As Power BI aces Gartner's new Magic Quadrant, what's the story behind Microsoft's success?

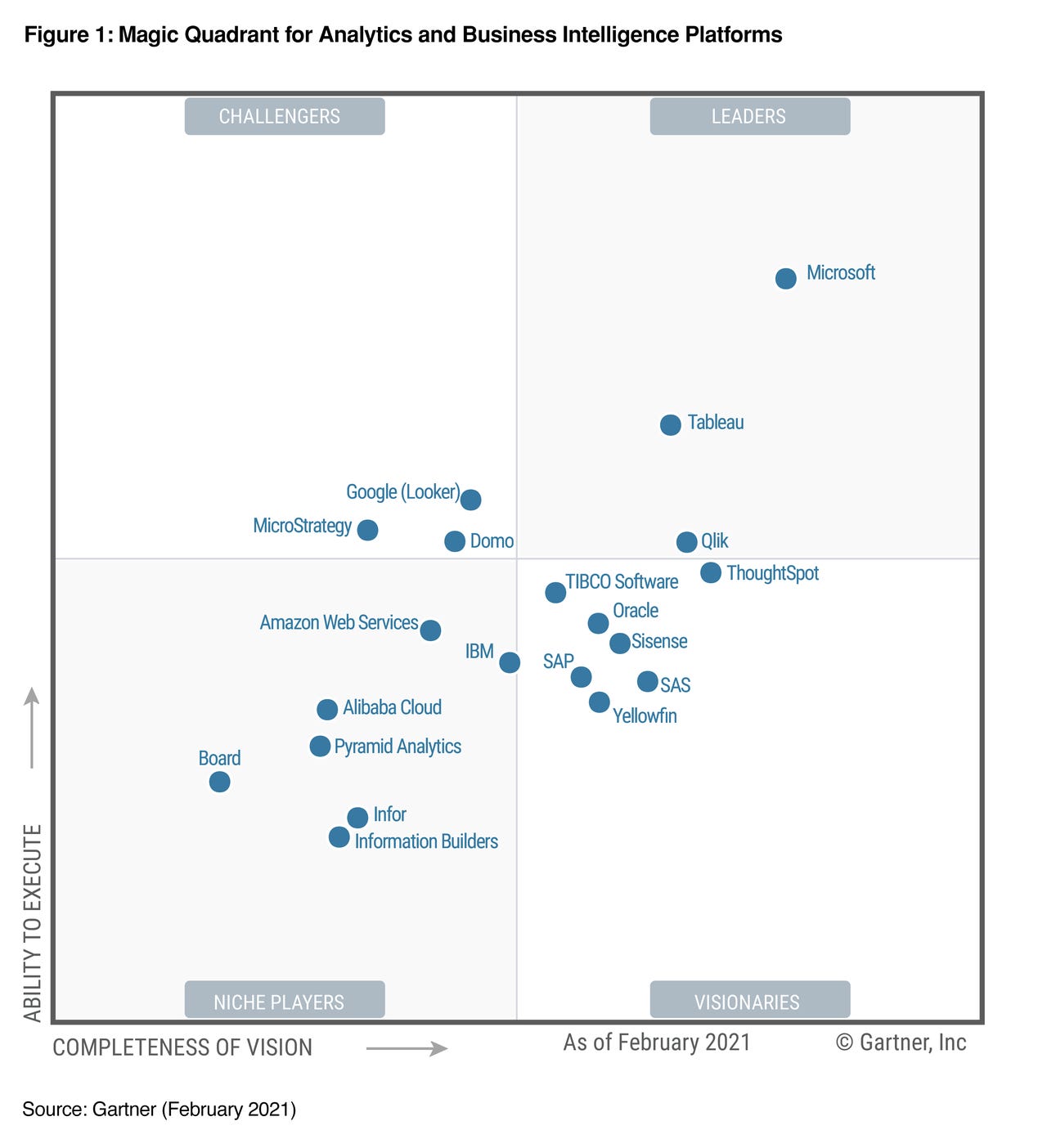

Gartner's 2021 Magic Quadrant for Analytics and BI Platforms, with Microsoft clearly in the lead

A new Gartner Magic Quadrant on analytics and business intelligence (BI) is out, and Microsoft is once again in the "Leaders" quadrant (see the figure above). In fact, according to Microsoft, this is its 14th year in a row as a leader in BI. While Microsoft is in virtually the identical spot as it was last year, its closest competitors have actually lost ground. Thoughtspot has fallen into the Visionaries quadrant. Qlik, while it has increased along the "completeness of vision" axis, it has slipped in "ability to execute." Tableau, meanwhile, regressed in both of those dimensions.

