Chip industry turnaround follows boom in memory sales

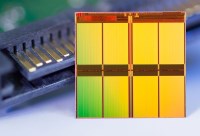

The global semiconductor industry fell by 2.5 percent last year, but IHS is projecting 4.9 percent growth to $317.9 billion this year, thanks to booming sales of memory chips. In particular, IHS's Semiconductor Value Chain Service expects the dynamic random access memory (DRAM) and NAND Flash memory markets to grow by 35.0 percent and 27.7 percent respectively in 2013.

The boom is a result of booming sales of smartphones and tablets, which use chip-based storage. Presumably, the growing use of SSDs (solid state drives) in laptops also contributed.

US-based Micron Technology is one beneficiary. IHS reckons its sales will grow by 109.2 percent to $14.2 billion, lifting it from 10th to 4th place in the semiconductor market’s rankings. This will double its chip market share to 4.5 percent. Micron's main competition comes from two South Korean companies, Samsung and SK Hynix. The latter grew revenues by 48.7 percent, though production was hit by a fire at its factory in Wuxi in China.

IHS's Dale Ford said in a statement: "Memory chips are coming to the rescue of the semiconductor business in 2013. Solid pricing and expanding demand for DRAM and NAND in smartphones and tablets have caused revenue for these memory devices to surge. Without these two high-performing product segments, the semiconductor industry would attain zero growth this year."

Intel will keep its usual position as the top chip supplier, ahead of Samsung -- see table below. However, IHS is projecting that Intel's semiconductor revenues will fall "from its historically high 15.7 percent share of the market in 2012 to 14.8 percent in 2013".

Thanks to its success in smartphones, third-placed Qualcomm has closed the gap slightly. With chip sales growing by 31.6 percent this year, IHS reckons it will take a 5.5 percent share of semiconductor market revenues.

Sony (down 28.1 percent) and AMD (down 4.2 percent) were among the companies that lost ground. AMD held on to 12th place but looks like being overtaken by the fast-growing MediaTek (up 32.1 percent).

Sales of some types of chip are growing while other types are falling. IHS sees growth in the markets for LEDs (up 9.5 percent), CMOS image sensors (up 5.7 percent), and sensors and actuators (up 3.6 percent). Declining markets include CCD image sensors (down 40.6 percent), specialty memory (down19.6 percent), digital signal processors (down 16.5 percent), SRAM (down 15.9 percent) and NOR flash memory (down 14.8 percent).