAPL stock has bounced back to close to its market opening price. It now currently stands at about 0.7 percent down.

Additional remarks from the first panel -->

<-- Later remarks from the second panel

11:56 a.m.: Phillip A. Bullock, Apple's head of tax operations, answers questions to chairman Levin. Both Cook and Bullock agree that "most" decisions are managed by its Apple U.S. headquarters.

11:55 a.m.: Cook: "I don't consider deferral to be a sham."

11:53 a.m.: Oppenheimer also notes that it acts in the "best interests of its shareholders."

11:50 a.m.: He also notes that "half of Apple [research and development] is funded through its Ireland operations." He confirms that Irish law dictates that its Irish operations can be incorporated without being a tax resident. "The reason [that its European subsidiaries are not tax residents] does not reduce U.S. taxes at all."

11:47 a.m.: Oppenheimer dips into more details regarding the subsidiaries it has in Europe, Ireland in particular: "Our U.S. tax structure is quite simple [...] Outside the U.S., we try to provide the same industry-leading support that our U.S. customers expect. Apple must follow the laws and the regulations of where we are located."

11:44 a.m.: Cook says: "We pay all the tax we owe. Every single dollar. The U.S. tax code has not kept up to date." But he notes that with an additional but "reasonable" tax on bringing foreign earnings back to the U.S. could result in Apple paying more than it does at present.

11:38 a.m.: Cook deviates from his pre-prepared statement from yesterday and says if Apple considers itself an American company. In a stern voice: "An emphatic yes."

11:37 a.m.: Cook and Oppenheimer take the oath and are sworn in to the hearing.

Previous remarks follow from the first round of hearings:

10:57 a.m.: Harvey asked simply: "How should technology developed in the U.S. be taxed?"

10:53 a.m.: "Apple points out in its testimony that it only does this for its international sales," Shay says. "There's nothing preventing this from being done. Microsoft did this with its domestic sales. This is not an Apple bashing exercise."

10:33 a.m.: Stephen E. Shay, an expert from Harvard Law School, said: "The revenue lost to tax base erosion and profit shifting is hard to estimate, but there is compelling evidence the amount lost is substantial," he said. "This revenue loss exacerbates the deficit and undermines public confidence in the tax system. Restoring revenue lost to base erosion and profit shifting would support investing in job-creating growth in the short term and reducing the deficit over the long term."

10:26 a.m.: Harvey said: "Apple recorded approximately $22 billion of its 2011 pre-tax income in Ireland. As a result, 64 percent of Apple's global pre-tax income is recorded in Ireland where only 4 percent of its employees and 1 percent of its customers are located."

Read this

10:22 a.m.: J. Richard Harvey, an expert from Villanova University School of Law, giving expert opinion said: "I suspect what Apple has done is within the bounds of the international tax law." He said he almost fell off his chair when he read that Apple does not use tax "gimmicks."

10:16 a.m.: "You can apologize if you wish, but that's not what this committee is about," Levin said, and then proceeded into a raised voice string of abuses that Apple allegedly has committed. "They use our law system, they lobby here, but they don't have the right to avoid paying taxes. Avoiding paying taxes here: it's not right. This subcommittee will not apologize." Politician war of words on deck.

10:13. a.m.: Sen. Rand Paul (R-KY) steps in to defend Apple. "Tell me what Apple's done illegal. I'm offended by this hearing, and that this hearing is bullying one of America's success stories. Congress should be on trial, and the committee should apologize to Apple."

Paul suggested that in helping companies repatriate their cash from offshore units, Congress should change the rate to 5 percent, rather than the 35 percent that Apple claims it would pay.

10:11 a.m.: Apple has utilized U.S. tax loopholes to avoid taxes in the United States on $44 billion in otherwise taxable offshore income over the past four years," he highlighted.

10:10 a.m.: McCain (whose full statement can be found here) continues: "I have long advocated for modernizing our broken and uncompetitive tax code, but that cannot and must not be an excuse for turning a blind eye to the highly questionable tax strategies that corporations like Apple use to avoid paying taxes in America."

10:08 a.m.: McCain noted that smaller companies are taking the brunt for Apple's tax strategies, by pay a higher tax rate because they can't siphon their funds or profits offshore, McCain added.

10:03 a.m.: Sen. John McCain (R-AZ) said the situation "reflects a flawed corporate tax system," after applauding Tim Cook, the late Steve Jobs, and Apple's products and services. He also said Apple was the country's biggest tax payers in the U.S.

"Apple is one of the biggest tax avoiders in the U.S.," he added.

10:01 a.m.: Citing President Ronald Reagan: "Individuals and corporations who are not paying their fair share or, for that matter, any share," adding: "These abuses cannot be tolerated."

9:58 a.m.: Apple shifted $36 billion in worldwide sales away from the U.S., Levin said, and paid "no U.S. tax on any of it," avoiding $9 billion in U.S. taxes.

9:53 a.m.: $AAPL is down 1.5 percent just after the Senate hearing began.

9:52 a.m.: Apple uses a "cost-sharing agreement in which Apple's U.S. headquarters develops the technologies and products, and its offshore units get the marketing rights and the profits for international sales. Apple's profits are shifted offshore, leading Apple to pay "almost no income tax." Apple on Monday said it paid $6 billion last year, and will pay more than $7 billion this year.

9:51 a.m.: "Most of the profits are assigned to [Apple's subsidiaries in] Ireland," Levin said, before pointing the finger at the Irish government for "negotiating" terms in which Apple pays less than 2 percent tax in the country.

9:46 a.m.: "Our legal system has a preference to respect the corporate form." He said that it was a "sham" that AOI and ASI [Apple Sales International] don not owe any U.S. taxes.

9:38 a.m.: Sen. Carl Levin (D-MI), the committee's chair, says he carries an iPhone in his pocket. But he reiterates his comments from yesterday that Apple sought the "holy grail" of tax avoidance by setting up companies in various locations without employees. (His full statement can be found here. Some key parts are below.)

Displaying a chart of Apple's offshore corporate structure, Levin explains that their "activities are entirely controlled by Apple in the United States," but did not appear to have any tax residency in any particular country.

Levin noted that its operations unit, Apple Operations International (AOI), is neither an Irish tax resident, nor is it technically based in the U.S. "It's neither here nor there," he says. Apple Operations International (AOE), "also has no tax home," he says, regarding tax residency. Apple is "exploiting" a tax absurdity, he says.

9:29 a.m.: Reuters is reporting that Ireland's EU affairs minister Eamon Gilmore said that the Ireland was "not to blame" for Apple's low global tax payments, following claims by the U.S. Senate investigators that the company created subsidiaries in the country.