Castlight Health surfaces health plan big data; Millennials' quirks

Castlight Health, a cloud healthcare analytics software provider, on Tuesday will highlight data from its platform of 130 signed self-insured companies showing that Millennials' top health care benefit searches revolve around dentists and anxiety disorders while midwife services are distinctive for women in the Midwest.

Big Data Special Report

The results will be outlined at the HR Technology Conference in Las Vegas. The research examines distinctive searches, or queries by an age, gender or regional group that differs the most from the overall search rate, instead of common searches. Across the board, primary care is the most common search term.

Castlight's visibility into the actual search terms among its customers is worth noting because it's just the beginning of a movement to better use big data and analytics to improve healthcare costs and outcomes. Castlight's data is the first public release on insured employees and what the care about.

Employers spend $620 billion annually on healthcare for employees and their dependents and about 30 percent of that money is wasted. Even Facebook reportedly wants to get into the healthcare education and analytics game — if only to provide peer support and boost engagement.

For Castlight's customers, ranging from Wal-Mart to Associates’ Health and Welfare Plan to Google, the analytics allows those companies to better tailor and target benefit plans to their employees. After all, benefits are a key employee retention and recruiting tool.

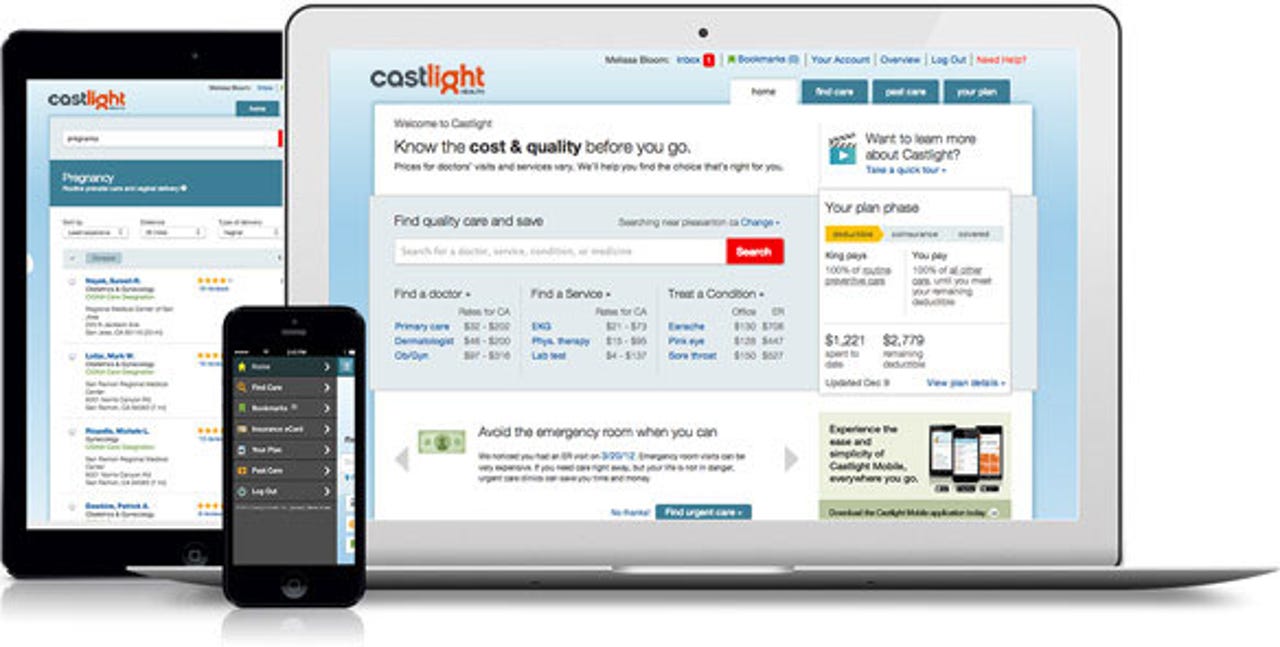

Castlight's cloud software aggregates data from its customers’ health care vendors, quality and research institutes and administrators — typically seven to nine providers — and analyzes costs, expensive tests that aren't needed and incentives needed to use carrots and sticks to improve employee health. The theory is that analytics can steer employees to doctors that get results while minimizing unnecessary trips to the emergency room via technologies such as tele-health.

