Cloud computing reaches co-opetition stage

Enterprise cloud computing rivals are teeing off on each other, but the reality is much more nuanced relative to vendor propaganda and a simple tally of wins and losses.

I touched on this point last week in an interview with Workday co-president Phil Wilmington and the week before when I noted that Google Cloud Platform's big enterprise wins were also sticking with Amazon Web Services to a large degree. See: Workday's Phil Wilmington: Cloud vendors' customer win claims murky | Google Cloud Platform courts enterprises and they'll bite on tried and true pitches

Now Okta's Business@Work report highlights how enterprises use multiple apps, clouds and vendors in the course of daily business. As Okta, which offers a cloud identity management service, has a nice ringside seat to what's going on in the enterprises. On-premise software vendors are reinventing themselves and sharing space with the alleged disruptors.

Repeat after me: Zero sum is a cloud fallacy. One company's win may not be a rival's loss. In fact, we're in a world where three vendors can all claim the same reference customer.

Digital marketing is an area where one customer will use multiple clouds. Is it all that odd to find a company that uses Google, Adobe and Salesforce (maybe Oracle too) for marketing cloud services? Not really. You can thank the application programming interfaces for the new world order. It has never been easier to try a new application in your enterprise and pit it against a rival on a daily basis.

Along those lines, you're going to see Oracle and Workday customers. AWS, Microsoft Azure, IBM and Google Cloud Platform may all share customers.

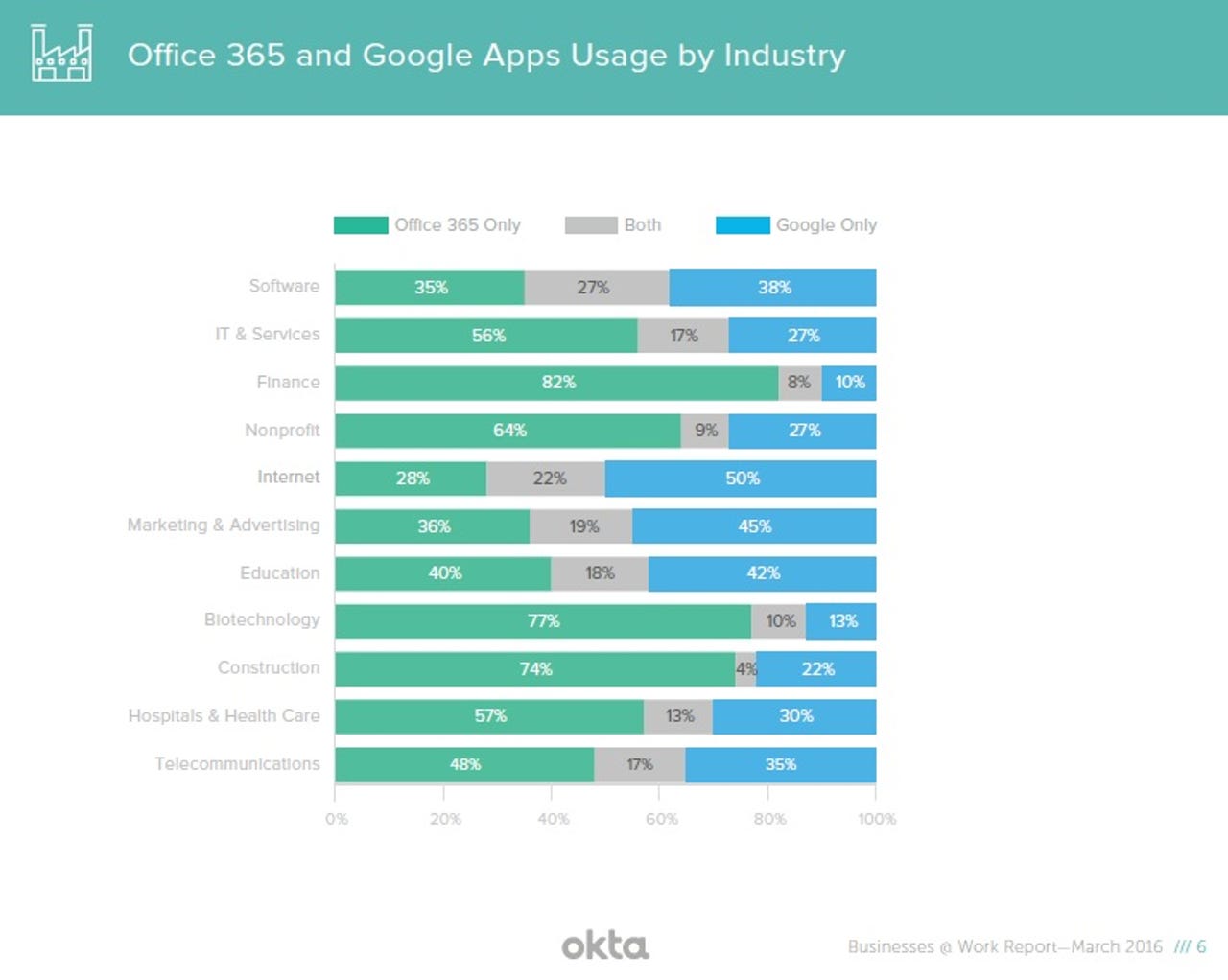

Okta's report illustrates the land of cloud co-opetition (or at least co-existence). The money finding from Okta: More than 40 percent of Okta's network uses both Google Apps and Office 365. That stat is absurd when you consider that most companies could get by with one productivity suite and call it a day. But Okta noted that "companies using both Google Apps and Office 365 do so because different departments prefer different applications."

Meanwhile, Okta's report also highlighted the fastest growing apps on its network for the second half of 2015. Consider Tableau, New Relic and Lucidchart all play in the same ballpark and rhyme. Microsoft Azure and AWS are obvious competitors. And Slack and Bluejeans roughly play in the same space.

And when you look at what apps and cloud services are being assigned to users on Okta, the cloud co-existence game is even more clear. Zendesk is there with ServiceNow. Box lives with Dropbox. GoToMeeting and WebEx co-exist. The list goes on and on.

Bottom line: Next time a cloud vendor touts customer wins without details or how it's being used skip the grain of salt and go for the whole container.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on the Monday Morning Opener:

- No, tablets aren't going to replace PCs in the office - but here's something that might

- Do not touch this one Android setting and most malware will leave you alone, mostly

- How Apple became Samsung, and why Steve might have approved

- Open Compute Project: Gauging its influence in data center, cloud computing infrastructure

- VR is the next big thing, whether you can see it or not

- For simplicity and security, Apple needs to draw a line now to prevent further ones

- Will Galaxy S7 keep Samsung in pole position?

- A call for more cloud computing transparency

- Microsoft and mobile: The headache that won't go away

- If a smartphone vendor acquiesces to anti-encryption laws, don't use them