Cornerstone OnDemand nets $300 million investment from Silver Lake, LinkedIn; reports strong Q3

Cornerstone OnDemand said it has landed a $300 million investment from Silver Lake and Microsoft's LinkedIn to expand and revamp its capital structure.

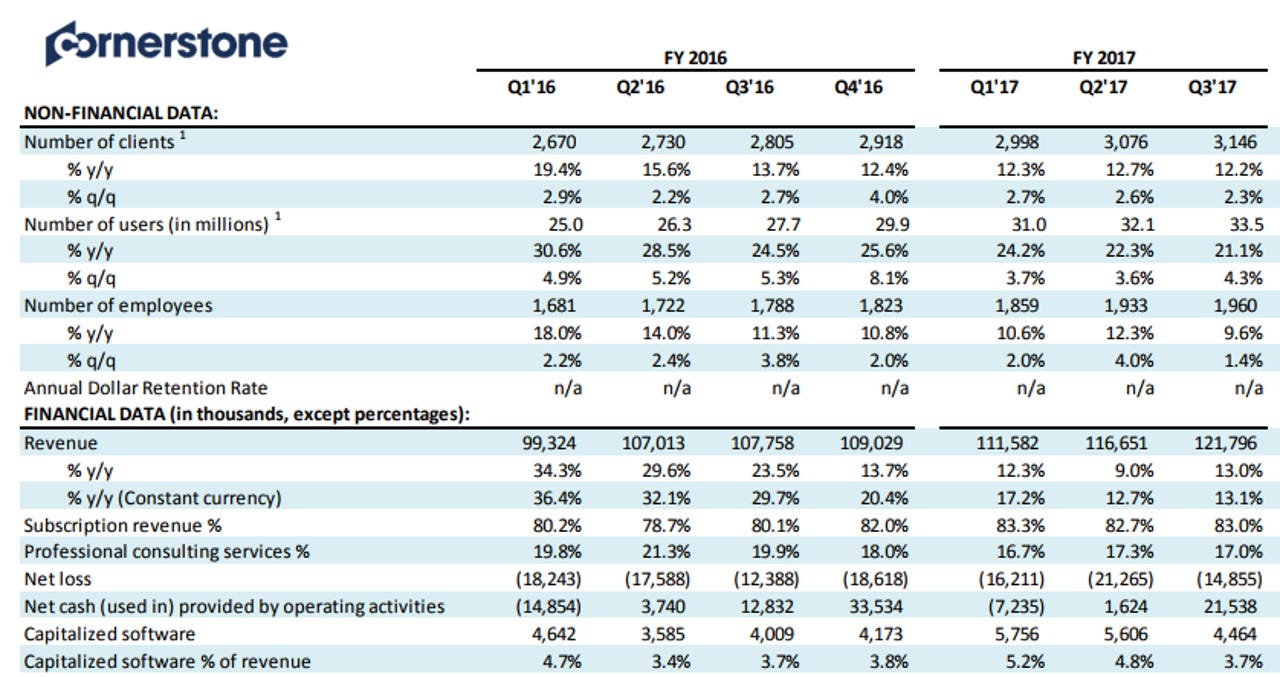

The news comes as Cornerstone reported a third quarter net loss of $14.9 million, or 26 cents a share, on revenue of $121.8 million, up 13 percent from a year ago. Cornerstone said its non-GAAP earnings for the third quarter was 12 cents a share.

Wall Street was expecting Cornerstone to report third quarter non-GAAP earnings of 10 cents a share on revenue of $119 million.

Cornerstone said it can improve its profit margins in 2018. As for the outlook, Cornerstone said it will report revenue between $129 million and $137 million. For 2017, the company said revenue will be between $479 million to $487 million.

While Cornerstone is doing well, the extra $300 million from Silver Lake and LinkedIn will help it launch a strategic plan to boost growth more. Cornerstone said the investment will allow it to:

- Focus on recurring revenue growth more.

- Drive operating margins and free cash flow.

- And expand its presence in e-learning content.

CEO Adam Miller said the company conducted a strategic review that also evaluated "solicited and unsolicited interest in the company."

Once the investment closes, Cornerstone will expand its board of directors from eight to 10 members.

Financially, Silver Lake and LinkedIn are buying convertible notes dated July 2021 with a conversion price of $42 a share. The new convertible notes will be used to pay off existing convertible debt next year. Cornerstone will also buy back $100 million in shares.