Carriers channelling Pavlov in data-frugality push, but will we bite?

I may be wrong, but I'd suspect that my mobile usage isn't that far gone from yours: lots of email, a bit of web browsing on the go, occasional YouTube videos on the train, a bit of tethered internet access from the iPad and lots of music played from the library on the phone.

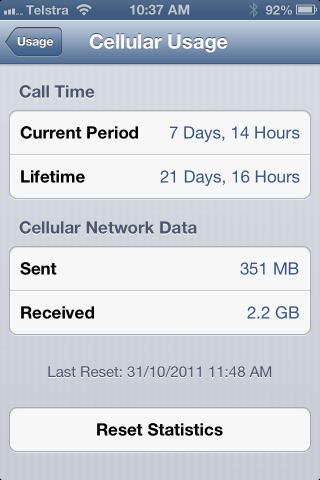

It may sound like a lot of data, but it's not: checking my usage meter just now, I have apparently used just 2.2GB of cellular data since I purchased my iPhone 4S a year ago. That's 183MB per month — less than 20 per cent of the 1GB on my monthly plan.

Mind you, that doesn't mean I'm not downloading more information than that — but that figure doesn't include the times I'm using the phone at home, or elsewhere in range of a Wi-Fi access point. That data isn't counted against the monthly carrier quota — but it is, by all accounts, growing at a harried pace.

I mention this to provide some perspective on the recent moves by Optus, Telstra, and Vodafone to restructure their wireless-broadband market propositions. All three have been reconfiguring their plans to offer less data for the same money, just as food manufacturers stealthily reduce the amount of actual product in the box, even though the box is left the same size.

At face value, this kind of move is the ultimate bastardry from a sector that knows that many customers will end up paying more for less. Carriers will argue that they're just trying to recover more revenues from heavy mobile users that are congesting their networks — but if your usage is like mine, we're using way less than we paid for.

That should make congestion a non-issue, since the carriers would obviously have ensured that there is enough capacity in their networks for every user to burn through all of their 1GB, 2GB, 4GB, or whatever, right?

Of course not. Carriers count on people like me to pay for more data than they use, which is what makes the recent reshuffling of data plans so unpalatable. Optus has defended its moves by arguing that surveys show that users are actually using less than 500MB per month — which may be true. But wouldn't the correct action therefore be to offer a cheaper plan to cater for low-bandwidth users?

Perhaps, but the rules always change when a company is undergoing a major corporate restructure. Indeed, Optus has been working hard on a spring clean of late — severing ties with prepaid licensed mobile provider Boost and retail operator Telechoice, even as it expands its 4G network footprint, invests in its own retail network, and generally redoubles its efforts to vie for Telstra's 4G crown.

Mobile data consumption, after all, reflects usage patterns that are driven by human behaviour — commuting habits, lunchtime breaks, and the like. These regular patterns aren't likely to change just because someone has a 4G rather than a 3G phone.

In this light, reducing its data quotas may be seen as a form of damage control: training users, Pavlov-like, to think even more about their usage — and backing it up with mobile-usage SMS alerts — may well be intended to spark a culture of data frugality, even as the shift to 4G-enabled mobiles make it easier than ever to download lots and lots of data.

Is this a sign that 4G networks can't keep up with real-world demand? Perhaps. Optus and its rivals may just be trying to buy themselves some time to bulk out their emerging networks before they get even more inundated with customer complaints. After all, Optus is already up to its neck in complaints, and things aren't likely to get any better as the company prepares to shut down the Unwired service it had paid $230 million for earlier this year.

Perhaps early usage of their limited-scope networks have confirmed that 4G-enabled users are finding more and more ways to guzzle wireless bandwidth, and they're running scared. Perhaps they're concerned about the potential cost of 700MHz 4G spectrum in the upcoming auctions, and they want to squeeze as much out of their existing 1800MHz services as they can — and train Australians not to run rampant over whatever 4G they do secure.

Turns out Optus did indeed buy Unwired only for the spectrum. And, as part of its new structure, it's working to make sure that it has as much spectrum available as its network and demand for 4G data expands. Since one key selling point of 4G is its data features, carriers may simply be retraining customer expectations, so that a 4G service with 2GB quota will once again look like a bargain.

I can't help but think again of that usage meter. Not everyone has Wi-Fi in their homes, of course, but I'd bet that there are enough Australians actively engaging in Wi-Fi data offloading that the amount of data actually being transferred over their carriers' networks isn't likely to change as much as carriers think it will.

Mobile data consumption, after all, reflects usage patterns that are driven by human behaviour — commuting habits, lunchtime breaks, and the like. These regular patterns aren't likely to change just because someone has a 4G rather than a 3G phone — which may mean that the carriers' latest changes do nothing but leave a bad taste in customers' mouths.

What do you think? Have we been spoiled with quotas we don't need or use? Should carriers be offering more data, not less? And will your mobile usage change when you get a 4G phone?