AT&T refocuses on 5G, combines WarnerMedia with Discovery in $43 billion deal

AT&T said that it will combine its WarnerMedia assets including HBOMax with Discover in a $43 billion all-stock deal that will allow the company to focus on its 5G and telecom business.

The move comes just about three years after AT&T wrapped up an $85 billion purchase of Time Warner on the theory that distribution and content should be under one roof. However, AT&T reversed course and decided it needed to focus on 5G, which requires heavy capital investment. Verizon made a similar decision when it recently announced it was unloading its AOL and Yahoo media assets.

In other words, focus is trendy again at Verizon and AT&T since they are competing with T-Mobile, which is executing well.

- Business broadband: Best internet service provider in 2021

- Best live TV streaming service 2021: Expert picks

The WarnerMedia and Discovery deal reflects a few realities. First, AT&T is in a 5G war with Verizon and T-Mobile. T-Mobile's first quarter was strong and a continuation of recent momentum vs. AT&T and Verizon. In addition, WarnerMedia and HBOMax had to fight a streaming war with the likes of Netflix, Amazon and Disney. You can't fight both wars at once and expect to win with AT&T's current debt load.

Under the terms of the deal, AT&T shareholders would own 71% of the WarnerMedia and Discover combination. Discovery shareholders will own 29%. Discovery CEO David Zaslav will lead the new company, which will combine a bevy of streaming assets led by HBOMax and Discover+.

In a release, AT&T said the WarnerMedia, and Discovery combination will accelerate streaming plans. The combined company will have 2023 revenue of about $52 billion and adjusted EBITDA of about $14 million. The merger should create $3 billion in cost savings that will fund content and streaming expansion.

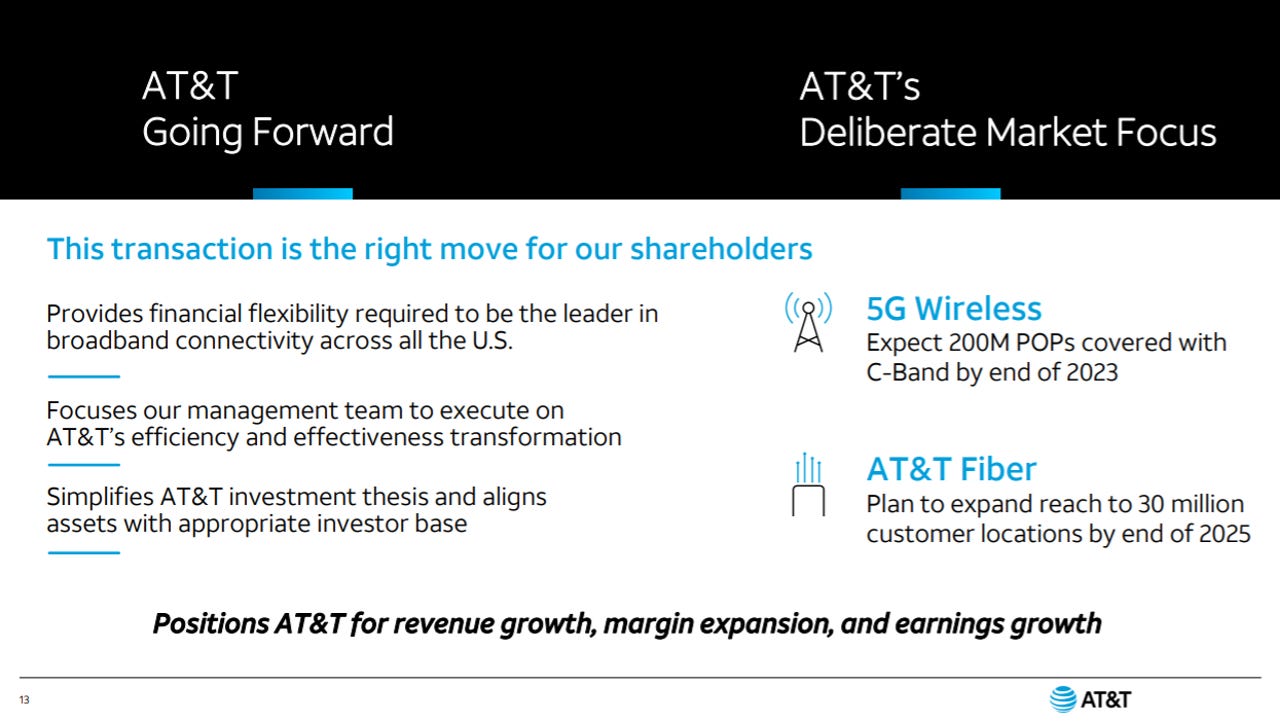

While AT&T shareholders will get to participate in the media play, the telecom giant will be able to reduce debt. "Capital structure improvement after closing will position AT&T as one of the best capitalized 5G and fiber broadband companies in the United States," said the company.

Indeed, AT&T will get $43 billion in the transaction.

AT&T CEO John Stankey said:

For AT&T shareholders, this is an opportunity to unlock value and be one of the best capitalized broadband companies, focused on investing in 5G and fiber to meet substantial, long-term demand for connectivity.

The WarnerMedia and Discovery combination includes properties such as HBO, Warner Bros., Discovery, DC Comics, CNN, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet and ID.

Once AT&T unloads its media business in the deal, which is expected to close mid-2022, it will produce low single digit revenue growth and increase its 5G and fiber broadband investments. Annual capital expenditures will be about $24 billion when the transaction closes. AT&T is expecting that its 5G C-band network will cover 200 million people in the US by the end of 2023 with more than 30 million fiber connections by the end of 2025.