Apple earnings: An example of Citizen Wall Streetin'

You've no doubt heard of a citizen journalism, the concept that everyday folks with blogging tools can track and report the news faster and, in some cases, better than mainstream journalists. Now, we have regular folks who are tracking companies and making Wall Street-like observations that can have an impact on a company's health and performance. Maybe we can call them "Citizen WallStreeters."

Case in point: Apple. The company reports its third-quarter earnings after the bell on Tuesday and, just like their suit-wearing Wall Street counterparts, some amateur online analysts are writing and publishing their own preview reports - in the form of blog entries.

Over the weekend, Fortune profiled Andy Zaky, an Apple enthusiast and small-scale investor who is not afraid to call out Wall Street analysts for what he considers to be poor forecasting.

It strikes me that, given the economic turmoil of recent weeks and the subsequent black cloud of distrust that's hovering over Wall Street, there's bound to be investors who put more emphasis on what the amateurs have to say.

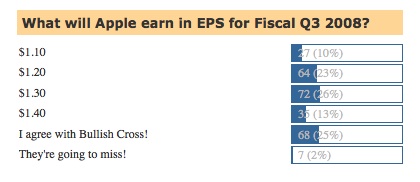

As for this week's Apple earnings, Zaky and Wall Street seem to agree that Apple will beat the expectations for Q3 when the company reports tomorrow. But Zaky and a couple of other amateurs are much more bullish than Wall Street. (The chart below was posted on the Fortune blog this weekend.) We'll find out Tuesday whose projections are closest to reality - those of Zaky and the amateurs or the big names from Wall Street?

These days, of course, what a company did in the quarter that just ended has suddenly become less important than what they expect to do for the current economically-troubled quarter, as well as the full year.