Bulletproof board rejects Macquarie Telecom advances

The independent expert appointed by the board of Bulletproof to evaluate the November AU$18 million offer for the company from Macquarie Telecom has declared that the offer is "not fair and not reasonable", and low-balled Bulletproof's valuation by one third.

Consequently, the board has advised investors to ignore all documents sent from Macquarie BidCo.

In November, ZDNet reported that the offer faced hurdles from significant investors, with Microequities Asset Management increasing its stake to oppose the deal, and Bulletproof co-founder Lorenzo Modesto said the bid was too low and his company's 12.6 percent stake would be used to oppose the deal.

"Major shareholders holding a relevant interest in 19.86 percent of the Bulletproof shares on issue have written to Bulletproof and advised that their current intention is that they will not accept the offer, subject to a superior proposal," the board said on Friday. "As a result of the position of these major shareholders, the offer is unlikely to succeed on its current terms."

MacTel needed 90 percent of Bulletproof shareholders to approve the deal in order for it to proceed.

Macquarie BidCo holds 16 percent of Bulletproof, thanks to a deal with an associated entity of Bulletproof CEO and co-founder Anthony Woodward, the Woodward Family Company. Due to the involvement of its CEO in the offer, the company set up an independent subcommittee to look at the proposal.

"Your independent board committee directors strongly believe that the offer is opportunistic, inadequate, and substantially undervalues your Bulletproof shares," chair Craig Farrow wrote on Friday.

The company said its turnaround plan is working, and that a number of other parties have said they would like to make alternative offers.

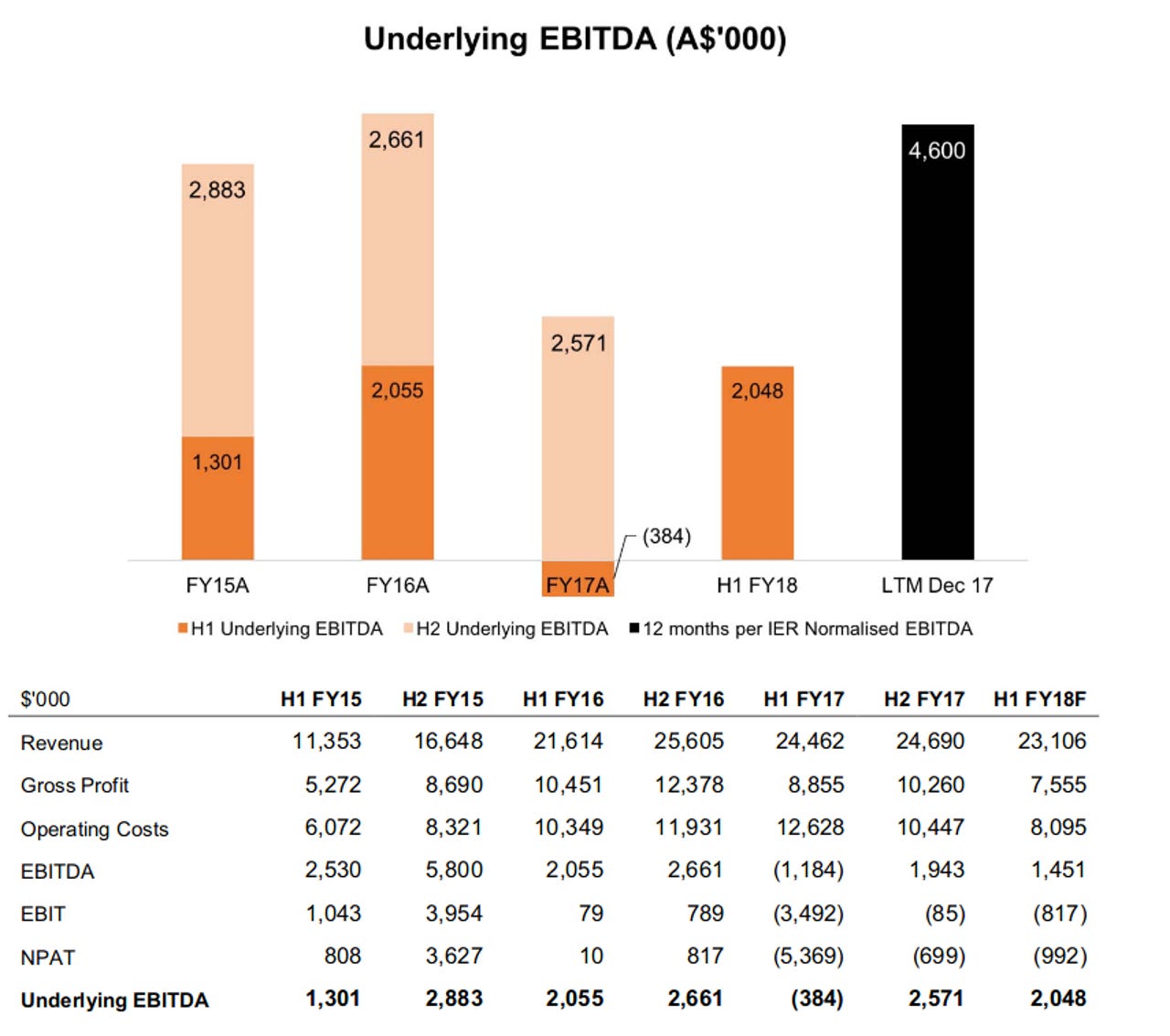

Bulletproof said it expects to post AU$1.45 million in EBITDA for the first-half of the 2018 fiscal year, a significant reversal of the AU$1.2 million loss made in the first-half of 2017, even as its revenue shrank from $AU24.5 million to a forecasted AU$23.1 million year-on-year.

Related Coverage

Bulletproof co-founder opposes Macquarie Telecom's AU$17.9m takeover bid

Although he exited the company in September, Lorenzo Modesto still has a 12.6 percent interest in Bulletproof and believes the bid from Macquarie Telecom is too low.

MacTel bid for Bulletproof opposed by microcap fund

Microequities Asset Management has upped its stake as it decries the MacTel offer.

Macquarie Telecom makes AU$17.9m bid to acquire Bulletproof

The Australian heavyweight has offered AU$17.9 million to acquire the remaining shares of Bulletproof and bolster its cloud offering.

Bulletproof plummets AU$2.1m into the red for FY17

While fighting a NZ$3 million lawsuit in New Zealand, the Australian cloud services provider has reported an EBIT loss of AU$2.1 million for the 2017 financial year.

Bulletproof posts AU$1.5m loss for first half of FY17

The first half of FY2017 saw Bulletproof cull 30 people from its workforce and post an underlying after-tax loss of AU$1.5 million.

Report: Cloud storage confusion leading to major security issues (TechRepublic)

Kaspersky Lab says nearly half of cloud-using businesses don't know whether their data is local or in the cloud, creating a ticking cybersecurity bomb.

Amazon cloud bolsters efforts in containers, databases, compute at AWS re:Invent 2017 (TechRepublic)

At its annual conference, Amazon Web Service unveiled new services for Kubernetes, bare metal compute instances, and more.