Dataminr raises $130 million to expand enterprise verticals for Twitter analytics

Big data firm Dataminr has raised $130 million in new funding that the company plans to use as fuel for its expansion into more enterprise verticals.

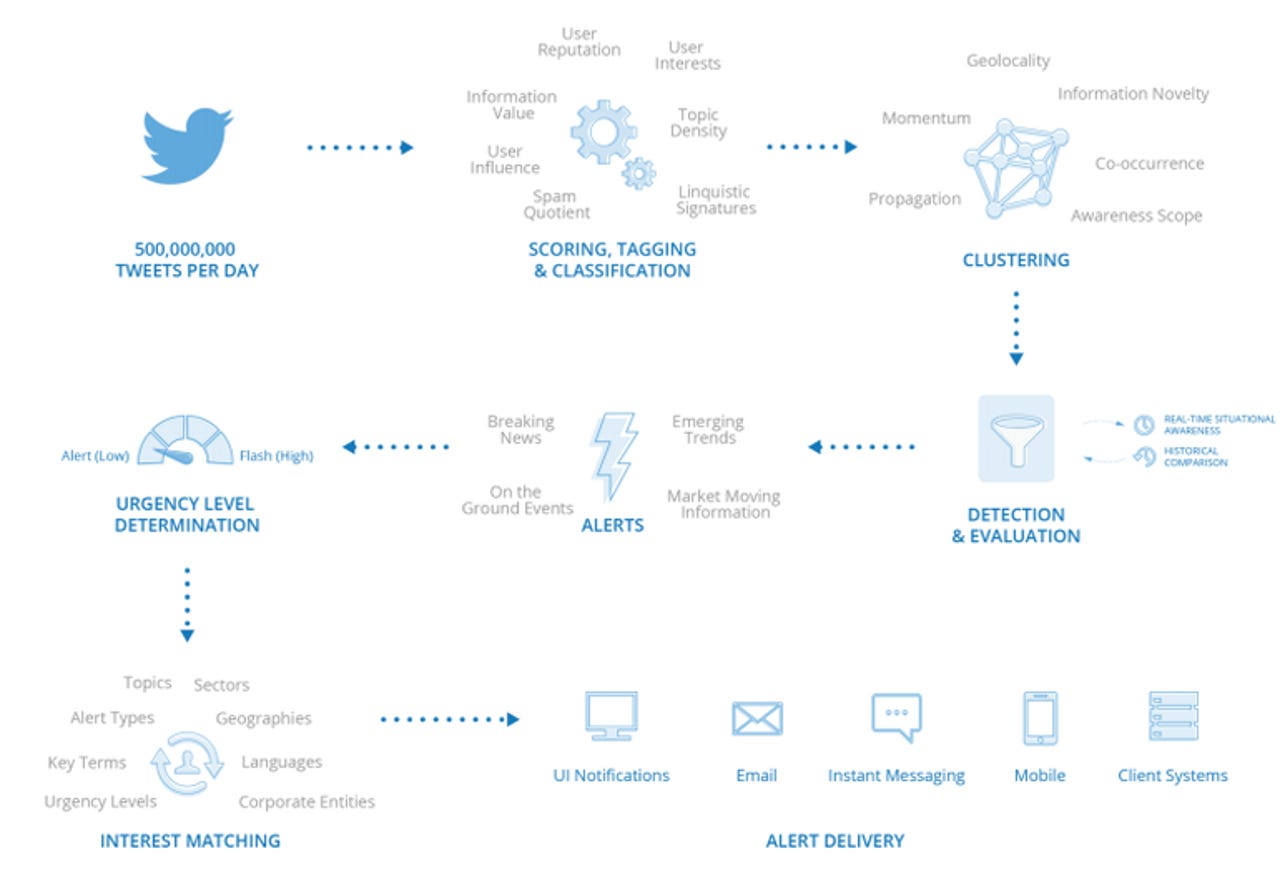

Founded in 2009, the New York-based startup uses complex algorithms to sift and comb through real time public data.

As a strategic partner of Twitter since last year, Dataminr has direct access to the company's data firehose, and uses it to spot relevant information that it delivers to clients via alerts on the desktop, email, or in a business system.

The company has enjoyed rapid adoption within news media outlets, the financial sector and government organizations. But with the fresh capital, Dataminr is looking incorporate new sources of data to help expand its enterprise reach to more areas.

"This capital will enable our company to meet the tremendous global demand for our products, expand into a number of new markets, and integrate valuable new datasets into our algorithmic engine to enhance our Twitter-based signals and broaden our offerings," Dataminr founder and CEO Ted Bailey said in a statement.

Given the explosion of real-time data from social media sites like Twitter, Dataminr's business hook is certainly compelling. The company says it has successfully identified significant current events long before they drew public attention or caught the eye of major news outlets.In 2013 Dataminr flagged a shakeup at BlackBerry for traders minutes ahead of the actual news and started telling of a train derailment in Lynchburg, Va. almost an hour before it was reported by news outlets. More recently, the company picked up on tweets that a TransAsia plane crashed near Taipei rougly 14 minutes before it was covered by a major news source.

While Dataminr is not the only big data firm using socially generated, real-time data, it is one of the few that remains independent. Dataminr's rival Gnip sold to Twitter in 2014, and fellow social data player Topsy sold to Apple in 2013. As for Dataminr, however, an acquisition is less likely.

The latest funding round was led by Fidelity and backed by Wellington -- investors that tend to signal a startup's march toward an initial public offering. However, it's still unclear when Dataminr's IPO time will come.

"While we don't have any specific plans, we have the ambition to be a large independent public company," Bailey said in an interview with the WSJ. "We will seriously consider an IPO in the future."

That WSJ article also puts Dataminr's valuation in the range of $700 million, although that number has yet to be confirmed. We have reached out to the company.

Additional investors in Dataminr's Series D include John Mack, former CEO of Morgan Stanley; Vikram Pandit, former CEO of Citigroup; Tom Glocer, former CEO of Reuters; Noam Gottesman (TOMS Capital LLC), founder of the hedge fund GLG; and Nicolas Berggruen, founder of the Berggruen Institute on Governance.

Read on:

Q&A with Dataminr CEO Ted Bailey: Making Twitter's firehose actionable