Broadcom plots $130 billion buyout of Qualcomm for more industrial Internet, connected auto and 5G clout

Broadcom wants to buy Qualcomm for $130 billion including debt, potentially add NXP, and create a semiconductor juggernaut that would define the industrial internet as well as 5G direction.

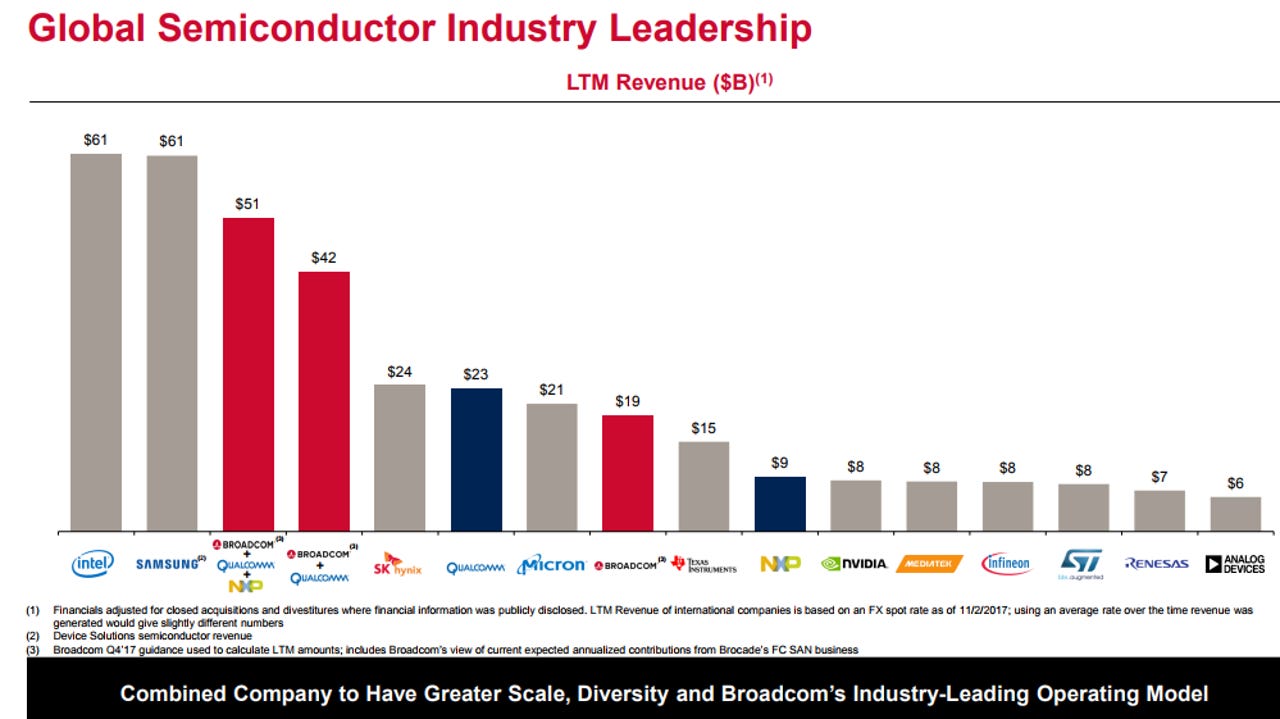

In the meantime, Broadcom with Qualcomm and NXP would have annual revenue of $51 billion and be the third largest chip maker behind Intel and Samsung.

Scale matters in manufacturing and Broadcom, which is the product of a series of mergers and acquisitions, is assuming that Qualcomm with or without NXP is a game changer.

In a research note, Cowen analyst Karl Ackerman said:

Aside from the financial merits of the deal, the predominant reason why Broadcom would acquire both Qualcomm and NXP is that Qualcomm has the broadest suite of technologies in processing and connectivity solutions and it has far superior baseband chipset technology over Intel, MediaTek and Spreadtrum, in our view. Combining its suite of technologies with NXP's sensor, analog, and in-car/industrial networking capability may allow Qualcomm/NXP to become the dominant player in connected industrial and automotive applications and further define the 5G ecosystem - an area where Broadcom is underexposed today.

Broadcom confirmed reports that it will make an unsolicited bid for Qualcomm in what'll equate to one massive rollup. One wild-card is whether Qualcomm can close its purchase of NXP, which is a major player in the connected auto space.

In a statement, Broadcom said that it will pay $70 a share for Qualcomm with $60 a share in cash and $10 a share in stock. Broadcom trades under the ticker AVGO.

Broadcom CEO Brock Tan said that the company's proposal would add value and offer multiple cost savings as well as scale. Apple is a major customer of both Broadcom and Qualcomm and could benefit the most. Apple and Qualcomm are suing each other over patent licensing fees and it's likely Broadcom would settle those issues.

Canaccord Genuity analyst Michael Walkley said:

We believe the combination could create shareholder value through potential accretion, synergies, increased share with Apple and Samsung; in addition, Broadcom could potentially settle the licensing dispute with Apple in a more-timely manner than could Qualcomm, given Broadcom's strong relationship with Apple. Further, we believe Qualcomm and Broadcom are uniquely positioned for reaccelerating revenue and earnings growth as the market transitions to 5G.

Broadcom also noted that it has completed five large acquisitions since 2013 and can integrate Qualcomm well. The biggest combination for Broadcom has been integrating the combination of Broadcom and Avago. Here's a chart that outlines how Broadcom has been built assuming the company ingests Qualcomm and NXP.

And here's a look at the markets Qualcomm would give a bulked up Broadcom.

The wild-card is whether regulators would approve a Broadcom-Qualcomm-NXP deal. Broadcom said it also plans to move its headquarters to the US from Singapore in a move likely to at least help start a conversation with regulators.

Previous and related coverage

Broadcom, Brocade push back merger deadline

The companies have been tied up in regulatory review hurdles for nearly a year.

FTC to force Broadcom to build a firewall to complete $5.5b Brocade takeover

Concerns over Broadcom supplying silicon to both Brocade and Cisco will see the semiconductor maker firewall its business with Cisco.

iPhone, Android hit by Broadcom Wi-Fi chip bugs: Now Apple, Google plug flaws

Google's Project Zero shows how attackers could target increasingly powerful Wi-Fi chips on phones as low-hanging fruit.