Capgemini: Banks must embrace 'open banking' evolution or risk disintermediation

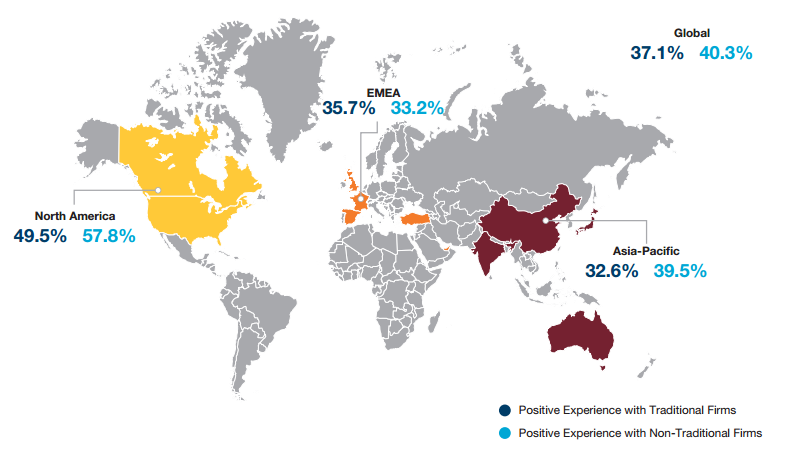

Positive customer experience for traditional and non-traditional firms in 2017

A report from Capgemini has suggested that banks address the "threat of disruption" by combining their strengths with those of fintech startups, with one such method being to open up APIs to other players.

Fintech startups have made their presence felt, with Capgemini's World Retail Banking Report 2017 noting that non-traditional financial providers are moving the needle in attracting customers; nearly one-third of banking customers are already banking with at least one non-traditional provider.

However, they are yet to achieve significant market share, with Capgemini highlighting that there is still action the traditional players can take, and the threat posed by tech-driven financial firms leaves a "far from grim" outlook for traditional banks.

"While most banks are leveraging APIs internally to improve information flow between legacy systems, many are still in the early stages of using them to incorporate functionality from business partners," the report explains.

"However, APIs have the potential to strategically deliver innovation and functionality to the business by making their systems and data widely available to outside third parties, as well as creating new revenue streams for both organisations."

Using APIs to their advantage will allow banks to innovate while bypassing issues of technology incompatibility, as well as allowing them to push new services out sooner than previously possible.

Ultimately, the future success of banks will require a shift towards a more open banking model, which the consultancy firm said will result in "uncorking the creativity" of third parties and generating opportunities the industry has not experienced before.

"Getting there, however, will require careful planning, and compel banks to make strategic choices about how to evolve their business models," the report adds. "With technology firms proving their power to delight customers, banks need to act now to ensure they remain a key part of the equation."

Fintechs have almost nailed the customer experience, but a closer interaction with the users of its platform can be linked to niche offerings and the fact that they have been built digital from day one.

"Fintech firms have been successful in identifying specific focus areas where there exist opportunities to 'wow' customers with relevant, attractive, and easy-to-use offerings," the report explains.

"The new competition deploys advanced technologies aimed at providing a frictionless and enhanced customer experience, and is not bogged down by legacy systems."

In North America, fintechs are delivering positive experiences to 57.8 percent of customers, compared to 49.5 percent for banks, with the report also stating that 29.4 percent of banking customers are using products and services from fintechs.

Those born between 1981 and 1994 are the most eager adopters of fintech services, Capgemini reported, highlighting that in emerging economies such as China and India, more than half of customers aged 23 to 36 have relationships with non-traditional firms, which is the highest percentage globally.

As a result, Capgemini expects partnerships between financial firms -- large and small -- will become a standard way of doing business; 91.3 percent of banks and 75.3 percent of fintechs said they expect to partner with each other in the future.

"Non-traditional providers have an edge on many fronts, but banks have a number of built-in advantages, including vast customer bases, access to resources, and customer trust," the company explained.

By 2018, banks in the United Kingdom will be required to effectively open up their APIs to enable consumer data to be accessed by competing banks, startups, and other financial institutions -- providing the consumer consents. This is a move the Australian House of Representatives Standing Committee on Economics is eager to see implemented in Australia.

A report from the committee, tabled in November, recommended that banks be forced to provide open access for third parties to customer and small business data by July 2018.

The data would be wrapped in security and privacy protections and would include information on a customer's transaction history, account balances, credit card usage, and mortgage repayments.

The committee also suggested that the Australian Securities and Investments Commission be charged with developing a binding framework to facilitate this sharing of data, making use of APIs, and ensuring that appropriate privacy safeguards are in place to allow such a practice.