Cable Might Try To Kill TV. It Would Not Be Suicide.

Cable operators have a love-hate relationship with TV. Giving Americans scores of TV channels,where they once had just three or four, built them into the telecommunications giants that they are today.

But now, the TV business is the least profitable of the three legs they stand on. Cable programming networks (like Viacom and its MTV Networks) keep demanding higher licensing fees. Now, broadcasters are getting into the act, demanding licensing fees for local TV signals and counting on that as a new revenue stream.

All of this dampens appetite for the subscription television business. After all, margins are much higher on telephone service and Internet access.

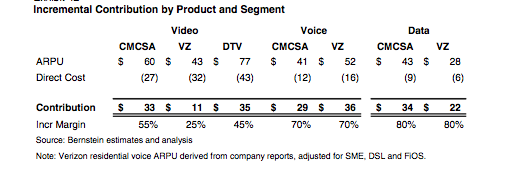

Here's a breakdown by BernsteinResearch analyst Craig Moffett. CMCSA is Comcast. VZ is Verizon. DTV is DirecTV.

What this says is:

A big cable operator, like Comcast, gets 55 cents of contribution toward overhead and profit from each $1 of revenue from television services. But it gets 70 cents from voice communications and 80 percent from Internet access.

Moffett projects that cable is moving toward 36% share of the market by 2012 in telephone service (see bottom chart), from 8.2% in 2006. Telcos are going from 91.8% down to 64.3%. And they're replacing it with lower margin video services (note that Verizon gets only an estimated 25 cents on the dollar from its TV service. This, despite what the FIOS commercials say, is NOT big).

Meanwhile, customer expectations are changing. A generational shift is underway. My sons (ages 19 and 22) expect to have all their video available all the time -- on computer. For about 20 million households, the move to digital TV is about replacing rabbit ear antennae either this month or in June (stay tuned). For the generation just entering the work force, the move to digital TV is about inserting a USB stick antenna into the side of a laptop.

My older son, Zack, is emblematic of this digital TV transition. When he went to work for Accenture in Minneapolis this Fall, fresh out of college, he saw no reason to buy a TV, since he had a laptop. Just as he saw no need to get a phone line, since he has a cell phone.

He relies on Hulu and the TV network sites for his video fare. And he'll probably spend about $100 to get a USB stick that pulls in digital TV signals from local stations over the air. And lets him record the shows on his computer for playback, later. This is mobile TV, in the process.

He's not going to disconnect cable, because he doesn't use it. Not for TV, anyway. He needs it really only for Internet access.

Over time, this habit will reinforce itself. Yes, Comcast is pushing on-demand programming as hard as it can (unlimited Disney family movies now, for $5.99 a month). But the Internet has infinite, worldwide capacity. If you can pay for just a broadband subscription to get to more video than you can possibly watch, when you want to watch it, the TV subscription becomes superfluous. As more boxes and TV's come along that are easily Internet-connected, this digital change will accelerate.

Cable operators may, behind closed doors, want to accelerate this. If programmers' demands for higher license fees keep mounting up and margins go down, don't be shocked if Comcast or Time Warner Cable at some point plays chicken for an extended period of time with one of the big programmers. Cox Communications did it in 2003 with ESPN to curb the sports network's license fee demands.

If you're one of only two Internet service providers in each town in America, why not concentrate on services with 70 percent and 80 percent margins? Comcast, for instance, is hedging its bets by moving to install 50 Mbps service in .... Minneapolis. 100 Mbps may come next year.

Threatening to kill TV networks that demand excessive fees wouldn't be suicide. Cable operators have to temper programming expense. Or they will just keep watching subscribers move onto the Net, long term. A showdown in the not-too-distant future could be used to send a message to programmers to either move wholly onto the Internet -- or stay wholly on cable, satellite and telco TV. At lower fees.