How did we get here?

This gives Microsoft, and its Power BI juggernaut, a huge lead on the competition. And while it's tempting to look at Microsoft as some behemoth that is winning because of its heft and industry dominance, I can say -- from personal experience -- that it was not always thus. I've worked with the Microsoft BI stack since its inception in the very late 90s, and I served on the company's BI Partner Advisory Council (PAC), roughly from 2005 until 2011. During that time, while Microsoft had a dominant BI server platform in SQL Server Analysis Services, its prowess on the application and self-service data visualization side was mostly characterized by 15 years of swinging and missing.

So, what changed? What did Microsoft start doing right? And how did it leverage its genuine accomplishments on the enterprise BI platform side? To get some insight from the Microsoft side, I had an hour-long conversation with Amir Netz, a Microsoft Technical Fellow, who is essentially the father of Power BI. Netz came over to Microsoft from an Israeli BI company (now headquartered in Canada) called Panorama Software, after Microsoft bought technology from Panorama in 1996 that would eventually become Analysis Services. Since I first met him 15 years ago during my tenure on Microsoft's BI PAC, I've known Netz to be talented as a technologist, a strategist and a salesman. So I was interested in his take, even if prepared for a promotional narrative.

Low-cost, low-friction, community-positive

Netz says the traction and success Power BI achieved in its first two years of life was due mostly the low cost of the product (Power BI Desktop is free, as is the entry-level cloud subscription), the low-friction adoption that the price point enabled and the enthusiastic and sizable user/customer community begat by both. He further feels that going "all in" on the cloud, at a time when most corporate data was still on-premises, was a big bet that paid off handsomely. He attributes that decision, and the steadfastness to see it through despite a very skeptical product team, to James Phillips, Microsoft's President of Business Applications. Phillips came to Microsoft from Couchbase, where he was a co-founder and CEO in the early days of the company. Though Netz didn't say so, it's pretty clear that bringing Phillips' startup mentality to Microsoft made a big difference in Power BI's success.

Also read:

- Microsoft's new Power BI service to be generally available starting July 24

- Microsoft Power BI: A report card

Perhaps also attributable to Phillips, the Power BI team adopted a cadence of monthly updates to the product, adding new features to the product at an unprecedented rate. When I was on Microsoft's BI PAC, updates to the platform could ship only when either SQL Server or Microsoft Office released a new version -- which meant updates every 18 months, at best. Along with the night-and-day shift in the pace of innovation came a new transparency, with Power BI product team members, including developers and program managers, engaging with the community prolifically, through blogs and social media, as well as videos that accompanied the monthly releases of the product.

That amount of community engagement really helped Power BI. While most people assume Microsoft can easily push new products because of its dominant market position, the reality is that new products at Microsoft face an uphill battle, and are underdogs against products from startups and other smaller companies. The reason is simple: Microsoft's field salespeople have always been focused on selling well-established, big ticket products and services, like Office, SQL Server and now Azure, in order to hit their aggressive quotas. Conversely, field sales has had very limited bandwidth to push new products with low price points. And unlike well-funded startups who hire their own enterprise salesforce, product teams at Microsoft have no such luxury.

It's (still) the enterprise, stupid

But low price and big community can only get you so far. So what happened next, to keep the growth going? Netz said that all the inroads Microsoft made in the self-service BI space at the individual user and departmental level often led to widespread corporate adoption afterwards. And that meant the product had to scale to enterprise demands. Meanwhile, because of its Analysis Services heritage (and the fact that Power BI and Analysis Services shared core engine technology), Microsoft was ready for, and stood up to, the enterprise scalability test. Ultimately, Power BI went from being a tool that overcompensated for Microsoft's erstwhile self-service BI deficiencies to a platform that balanced self-service and enterprise strengths.

