Dell's third quarter disappoints yet it sees IT demand improving

Dell's fiscal third quarter financials fell well short of estimates across the board.

The company on Thursday reported third quarter net income of $337 million, or 17 cents a share. That tally is down 54 percent from a year ago. Wall Street was expecting earnings of 28 cents a share. Dell's earnings included pre-tax expenses and other moving parts that knocked 6 cents a share off of the earnings sum. But even excluding those items, Dell fell short.

Revenue wasn't much better relative to expectations. Dell reported revenue of $12.9 billion, down 15 percent from the $15.16 billion in the third quarter a year ago. Wall Street estimates: $13.18 billion.

Meanwhile, Dell's gross margins fell short of targets too. Dell reported gross margin of 17.3 percent in its fiscal third quarter compared to Wall Street estimates calling for 18.19 percent.

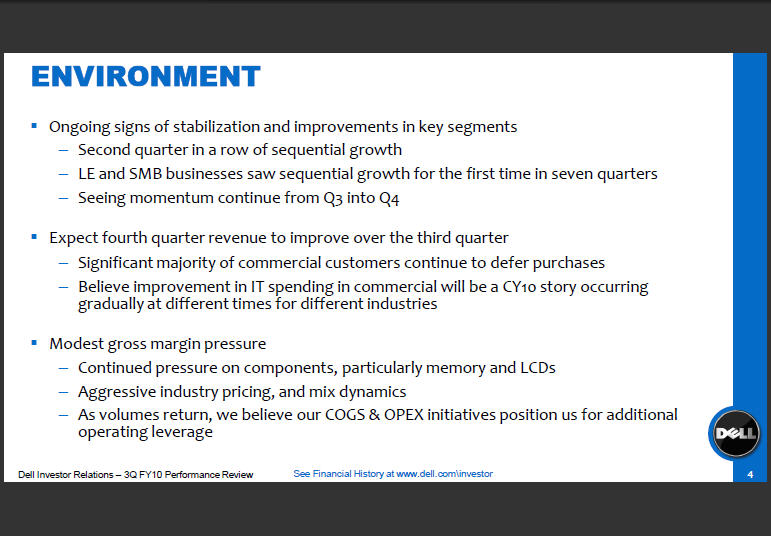

Simply put, Dell is either taking hits in the PC market or analysts got way ahead of themselves predicting a rebound. In a presentation, Dell did note that pricing has been aggressive (statement).

On a conference call, Dell CFO Brian Gladden said:

Our third quarter reported revenue was adversely affected by the timing of the Windows 7 launch and our SMB and consumer businesses where we did build more backlog than normal due to the later quarter order dynamics. We expect our backlog to return to more normal levels in the fourth quarter.

For its part, Dell did say that things were improving sequentially. Shipments were flat sequentially and down 5 percent from a year ago.

Here's Dell's view of the PC market:

In a statement, Dell CEO Michael Dell said:

We are seeing improvement in overall underlying IT demand that is continuing into the fourth quarter. The same is true with momentum in Dell’s business, specifically in our Large Enterprise and SMB segments. The launch of Windows 7 is being very well received by SMBs and consumers, and we’ll see the benefits of that more fully in our fiscal Q4.

In a presentation, Dell noted that commercial customers are still deferring purchases, memory and LCD prices are impacting costs and the fourth quarter should deliver the typical seasonal demand gains.

However, the improving IT market may not benefit Dell. In the third quarter, Dell's storage products took a hit, but the company noted that EqualLogic performed well.

By the numbers:

- Dell's large enterprise revenue in the third quarter was $3.4 billion, up 4 percent from the second quarter, but down 23 percent from a year ago. Operating income for the quarter was $174 million.

- Public revenue was $3.7 billion, down 3 percent from the second quarter and 7 percent from a year ago. Dell said seasonal factors were to blame. Operating income was $352 million.

- Small and medium business revenue was $3 billion, up 5 percent from the second quarter but down 19 percent from a year ago. Operating income was $282 million.

- Consumer revenue was $2.8 billion, flat with the second quarter and down 10 percent from a year ago. Operating income was $10 million.

- Perot Systems revenue in the third quarter was down 12 percent to $629 million. Operating income was $43 million.

So what went wrong? It appears Dell is getting thumped by HP and Acer and its plan to diversify its revenue stream with services (see the Perot Systems acquisition) hasn't kicked in yet.

The report wasn't well received: