Cost cutting pays off for Dell; IT spending, demand 'challenging'

Updated: Dell's third quarter was a mixed bag. Revenue was down amid weak demand, but earnings were better than expected by a wide margin. The outlook was "challenging" as expected.

The company reported third quarter earnings of $727 million, or 37 cents a share, on revenue of $15.16 billion. The good news: Earnings handily topped estimates of 31 cents a share. The bad news: Revenue was down 3 percent from a year ago and below the $16.2 billion analysts were expecting, according to Thomson Reuters. Estimates were fluid leading up to Dell's report. For instance, FactSet Research predicted earnings of 33 cents a share.

CEO Michael Dell in a statement noted that the company's "business model adapts quickly to economic changes, even the kind of significant challenge we saw in the third quarter." Dell said that more than a third of revenue and profit come from servers, storage, services and software and peripherals. On a conference call, Dell said the company was making "significant progress" on its initiatives and is looking to "regain cost leadership." The goal is to be a "stronger more nimble company," said Dell, who added the company is looking to be competitive on costs in the retail channel and the leader in direct sales. On the enterprise side of the business, Dell said it is broadening its server and storage line-up to reach more customers.

Preview: Dell: How bad is it?

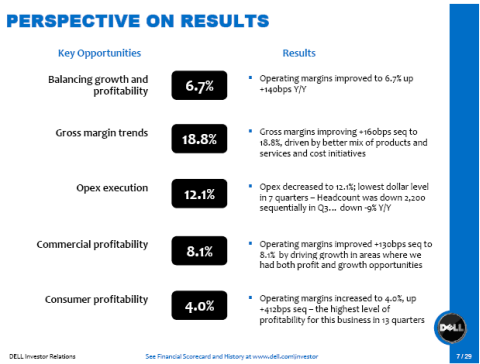

So how did Dell improve operating income 22 percent with margins of 18.8 percent? The company got a headwind from lower component costs and cost cutting. Dell ended the third quarter with 2,200 fewer workers than a quarter ago. In its earnings presentation, Dell highlighted how it plans to whittle down features to those that are high-value, use better pricing models to boost margins and align that effort--a 7-step "design to value" process--with marketing.

Dell's message: The company can adapt. Executives claim that Dell's direct model can allow it to adjust faster than rivals. But there are a few caveats: Dell had negative cash flow from operations of $86 million in the quarter. Here's what Dell is highlighting on its conference call:

As for the outlook it's more of the same from Dell:

Dell believes that global IT end-user demand will continue to be challenging. Against this backdrop the company will continue to focus on improving competitiveness, lowering costs and improving its mix of products and services to optimize liquidity, profitability and growth. The company will continue to incur costs as it realigns its business to improve competitiveness, reduce headcount in certain areas and invest in infrastructure, growth opportunities and acquisitions.

By the numbers:

- Dell's third quarter consumer revenue was up 10 percent to $2.8 billion while the commercial business was down 6 percent to $12.3 billion (click to enlarge chart).

- Commercial demand definitely dropped off for Dell.

- Dell's consumer business is showing signs of life with the best operating income in 13 quarters ($112 million). Dell is hoping to sell more consumer PCs direct as it cuts costs and expands its retail footprint (click to enlarge).

- Dell is cutting its cycle times.

- Under the surface, Dell's picture is muddy (click to enlarge chart below). In the third quarter compared to the second quarter the best Dell could do was to stay flat on revenue (notebooks). Across the board, Dell saw sequential revenue declines with desktops, servers and networking taking the biggest hit quarter-to-quarter. Globally, revenue fell quarter to quarter 11 percent in the Americas and Asia Pacific.