Cloud financial software continues its march into large enterprises

The news in the accounting software world is still positive, particularly for the cloud vendors.

Anaplan raised $100 million in new funding and got a $1 billion valuation in the process. Revenue growth at Anaplan has been stupefying of late. Business Insider reported that revenues have gone from $10 million/year in 2012 to $10 million/month as of this January. Workday and Salesforce were also investors in this round.

Tidemark, a purveyor of cloud enterprise performance management software, closed a $32 million investment round this year. That brings their total funding to $80 million.

Adaptive Insights (nee Adaptive Planning) is growing, too. In a press release they issued July 10, they stated:

“Adaptive Insights, the worldwide leader in cloud business analytics for the biggest brands and the hottest companies, announced record second quarter results for 2014, with 109% growth in year over year new software bookings for the quarter, larger deal sizes, and hundreds of new enterprise, global, and high-growth customers in the first half of 2014. Notable new Adaptive customers in Q2 include The Jacksonville Jaguars, The Country Music Association, DHL, PayLess Drug, AAA Mid-Atlantic, Maple Leaf Sports Entertainment, Weyerhaeuser, Shutterstock, Heidrick & Struggles, San Francisco Opera, Frost & Sullivan, Radio Shack, and Warner Bros. Home Entertainment Group.

"Adaptive’s continued high growth brings the company’s customer base to well over 2,200 active customers, representing 5x more customers than any other cloud CPM competitor.”

Workday continues to add customers, too. Their latest quarter financial results showed revenues growing by 74% year-over-year. Other measures (e.g., customer additions) show similar growth.

Why is this space growing?

I’ve written a lot the last few years as to why enterprises, even large enterprises, continue to embrace cloud solutions. The key reason, known by many today, is that multi-tenant cloud solutions are maintained and supported by the vendor – not the customer/user. The number of people dedicated to supporting older on-premises solutions vs. the number required for multi-tenant cloud solutions is significantly different. Smart firms redeploy their IT support personnel to work on more strategic applications and application development.

Other reasons I’ve heard CFO’s mention re: their preference for cloud solutions include:

Greater flexibility in opening new offices (no hardware required, no implementation required).

Solutions scale up AND down based on changing business conditions.

Costs scale up AND down, too.

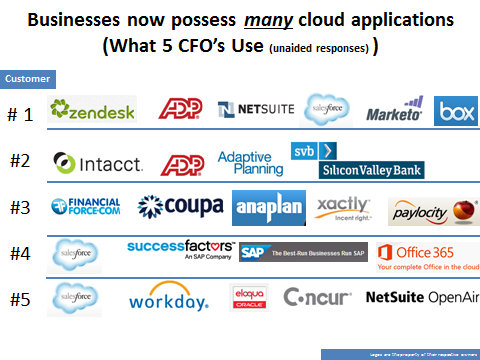

Their own department is a big user of other cloud apps.

Their firm had successfully experimented with cloud solutions previously (e.g., many reported that use Salesforce.com, Box.com, Office365 and other cloud applications).

Cloud providers they’ve used had equal or better data security.

If you don’t believe cloud usage in the finance area is growing, consider this recent Netskope report. It stated that: "On average, there are 35 HR and 18 Finance/Accounting apps in use per enterprise, where by their own estimates, they had assumed only one or two per department." [Source: Netskope Cloud Report, 1.14 RS01102, pg. 1]

But there’s another reason these cloud-based solutions are gaining in popularity. Prior generations of solutions, those of the on-premises kind, are getting long in the tooth. These older products are running into their obsolescence cycle and are ripe for de-installation/replacement.

This week I spoke with two HR executives who were shopping for new software precisely because the maintenance fees for their old on-premises solution had grown so much over the years and they’re tired of the fee escalations without a corresponding increase in capability or functionality. Old solution providers who continue to mistreat (or take advantage of) their customers do so at their own peril. This bad behavior only acts to inflame customer animus and trigger more cloud software selections.

What are the vendors and customers reporting?

Users like solutions that take old problems away (like upgrades) and make other problems less so. Any cloud financial solution that does anything to make spreadsheets more dependable, more usable and more valuable often finds a soft spot in a CFO’s heart. Spreadsheets are to Finance like suspension parts to a car. Neither looks good but they’re necessary to get from point A to point B.

In May, I spoke with the CMO of Host Analytics, Lance Walter. One item in our wide-ranging conversation concerned their AirliftXL functionality. This product can take the logic embedded in a customer’s numerous Excel spreadsheets and recreate that logic in their cloud solutions. The advantage of this capability is that it allows Finance departments that have built elaborate spreadsheets replete with complex macros, formulas, embedded links, etc. to replicate that functionality in a new solution.

For Finance professionals, anything that permits them to easily migrate their old reporting environment and improve the productivity of their team has to be something worth looking into.

But, it’s the other part of it that I liked even better: the solution may actually do a better job of keeping all the links, etc. from breaking than what Finance workers experience in a typical on-premises environment. For Finance professionals, anything that permits them to easily migrate their old reporting environment and improve the productivity of their team has to be something worth looking into.

Finance executives are choosing more cloud solutions simply because more and more of them are available. When I recently spoke with Tim McKiel – Director of Financial Systems and Integration for Earthlink – regarding his firm’s use of Host Analytics, I wanted to know how this selection came to be. Earthlink uses Host Analytics cloud financial software for planning, budgeting and reporting.

Earthlink has about 150 departments, a 40-person Finance department, and budgets that contain 5-6000 accounts. Host Analytics software is used exclusively by the Finance department. The software utilizes out-of-the- box integration with their Oracle e-Business Financial software (R12).

Tim indicated that Earthlink is looking at cloud solutions a lot now, though it recently chose a couple of on-premises products. He said that they decide on the deployment platform (i.e., cloud vs. on-premises) based on business need and market availability.

Tech Pro Research

Market availability is the key phrase. While many cloud financial solutions exist for the SMB (small to medium business) market, solutions for larger enterprises have been a bit more limited. Yes, there are several solid products for budgeting, planning, treasury and reporting buyers, but core financial solutions in the cloud have been a bit wanting. Workday’s solution — a product that is continuing to evolve at a rapid rate — is clearly oriented toward large enterprises. Other vendors, like NetSuite, have added big-league functionality for divisions/business units of large enterprises, too.

And where your firm is headquartered can also have an impact on its financial software cloud adoption.

I also spoke recently with Dave Kasabian, SVP & GM of Tagetik North America. This firm sells corporate performance management solutions and has long roots back to Northern Italy. Tagetik’s team actually started by implementing Cognos solutions but moved to creating their own products years ago.

Dave shared with me an interesting perspective on the cloud adoption differences between the US and Western European markets. He said that in Europe, customers preferred their cloud solutions to be hosted while US firms wanted a multi-tenant cloud solution. He added that the largest companies often have a preference for hosted solutions unless they believe they can obtain superior performance and integration from the full cloud solution. Security concerns, he added, were a secondary matter vis-à-vis performance.

Bottom line: The move to cloud financial software is on-going and growing. The revenue numbers of the vendors in that space speak to that alone. How it gets rolled out varies a bit by application type and geography.