Can open source save the debt market?

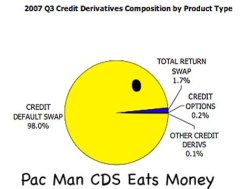

The engine is used to price Credit Default Swaps, the contracts which collapsed the whole financial world starting in 2007. (Picture from Elaine Meinel-Supkis.)

The ISDA insists that CDSs are "insurance" that "hedge risk" despite all evidence to the contrary. They were used for years to leverage profits on debt instruments and to let people pretend they had no risk.

Still, it will be interesting if ISDA really releases the code and lets all market players get access to it. I would like to know which license they will use for the code release -- it would be cool if it were GPL'ed.

Will this release actually help unwind the market and return some order to the debt market? Or is this just J.P. Morgan throwing some bad code over the side and hoping for a pat-on-the-back at a time when its credibility is near zero?

Stay tuned.