Best Buy hunkers down; Consumer electronics sales plunge; Home office remains solid

Best Buy on Tuesday offered a recent snapshot of consumer electronic sales and the picture--high def, LCD, plasma or otherwise--isn't pretty. As a result, Best Buy is cutting capital expenditures by about 50 percent and offering voluntary separation packages to employees.

The electronics retailer's fiscal third quarter results weren't a surprise given that just a month ago the company said it was witnessing the "most difficult climate" it has ever seen. Indeed, Best Buy's third quarter same store sales were down 5.3 percent as merchandise inventory surged 10 percent from a year ago. In a statement, Best Buy said inventory was up due to new store openings in the U.S. and Europe. In the U.S. Best Buy said it was able to keep inventory flat on a same store basis from a year ago. In the U.S. Best Buy's same store sales fell 6.3 percent.

Best Buy reported third quarter earnings of $52 million, or 13 cents a share, on revenue of $11.5 billion. Excluding items the company reported earnings of 35 cents a share. Wall Street was expecting earnings of 24 cents a share on revenue of $11.09 billion, according to Thomson Reuters estimates as of this morning. Best Buy said Wall Street estimates were 25 cents a share, but projections were fluid ahead of earnings. However, Best Buy's results are down dramatically from a year ago when it reported earnings of $228 million, or 53 cents a share, on revenue of almost $10 billion.

On a conference call, Best Buy CEO Brad Anderson said that he expects "consumer spending will get worse before it gets better." He added that Best Buy was "preparing for a wide range of outcomes." Anderson said he was studying history of past downturns, preparing for the worst and reloading for an economic rebound in the future.

The latest snapshot of consumer behavior from Best Buy is mixed. The company said the third quarter was a bit ahead of expectations due to a better than expected performance over the Thanksgiving weekend. Following the Black Friday weekend, "revenue trends slowed further as expected," but December same store sales are on track with expectations.

To adjust to what Best Buy described as "a dramatic and potentially long-lasting change in consumer behavior" the company announced employee buyouts effective Dec. 15. If employees don't take the voluntary separation packages Best Buy "stated that involuntary reductions in corporate staff may be required." Best Buy also said it would cut its capital spending by about 50 percent and throttle back on new store openings in the U.S., Canada and China. Best Buy added that it couldn't tally fourth quarter charges given that it's unknown how many employees will take the voluntary separation packages.

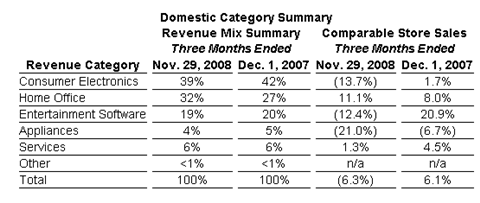

Underneath the surface there were a few interesting cross currents among Best Buy's U.S. sales. Home office sales remained strong, but consumer electronics and entertainment software (video games) fell.

Here's a look:

Judging from the chart, Best Buy's home office sales were the only bright spot. Here's a theory: As people are laid off in the U.S. home offices get revved up as workers start their own gigs or make finding a job a priority. Best Buy credited strong notebook and mobile phone sales for the home office results. Printer and desktop sales declined.

Best Buy noted that gaming software and consumer electronics sales were hurt by declines in digital cameras, MP3 players and GPS devices. Flat-panel TV sales also fell along with home theater sales.

The company maintained its outlook for 2009 and predicted that it would report earnings of $2.30 a share to $2.90 excluding charges. Best Buy is assuming an annual same store sales decline of 1 percent to 5 percent. In premarket trading, investors cheered Best Buy results for a gain of about 9 percent.