CIO survey: HP shines; Virtualization, storage top priorities

UBS released its CIO survey this week and illustrated a number of cross currents in enterprise spending and hardware. The short version: HP is being increasingly viewed as a most valuable vendor; Vista has no affect on PC demand and server and storage spending is expected to jump.

UBS surveyed 100 CIOs, 60 in the U.S. and 40 in Europe. The survey was conducted in September.

Like Citigroup's checks on Tuesday PC demand is stable and Vista has had no impact as most CIOs plan on implementing Microsoft's latest operating system in 2008 or later.

Overall, the IT spending picture is mixed. Twenty-six percent of respondents expected IT spending to grow in the second half of 2007 compared to 2006 with 17 percent expecting a decline. The remainder saw flat technology spending. For 2008, 35 percent expect to increase spending with 20 percent planning for budget cuts.

Among the key trends compared to UBS' March survey:

- HP ranked high on purchase intentions for servers, storage and notebooks;

- Dell has lost momentum in most categories except for storage;

- HP was cited by 37 percent of CIOs as the best suited strategic vendor with Dell pulling in 26 percent. IBM fell from 24 percent in March to 13 percent in September.

The big spending priority for the second half is servers followed by storage and desktops. UBS notes that CIOs are buying "richly configured servers" while adopting virtualization. Twenty-four percent of respondents said servers were their highest priority with 16 percent citing storage and desktops each. In UBS' March survey 23 percent of CIOs said desktops were a priority. In the long run, however, it's unclear how virtualization will affect server spending. For instance, 32 percent of CIOs said virtualization allowed them to reduce server spending. Fifty four percent said server spending stayed the same.

UBS writes:

The survey shows PC desktops are falling in terms of strength of priority, perhaps indicating a modest softening of demand (in the US especially) from just a few months ago. We do not believe that corporate desktop spending will pick up meaningfully until mid to late 2008 at the earliest. In fact, CIO’s don’t see Vista boosting PC purchases at all this year and barely at all next year. Our recent checks have indicated that most CIO’s of large companies do not see a pressing need to upgrade to Vista and may wait at least another year.

UBS reckons that there was end-of-quarter jockeying among technology vendors as "certain customers are assessing recent economic events." In particular, IBM had a flurry of activity at the end of the third quarter. "At this time it is hard to tell for sure whether IBM’s flurry of activity represents a real shortfall or more business being pushed into the 4th quarter," writes UBS.

The UBS survey also reveals some early vendor specific concerns. For instance, more CIOs indicated that they planned to spend less on Dell desktops compared to March. According to UBS only 9 percent said they expected to increase spending with Dell in the second half of 2007 compared to 23 percent in March. Twelve percent of respondents plan to decrease spending on Dell desktops. HP appears to be the beneficiary with 16 percent of CIOs expecting to increase spending on HP desktops with 11 percent reducing spending.

On the server front, HP appears to be gaining share at the expense of IBM and Sun has gained momentum. Thirteen percent of CIOs said they planned to spend more on HP servers followed by Dell (11 percent spending more on servers) and Sun (6 percent).

Storage was a bright spot for Dell as 13 percent of CIOs said they planned to buy more storage systems from the company. Ten percent said they'd spend more on storage with HP. UBS said that Dell's partnership with EMC and low prices have given it an edge.

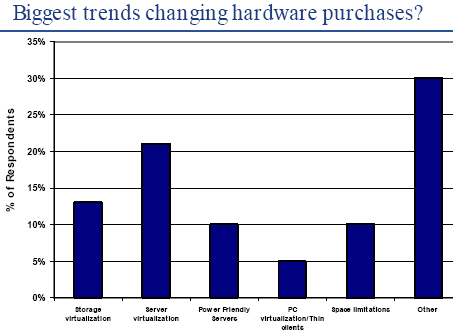

When priorities were considered virtualization--both server and storage--led the pack (chart via UBS).