Chegg's growth, investments accelerate along with online learning

School districts and universities are currently plotting remote learning plans, hybrid arrangements and in-person classes, but amid the uncertainty is one sure thing: Online learning is a boom market.

The latest example is Chegg's second quarter, which was well ahead of estimates. The online education company, which includes learning content, textbooks, tutors, writing help and apps such as Mathway, also raised its outlook for 2020.

Chegg reported second quarter net income of $10.6 million, or 8 cents a share, on revenue of $153 million, up 63% from a year ago, and well ahead the sales estimate of $136.6 million. Non-GAAP earnings for the second quarter were 37 cents a share, a nickel better than expectations.

Digital education accelerated:

- Education reinvented: How COVID-19 has changed how students learn

- Online learning gets its moment due to COVID-19 pandemic: Here's how education will change

- How higher education may go best of breed, be disassembled amid online learning

- Microsoft Teams: These new features fix remote classroom shortcomings

- Back to school: Gear for teachers who want to up their online game

- How will online education evolve? Coursera's Leah Belsky has a few ideas

For the third quarter, Chegg projected revenue growth topping 45% to $140 million to $145 million. For 2020, Chegg is projecting revenue between $605 million to $615 million.

Wall Street was expecting Chegg to report 2020 revenue of $551 million. For the third quarter, Wall Street was expecting revenue of $123.4 million.

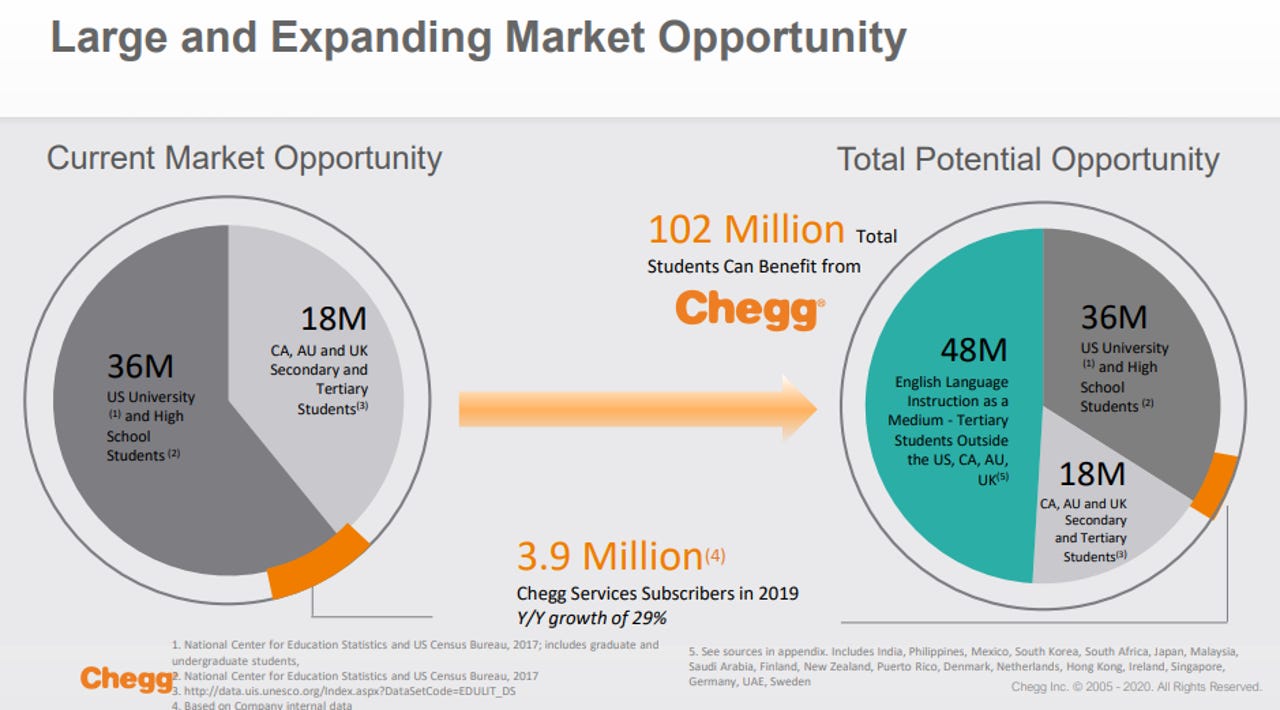

Chegg ended its second quarter with 3.7 million subscribers including recently acquired Mathway. Chegg Study content had 375 million views in the quarter.