The introduction of Power BI Premium formalized that duality. Its relatively high cost of entry, starting at about $5,000 per organization/month (versus $10 per user/month for Power BI Professional) actually made better economic sense for the large corporates at which it was aimed. On top of everything else, the enterprise push meant that all of the professionals who built careers on the Microsoft enterprise BI stack could come into the Power BI ecosystem and community. This was a proverbial win-win: those professionals got new marketability and could extend their franchise to the cloud, and Microsoft gained even more momentum in the BI market.

Also read: Microsoft's Power BI Premium delivers enterprise-grade features and bulk discounts

Integration is integral

Another hallmark of Power BI has been its integration with other strategic Microsoft platforms. This includes Excel; Azure Synapse Analytics, the company's cloud-based data warehouse and data lake analytics platform; Azure Machine Learning; Azure Purview, Microsoft's data catalog and governance platform that recently launched in public preview; and, most important, especially in the Pandemic age, Microsoft Teams.

Also read: Microsoft announces Power BI Teams integration, NLP and per-user Premium subscription

Netz says the goal with the Teams integration is to make data as fundamental as chat and calendar, to make it one click away, enabling incidental analysis through serendipitous "want to know more?" scenarios. Netz says that this cultural shift has already taken root at Microsoft, claiming that data now comprises a good 50 percent of the content in internal presentations to Microsoft's leadership.

But wait,

There's more to Power BI's achievements and success:

- The integration of artificial intelligence into Power BI has been pretty fluid, making AI consumable within the BI paradigm, without requiring data science knowledge. Power BI has made assets developed in Azure Machine Learning easily available to business users by injecting prediction data as new columns in existing tables within Power BI models. In Power BI, predictive analytics is simply part of data prep

- Power BI's membership in the Microsoft's "Power Platform," which also includes Power Apps and Power Automate, makes it part of a franchise that has seen huge growth

- Though so far executed mostly at the proof-of-concept level, Microsoft is working to bring BI to front line workers through industrial application of augmented reality. And while this had been premised exclusively on Microsoft's HoloLens platform, the Power BI team is working on extending it to everyday mobile devices running iOS and Android

Also read:

No rest for the leader

This has been a very long post, and there wasn't room to tell every aspect of the story, but I'll close by pointing out that, as well as Power BI has done, it most certainly faces some challenges. For example, the lack of a Power BI Desktop client for the Mac, disenfranchises Microsoft from the vast community of data scientists, developers, analysts and business users at startups who almost universally eschew Windows. Once upon a time, Tableau was Windows-only as well. It addressed that by offering both a fully-functional Web browser interface and a genuine Mac client. And that's made it the default choice for the aforementioned Mac-prone groups.

Speaking of Tableau, its acquisition by Salesforce, which also recently acquired Slack, means the Power BI-Teams integration will likely see serious rivalry. Another issue, as Gartner pointed out in its report, is that Power BI naturally has a strong affinity with the Azure cloud, creating something of an adoption barrier for the gung-ho multi-cloud crowd. Tableau, and independents like Qlik, Sisense and ThoughtSpot don't have that problem. And even Google Cloud's own Looker is more cloud-agnostic, since it came to Google through acquisition.

Also read:

- Salesforce acquires Tableau Software in $15.7 billion deal

- Google buys Looker for $2.6 billion, aims to extend its analytics reach, support multiple clouds

- Salesforce-Tableau, other BI deals flow; the tally's now five in a row

So, yes, Power BI is out in front and doing well. But it needs to keep looking over its shoulder, because the BI world will continue to be hyper-competitive, growth-fueled and strategic, to customers, the enterprise software mega-vendors, and public cloud providers alike. The good omen for Microsoft in all of this is that the Power BI team understands this, and is careful to keep "old Microsoft"-style hubris in check. Perhaps most important, the team has maintained super-high morale through the life of the product. Put another way, the team is having fun. The result is a product that's fun to use, which is something that rubs off on partners, and on customers. It seems to help with analyst firms, too.