Blackstone considering last minute bid for Dell

Private equity investment firm Blackstone may be considering a last minute bid to buy Dell, before the deadline for offers is reached at the end of the week.

Dell founder Michael Dell announced the intention to turn the company back into a private entity by buying out shareholders in a deal that sees the company valued at $24.4bn. The deal is being partly financed through investment from Silver Lake Management.

However, according to Bloomberg, Blackstone is considering making an offer for Dell which could trump the $13.65 per share valuation placed on the company.

According to the report, which cited "people with knowledge of the matter," Blackstone would be bidding as part of a group of investors, none of which were named.

However, no bid has been forthcoming, and the group will have until Friday to put forward a deal that could trump Dell's buyout.

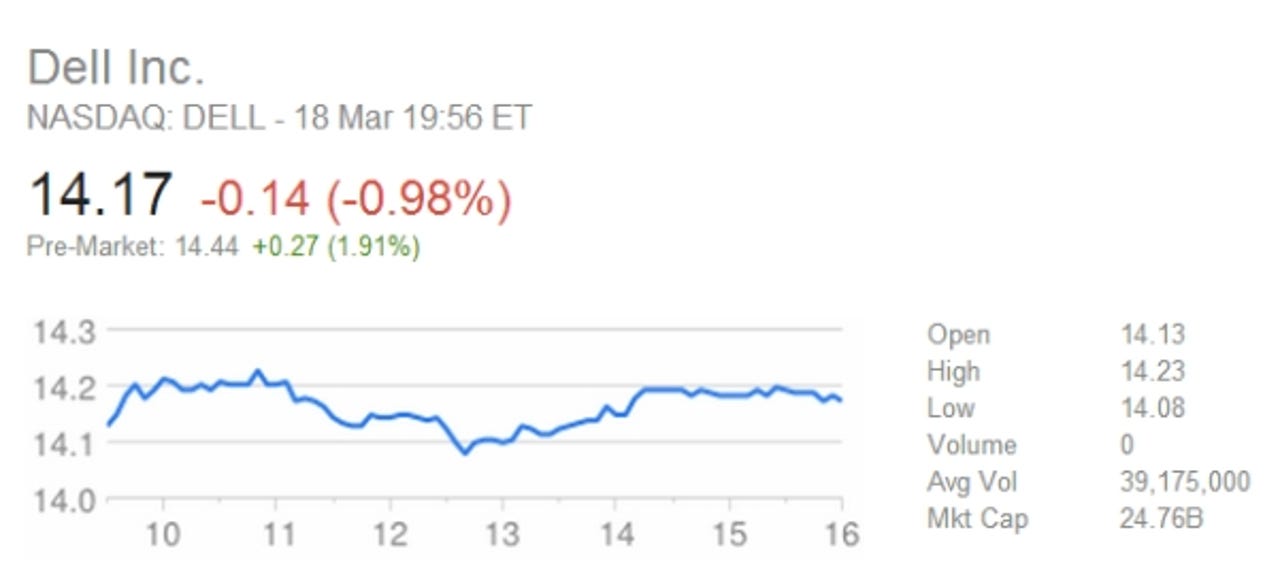

News of the rumours resulted in movement on Dell shares, with the price rising to $14.49 in after-hours trading. At the time of writing, the share price stands at $14.17, giving the company a market cap of $24.76bn.

Michael Dell's plan to buy out the company has been met with resistance from shareholders, including its single biggest shareholder Southeastern Asset Management Inc, which said at the start of February that the company was undervalued at $24.4bn. Activist investor Carl Icahn also recently was granted permission to look at the company's books in a bid to allay his fears that the company was being undervalued.

Neither Blackstone nor Dell had responded to a request for comment at the time of writing.