"We're trying to address the biggest expense of the American enterprise. There is absolutely no accountability for how this money is spent. Every other area of expense has a platform on how a dollar is spent and how to optimize it," said Dr. Gio Colella.

Castlight's platform becomes the front end of an employee's health care experience and aims to steer them to make the best possible decision via information and educational content. Dr. Jennifer Schneider, vice president of strategic analytics, says the goal is to prevent expensive tests like an MRI on a back ache you've had for two weeks. "We get in front of employees when they make a decision," said Schneider.

If successful, Castlight's customers will be able to use the platform and analytics behind it to tailor benefit plans to employee groups and move quickly to add features that may be winners for workers. "Benefit leaders are creative and nimble and the more information you can give them the better," said Schneider. "Can someone change a dental plan midyear? Yes there is some pain midcycle, but with data you can at least strategize around it."

Big data just starting in health care

Castlight's high-level analysis of distinctive search terms sheds light on some key developments, but is also notable for what's missing.

The company, which runs on co-located data centers to deliver its software as a service, uses parallel processing stories and technologies such as MapReduce to crunch data, but the sets could be filled out more. Yes, Castlight's data highlights how there is no one-size-fits-all benefit plan or answer to health care issues, but is limited to its customer base.

Colella said if there were one data set he'd like to have its Medicare's database. Sophie Pinkard, director of strategic analytics, and Schneider both noted that Castlight's go-forward plan is to start adding public data sources to the mix, say Twitter's information, weather patterns and Google search terms.

Meanwhile, Castlight's data shows how information on health care has to be a 24/7 affair — especially since young men are searching about benefits late night.

The main takeaway is that Castlight efforts show promise, but represent a good start. Castlight's findings offer a good baseline for future research.

Among the key takeaways from Castlight's findings:

- For Millennial men age 20-24, dentists are the most distinctive search in almost every region. In general, millennial men and women across the country search for dental care 2-5 times more than Castlight's average.

- Anxiety Disorders is the most distinctive search term for women 20-24 in the Northeast. In general, millennial men and women across the country search for Anxiety Disorders 1.5-2 timesmore than Castlight’s average.

- "Birth control", "fertility", "pregnancy", "birth", and "pediatrics" are distinctive searches across regions and genders for men and women under 40.

- In the Midwest, Mountain West, and South Atlantic, distinctive searches for maternity occur sooner — in the 25-29 age group — compared to the 30-34 age group for women in the Northeast, Pacific West, and in the South Central.

- Men use natural language search to address a specific problem or body part, like "tooth" or "rash," while women's distinctive searches include medical terms like "laparoscopic fibroid removal" or "colposcopy"

- "Naturopathic medicine", "massage therapy", and "acupuncture" are distinctive searches across ages and genders in the Pacific West.

- Men and women in the South Atlantic and South Central regions were almost three times as likely as the rest of the country to search for surgery related to weight loss, such as "bariatric surgery", "gastric bypass', and "lap band."

Castlight's future

Another reason Castlight is notable because it's one of those emerging cloud providers that are highly focused and specialized. While Google, Microsoft and Amazon Web Services vie to be the compute and storage infrastructure providers for the masses, a bevy of cloud levels are emerging. Cloud players such as Rackspace and Verizon have more specialized infrastructure and platform offerings. Beneath them are developmental companies such as Castlight as well as operational systems vendors like Guidewire and Rootstock.

Featured

Castlight earlier this year launched a high-profile initial public offering at $16. Shares topped $40 and then slid to their current $11 level and $1 billion market capitalization.

The company reports earnings in a few weeks, but remains a story stock. For the six months ended June 30, Castlight reported a net loss of $46.06 million on revenue of $19.9 million, up from $4.23 million for the same time period in 2013.

Castlight's top 10 customers account for 61 percent of revenue. Customers typically sign up for three-year terms.

For the company to really become the Workday of healthcare, Castlight has some development to do. Its regulatory filings note that the flagship product, Castlight Medical, has been complemented by pharmacy, rewards and pricing applications.

The risks for Castlight revolve around competitors such as Truven Health Analytics, ClearCost Health and HealthSparq as well as massive health plan providers such as UnitedHealth and Wellpoint who cooperate today but may compete in the future. The likely outcome is that Castlight will continue to develop its analytics approach, garner returns for its customers and possibly be acquired down the road if doesn't scale.