Apple earnings: A heads-up on accounting change would have been nice

Updated: Apple's first quarter earnings were just swell, but an accounting change---with no advance notice---led to confusion about the results and rendered Wall Street estimates useless.

The accounting change relates to recognizing iPhone revenue up front or over time. The master bean counters that set accounting rules figured that companies can recognize sales up front. Fair enough. And Apple had mentioned in passing that it would make the accounting change---just not so soon. Just a little heads up would have helped.

See: Apple earnings: Mac sales rise but iPod sales slip for holiday quarter

So what happened? A little chaos ensued. CNBC's Jim Goldman did his usual cheerleading routine. It's a blowout, said Goldman, as if he really knew what was going on 10 minutes after the report. Goldman assured us that investors would come around to seeing how brilliant Apple's quarter was. Other outlets held back to see what the deal was with the results. Apple shares were halted. I dove into SEC filings.

Simply put, this accounting shift wasn't a minor change. And if any company other than Apple did this accounting rule change without any heads up it would have been pummeled. Of course, Apple can get away with it, but that doesn't make "transparency-sort-of" all that helpful.

All Apple had to do is give two sets of figures. Apple's quarter under the new accounting along with results under the old way---at least for comparison's sake. For fiscal 2009 and the years preceding it, Apple did just that. However, the first quarter of 2010 has no such reconciliation.

To wit:

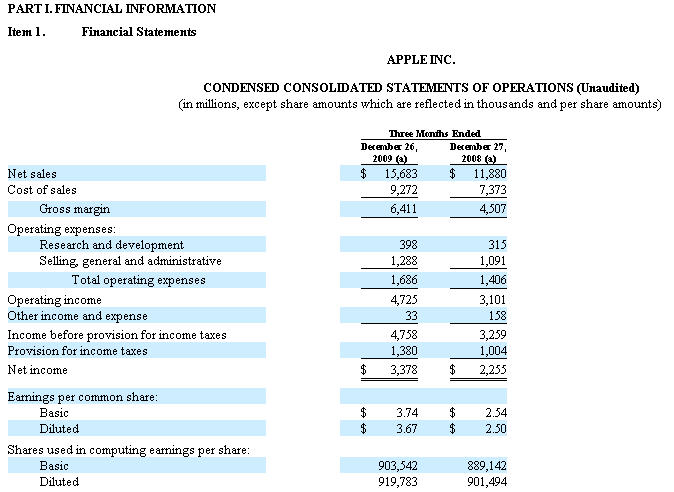

Here's Apple's results in its 10Q:

Apple's presentation for fiscal 2009 shows the adjustments due to the accounting change. The most transparent changes revolve around cash flow instead of revenue. Other areas just note the accounting is new and give you the restated results.

Apple showed the adjustments for all the previous years and it's a nice chunk of change. Here's a look at 2008's December quarter.

Why not offer us something similar for the current quarter? Simply put, the transparency here could have been a lot better.

Update: On Tuesday morning, there was a little more handicapping of Apple's results. Piper Jaffray analyst Gene Munster was helpful sorting out the numbers. Munster writes in a research note:

While they are not exactly apples-to-apples, we see the $25 revenue deferral on each iPhone sold ($638 ASP) as immaterial. As a result, our old non-GAAP numbers are helpful in understanding Apple's guidance under the new GAAP accounting principles. Apple reported Sept. quarter results of $3.67 on $15.68b; Street was looking for $3.50 on $14.96b.

And his scorecard:

Oppenheimer's Yair Reiner said in a research note:

Apple posted solid F1Q10 results, as very strong Mac and iPod sales helped offset slightly weaker than expected iPhone sales. By Apple's standards, it was a rather humdrum performance, more or less in line, we believe, with buy-side expectations. Relative to sell-side models, the results appeared to come in a shoulder's length ahead. The extent of the beat is difficult to measure, however, since Apple reported results according to revised revenue recognition rules, while consensus was based on prior GAAP standards. The expectations conundrum notwithstanding, we see a lot to like in Apple's results.