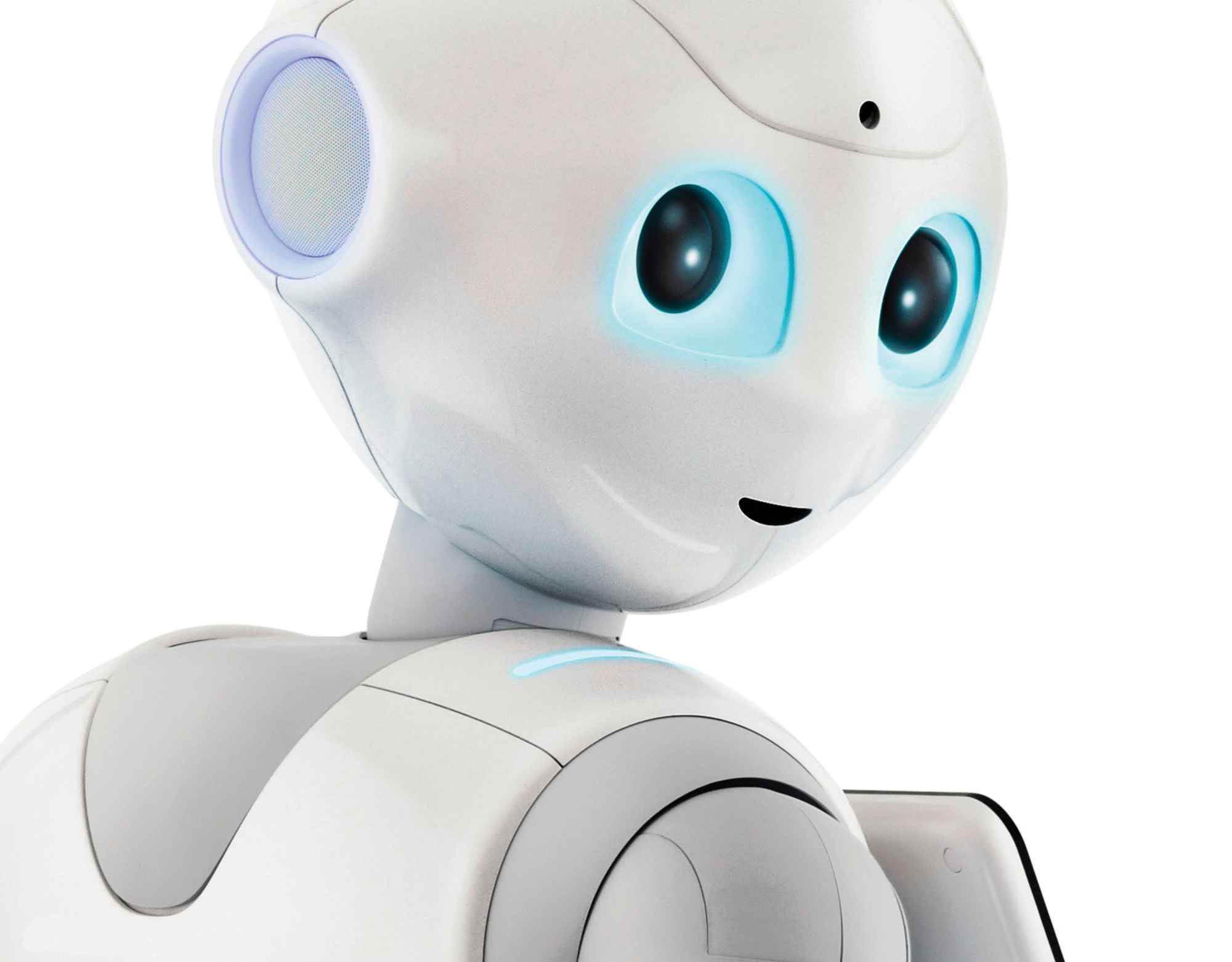

Canada's ATB Financial using Pepper to redefine its customer experience

Customers of ATB Financial may be surprised upon entry into the company's Chinook Centre branch in Calgary, Canada this month being greeted by a robot rather than a human concierge.

According ATB Financial's chief transformation officer Wellington Holbrook, the adoption of SoftBank's Pepper sees his company break away from the banking norm.

"Banks suck at creating great customer experiences, and it's not because we don't work hard," he said at SAP Sapphire Now in Orlando last week.

"It's not that bankers and people that work in financial institutions don't work hard, they do, but we built processes, literally, that are a thousand years old; we've just modernised them and dressed them up."

To Holbrook, banks are essentially giant computers, and many have let its applications drive customer experience. He's somewhat baffled how this has been allowed to become the norm.

"People really do want to engage with different types of customer experiences and too often in the financial services sector we think it's about people -- people are really important, I don't want to give the wrong idea -- but people just want to engage," he said. "What we're learning from Pepper is people actually love engaging with a cute little robot that can dance and say nice things to you."

With Pepper as its springboard, the CTO believes the future of the financial services sector will be centred on creating digital interfaces for customers to transact the way they like, with the bank's experts hidden away until called upon.

One monolithic process Holbrook believes needs to be completely reworked is the opening of a bank account.

"You go into any bank ... and at the majority of them it probably takes you half an hour to sign up for a bank account," he said. "I suspect if you were buying something online you'd be quite frustrated if it took you 30 minutes to buy anything but that's been acceptable in the banking industry for a long time and that can't be acceptable anymore."

Instead, he said this should be a process taking up only a couple of minutes.

"A 10 percent improvement [in opening a bank account] is still a crappy experience, yet a lot of us are still thinking about how to make these incremental improvements to bad processes," he explained.

"We have to blow it up and start over and the only way to do that, I think, are through digital means.

"It's a lost opportunity for financial institutions where that is their expertise."

He said financial institutions need to discover and interact via the ways customers want to, rather than sticking to the prescriptive ways they have previously tried to solve problems in the past.

"There's a lot of buzzwords and a lot of stuff everybody's trying to do," he explained, pointing to partnerships ATB has kicked off with fintech firms to rework its offerings.

"I think we have to start imagining the customer experiences or the employee experiences, whatever, that we're trying to create and then look at ways to get there."

read more

Disclosure: Asha Barbaschow travelled to Sapphire Now as a guest of SAP.