Can AI make your health insurance better?

Healthcare and Artificial Intelligence (AI) are each very much in the news right now. The United States Senate has released draft legislation for the repeal the Affordable Care Act (aka "Obamacare"), leaving some Americans with trepidation about their coverage. Meanwhile, the phrases "machine learning" (ML) and "artificial intelligence" can inspire concerns of their own.

What if there were a way to combine healthcare coverage with machine learning to try and make delivery of services not just more efficient (which many worry can be code for "less generous") but more proactive as well? Could this cut costs and enhance care? Could it help payers optimize customer care beyond the blunt metric of keeping customer service call durations low?

Healthy tech?

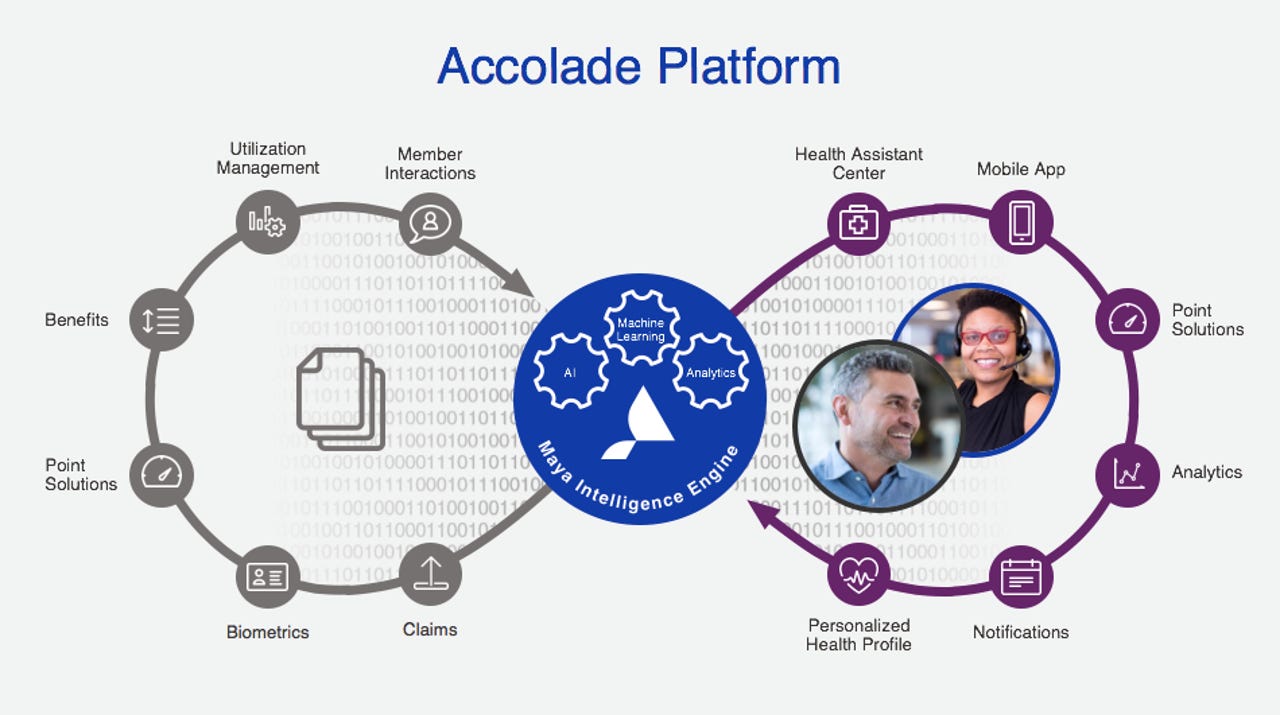

One company thinks so. Accolade, and its Maya Intelligence Engine, which it announced just last week, use ML and AI towards these very ends. While the company has the perhaps ambiguous ambition of delivering the "most personalized healthcare experience," it seems also to be applying both data science and common sense to help insurance companies do a better job of helping their customers.

Maya Intelligence Engine flow description

When I spoke with Mike Hilton, Accolade's Chief Product Officer this week, he explained to me that the conventional model in health care is to target the sickest 5% of its customer population, conduct some outreach to them and maybe do some predictive analytics on what their next course of action should be. Hilton says customers don't tend to like this approach and participation rates for these outreach efforts on the part of the customer is very low.

Beyond the 5%

Accolade's approach is to cast a much wider net, targeting not just the 5% of the customer population in the most acute states of illness, but to include lots of healthy customers as well. Targeting younger members, who may be quite healthy, has merits too -- because those may be the very same members who, for example, bristle at filing claims, or naively use out-of-network providers and are hesitant to call and ask for clarification about a high bill they may receive.

This, in turn, may make them quietly dissatisfied with their coverage, ill-at-ease with using it, or lax about scheduling free in-network physicals and the like. Such aloofness from their benefits may lead to poor health later, as well as less than tenacious management of their conditions.

ML is proactive

Machine learning can help here. It's clearly in the insurers' interest to have their healthier members satisfied with their coverage and take advantage of their preventative benefits. Intelligence in the Accolade platform can trigger outreach that explains the parameters of the provider network, or have a (human) healthcare assistant do likewise, by phone. This can help establish trust and a rapport that leads members to be more comfortable taking advantage of their coverage and proactive in their own care.

Beyond the "healthy millennial" scenario, imagine a middle-aged woman who is pre-diabetic. Early engagement will make sense, for both the insurer and the member. Proactive management of the condition will clearly lower costs for the former. But it also constitutes responsible care coordination. Without machine learning, telling payers they should engage in such outreach might be glib at best; but with ML, insurers can implement it, as a matter of procedure, with a high degree of confidence, statistically, that it's in their interest to do so.

Caring for the iPhone generation

This whole calculus of analyzing engagement data, medical history, conditions and "life context," and then engaging, has some lingo that goes along with it: determining the "next best action." That's a big part of what Accolade does, but its technology is by no means on the back-end only. Accolade offers a mobile app as well that members can use to communicate with both health assistants and nurses -- something far more palatable in this era than making an appointment for an office visit and taking perhaps hours out of the day in travel, waiting and appointment time.

A screenshot form the Accolade Mobile app

Even with mobile app interactions, the Maya engine can help. Using Natural Language Processing, Maya can once again engage around next best action...it can also determine if the health assistant is recommending it and if the member pursues it. Again, this is as much common-sense as it is AI and, let's face it, the health insurance world can really benefit from both.

Serving competing interests

Interestingly, although Accolade has customers who are carriers participating in health insurance exchanges (there's that Obamacare thing again!), most of its customers are self-insuring employers. That's an interesting constituency, because it's got vested interests both in cost efficiency as well as employee health and employee satisfaction (as these lead to higher employee retention). Self-insuring employers are not well served by systems that play only to minimizing costs -- such an approach would only result in higher costs in recruiting and employee productivity.

Accolade says its platform has a 70 Net Promoter Score and says that's ten times the industry average. Hilton explained an industry term of art to me: the so-called "Triple Aim," which entails satisfying the goals of happier consumers, healthier consumers, and lower cost of care. As with the CAP theorem in data science, each facet of the Triple Aim can work in opposition of the other, and achieving all three is elusive.

But Hilton says Accolade is doing very well in all three aspects. He also told me Accolade has a large data science team. That correlation may have an element of causation as well. Sometimes, data science just makes it more straightforward to do the right thing.