Cognizant: Customers spending, SMAC stack services developing well

Cognizant's first quarter and outlook was in line with expectations and the company said that its customer base has been "experiencing positive demand and growth characteristics."

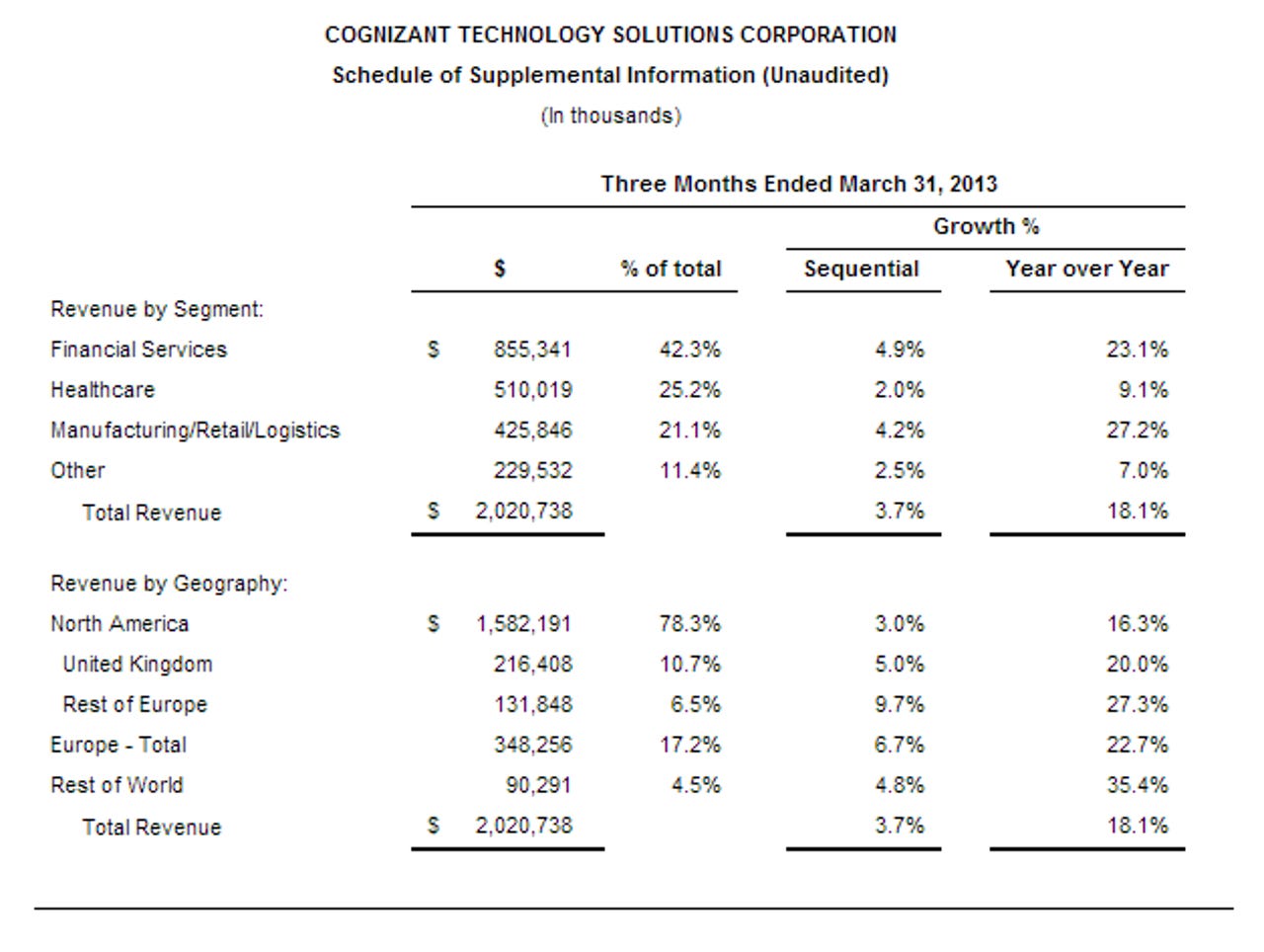

The company reported first quarter earnings of $284.2 million, or 93 cents a share, on revenue of $2.02 billion, up 18 percent from a year ago. Non-GAAP earnings were $1.02 a share. Wall Street was looking for first quarter earnings of 93 cents a share on revenue of $2.01 billion.

As for the outlook, Cognizant said its second quarter revenue will be at least $2.13 billion with earnings of 97 cents a share and $1.06 a share non-GAAP. For fiscal 2013, Cognizant projected revenue of $8.6 billion with earnings of $3.95 a share and $4.31 a share non-GAAP.

Those projections were in line to slightly higher than what analysts were expecting.

Cognizant's quarter got a slight revenue boost — $8.2 million — from the acquisition of C1 Group, a service provider in Europe. The purchase will boost Cognizant's presence in Germany and Switzerland.

On a conference call with analysts, Cognizant CEO Francisco D'Souza said:

While economic uncertainty is leading some companies to be more cautious, we are [optimistic]. As we look across our business, while there continues to be pockets of weakness, we are encouraged the majority of our businesses are experiencing positive demand and growth characteristics.

D'Souza also said Cognizant's strategy is to help customers run better and different with an emphasis on the SMAC stack (social, mobile, analytics and cloud). Cognizant now gets 20 percent of its revenue from consulting, business process outsourcing and infrastructure management.

The Cognizant CEO also addressed progress with the SMAC stack. D'Souza said:

This year we expect to deliver about $500 million in SMAC related services. While a significant majority of this work will be done with our existing client base, I'm also pleased to see many new clients whose first engagement with Cognizant is in the SMAC area. Our progress in the SMAC area is validation of our run different value proposition, our strategy of reinvestment and testament to the strength and versatility of our client relationships.

Regarding the cloud, D'Souza outlined Cognizant's BusinessCloud platform that enables digital content delivery and Cloud 360, which manages cloud environments.

In addition, Cognizant said it will expand its stock buyback program from $1 billion to $1.5 billion.

Vertically, Cognizant continued to garner most of its revenue from financial services, healthcare and manufacturing, retail and logistics. The customer base remains largely from North America.