Biotech company Imagion lists on the ASX after AU$12m IPO

Imagion Biosystems, which offers bioimaging and nanomagnetic detection systems for the early detection of cancer, is now a publicly-listed company in Australia, after raising AU$12 million at 20 cents a share in its initial public offering (IPO).

The IPO brought the biotechnology company's market capitalisation to AU$43 million.

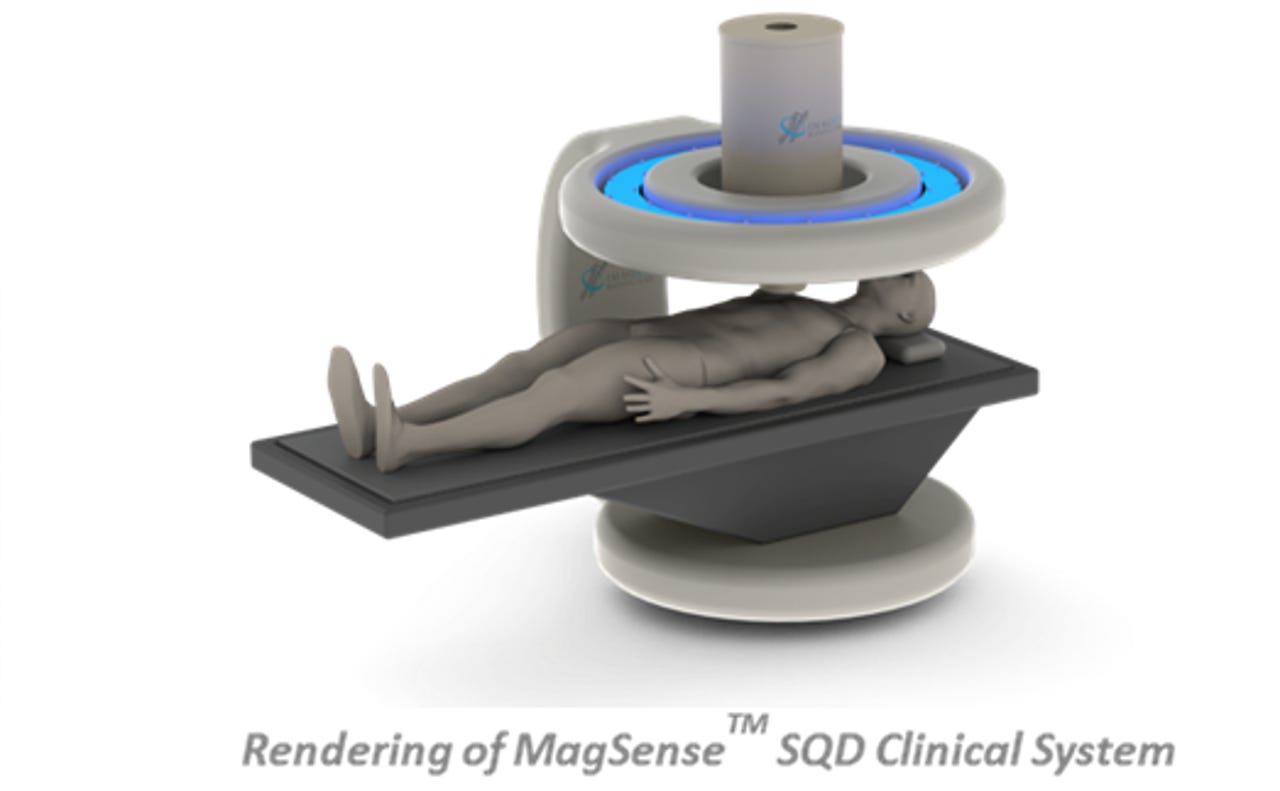

Founded 15 years ago in the United States, Imagion's medical imaging technology MagSense is equipped with "highly sensitive" magnetic sensors that hold the potential to detect, locate, and characterise tumours at their earliest stages.

Imagion CEO Robert Proulx said the magnetic sensors are 1,000 times more sensitive than conventional imaging methods -- it is able to detect tumours that are 1 millimetre in diameter -- and comes at a lower cost.

"The use of cancer-tagging nanoparticles allows the instrument to be of a relatively simple and low cost design, and unlike other less sensitive imaging methods such as MRI, CT, or PET, the MagSense system does not require an expensive shielded environment, translating into lower installation costs for the hospital or clinic," the company stated in a disclosure to the Australian Securities Exchange (ASX).

Magsense is also a non-invasive alternative to procedures such as biopsies as patients are administered with a low dose of cancer specific nanoparticles via intravenous injection, then positioned under the detector, after which the nanoparticles are briefly magnetised and detected.

"Additionally, from a business case perspective, having both the measuring instrument and the cancer specific nanoparticles is akin to a 'printer and ink' scenario, providing a high gross margin recurring source of revenue on the installed base of MagSense machines," the company said.

Imagion believes its technology will optimise patient care and reduce mortality rates across various cancer indications.

"Many cancers go unnoticed and asymptomatic until reaching advanced stages," the company said.

Pre-clinical research has focused on the staging of HER2+ breast cancer and the early detection and diagnosis of both ovarian cancer and prostate cancer.

Imagion expects to conduct clinical trials using MagSense during in the second half of 2018.

The technology will also be used for the detection of other diseases, the company said.

Imagion is not the only company looking into early cancer detection: The Commonwealth Scientific and Industrial Research Organisation (CSIRO) announced in May that researchers from its Data61 division are developing software that could enable the early detection of malignant tumours.

Specifically, the software tool is being built to detect angiogenesis -- the development of new blood vessels -- which precedes the growth of cancers.

In December, the Australian government-backed organisation announced that a new, more accurate blood test to detect bowel cancer recurrence, known as Colvera, had been launched in the United States.

The blood test, which detects cancer-specific chemical changes in fragments of DNA from tumours found circulating in blood, is the result of a collaboration between CSIRO, Flinders University, and Clinical Genomics.

California-based Guardant Health is also looking into early cancer detection and recently raised $360 million to sequence the tumour DNA of more than 1 million cancer patients within five years and use the data to develop blood-based tests for early cancer detection.

Freenome, a South San Francisco-based liquid biopsy startup that uses a combination of machine learning and biology to detect the cell-free DNA sequencing of cancer before it becomes deadly, has raised $71.2 million to date, $65 million of which was raised in March this year. One of Freenome's investors, Google Ventures, has also backed Freenome competitor Grail.

In January, Grail, a spin-off of the NASDAQ-listed DNA-sequencing giant Illumina, also raised $900 million in a Series B round led by Arch Venture Partners, with contribution from other investors such as Johnson and Johnson's innovation arm.

Another company to list on the ASX on Thursday is Shanghai-based edtech company Retech, which offers corporate training solutions. The company raised AU$17.9 million through the issue of 35.8 million Chess Depositary Interests (CDI) at 50 cents per CDI.

Retech's investors include co-founders of Chinese ecommerce giant Alibaba, James Sheng and Eddie Wu, Vickers Venture Partners, Hailang Group, and Chinese billionaire Pang Shengdong.

Perth-based Spectur, which offers solar-powered security camera networks, announced that it is opening up its IPO to raise AU$4.55 million at 20 cents a share.