CEO Dan Rosensweig said Chegg saw unprecedented engagement and numerous records in the second quarter. Chegg is landing subscribers as schools wrestle with online experiences and hybrid strategies. Rosensweig added that Chegg's long-term strategy is being accelerated as the higher education bubble bursts due to COVID-19.

As education becomes more disaggregated, platforms such as Chegg will start owning the direct relationships with students and customers. Rosensweig said on an earnings conference call:

We're actually finding more and bigger opportunities to grow. And that is a rare situation and I think happens really only to platform companies, which is whether it's Netflix or Microsoft or Adobe or Facebook. Once you're a platform company and you create a category and you become the verb, as Chegg has become in education, the benefits start to accrue even faster.

Rosensweig added:

We remain optimistic that this pandemic will end soon. And when it does, one of the legacies will be that the door is permanently open to the promise of online learning that is affordable, scalable, on demand. If anything surprised us, it was the [spirit] in which students outside the United States have come to embrace Chegg.

TechRepublic: Virtual schoolhouse: The best learning apps for online education this fall | eLearning and continuing education policy

Chegg's plan is to step up its investment cadence. CFO Andrew Brown said the company is planning to accelerate investments in device management and features. Chegg will step up these investments as the company is becoming more profitable. Brown said:

The momentum we are seeing in the business, accentuated by the pandemic, is likely to continue for the foreseeable future. And we expect to be a high growth, high-margin company for years to come. As such, we have decided this is a moment in time where we need to lean in and reach more students globally with high-quality, low-cost services. Thus, we have decided to accelerate incremental investments to build for our future. These include investing in international growth and development, the Chegg Study Pack, device management technologies and our skills-based learning service, Thinkful, along with additional infrastructure and resiliency investments that will allow us to scale rapidly.

Chegg can have the confidence to invest and raise its outlook because there are multiple ways it can play demand.

For instance, many incoming university students are planning gap years or community college given tuition costs for a virtual experience. Rosensweig said Chegg will be utilized no matter what the format and that reality provides an opportunity for its Thinkful service.

Rosensweig also outlined the to-do list for investments. "Everything we're doing, we expected to do. We just accelerated it by moving it up. So this is something that will benefit us not only short term but in the long term, both from a revenue growth area and profitability area. So we're super excited about that opportunity," said Rosensweig.

Here's the list:

- Invest more in content such as Chegg's Q&A network, which is seeing record growth and can tap into international growth.

- Invest in international content in local languages. Rosensweig said 99% of international customers are brand new to Chegg and finding online education support via search for STEM and business course content. In the US, Chegg gets marketing support via word of mouth then search. Internationally, that dynamic is flipped. Either way, Chegg hasn't had to up its marketing spending in years.

- Beef up the core Chegg Study Pack service with Mathway and new content.

- Focus on markets such as online colleges with specialized content. Colleges like Southern New Hampshire University and Western Governors are among the largest in the US in terms of enrollment among non-profits.

- Grow the community college audience base. Community colleges are increasingly popular due to costs and virtual models and Chegg is seeing strong demand.

- Device technology to manage accounts and password sharing as well as infrastructure investments. In mid-August, Chegg will limit the number of devices on an account and authenticate them.

- Target the upskilling market. Rosensweig said:

When we look at the opportunities, we continue to believe that the best place for Chegg to play is direct to student. That means that we're likely to go older rather than younger. As a reminder, the average age of a college student in this country is not 18 to this country is not 18 to 22. It In fact 25. They're already parents. They already have jobs. There are people who are in the middle of middle of careers trying to finish -- change their careers. They are people that got partial degrees, and they want to finish those degrees.

The tab, according to Brown, is likely to be in the "tens of millions of dollars range," but "is the right thing to do."

"So yes, it's been fairly significant, but it's coming with significant profitability at the same time," said Brown.

More education:

- Back to school: The 5 best Chromebooks for students

- Google Meet adds zoombombing protection for education customers

- Intel aims to bring AI education to community colleges

- In the wake of overnight digital transformation, demand for technology skills training surges

- Coursera's Global Skills Index highlights rush to digitize careers, focus on data

- Apple offers free Swift, Xcode coding courses for teachers

- Students checking AP scores still waiting after College Board site struggles with traffic surge

- Robots will take 50 million jobs in the next decade. These are the skills you'll need to stay employed

- James Madison University President: People are the most important strategic resource