Catch Yourself If You Can: A Con Artist Guide To Forging Checks

"If you believe you have created a fool-proof system, you have failed to take into account the creativity of fools." --Frank Abagnale, June 23, Securities Industry and Financial Markets Association Management Conference, New York City

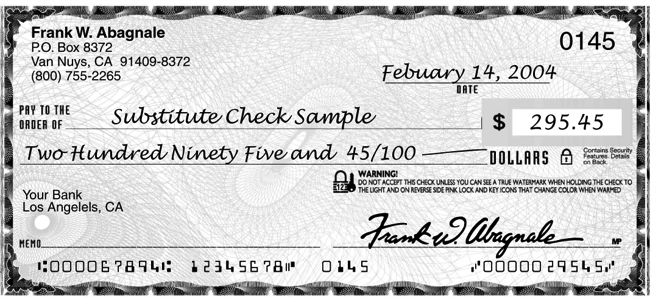

Frank Abagnale has spent 35 years helping the FBI fight forgery, embezzlement and identity theft. This is a guy spent five years in prison after starting out in adulthood as a con artist. He created counterfeit identification (think Pan Am employee identification card and Harvard University law transcript). His feats, such as they were, were more or less immortalized in the Steven Spielberg film “Catch Me If You Can,’’ starting Leonardo DiCaprio.

Now, he’s dedicated his professional life to figuring out the flaws in financial systems and fixing them. But he’s not beyond giving out enough clues on how to socially engineer your way to pulling in some money fraudulently, in this information- and technology-soaked society.

Want to drain some money out of a Continental Airlines’ bank account?

Easy.

Take your laptop computer and digital camera to the Newark airport.

1. Grab a corporate logo, from Continental’s corporate web site. 2. Take a photo of a Continental plane, taking off. 3. Screen it in to the background of your template for a corporate check. 4. Call Continental’s corporate accounts receivable department. Tell the responding representative that you have an invoice and want to pay it. 5. Tell the person you prefer to pay by wire. 6. Let the person tell you everything you need to know about what bank Continental uses, what the account number is and the transfer coding. 7. Call Continental’s corporate communications department. Ask to be sent an annual report. 8. Go to page 3. Take snapshots of the signatures of the company’s CEO, CFO, treasurer and/or controller. 9. Create and deposit a beautiful check that has an authorized signature on it. 10. Deposit same.

Of course, be prepared to accept the consequences, if caught. Even Abagnale got arrested. And says he still shoulders the burden for his youthful crimes.

He has built a career on this, first outside the bounds of law and now inside, for the law enforcers.

But realize this: He is the voice of experience. When, in his youth, he opened a checking account, he asked how he was going to deposit money in the account.

He was told that, in seven to 10 days, he would receive checks with his account number on them as well as deposit slips, with same.

In meantime, he would have to use blank deposit slips, write in his account number and then make deposits.

He took a stackful of the slips. Spent some time thinking about this. Then, went out and … bought a Burroughs 1000 Magnetic Encoder.

He used it to place his account number and bank routing number on the bottom of each of those blank deposit slips.

At which point, he went back to his bank, put the “blank” slips into the dispensary from which he had gotten them.

And waited. And watched … as the deposits of unsuspecting customers were placed, automatically, in his account.

Instead of the accounts that the customers had penned in.