Demand this from software vendors

I was getting a briefing last week from a software executive. We got to a point in the conversation where the discussion was focusing on existing products. I moved the conversation to a different space, though. If you're getting a pitch from a vendor, you should move the conversation, too!

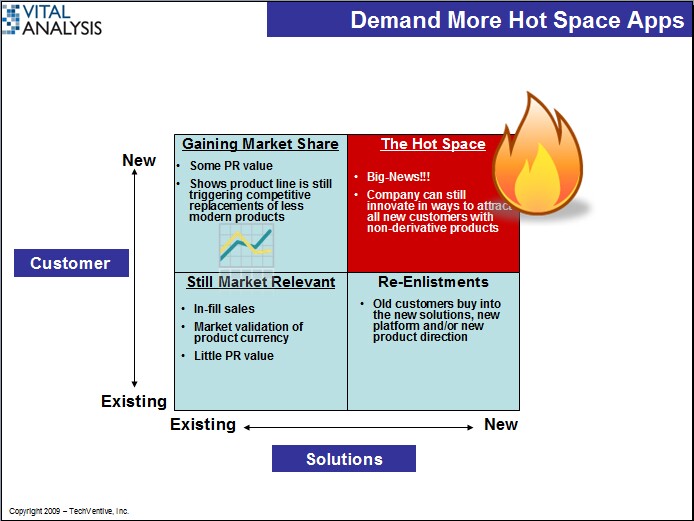

Still Market Relevant - When the vendor dialogue is all about existing customers buying more of the old product line, it’s not all that intriguing. Yes, it tells me that the vendor is still relevant to its customer base but these sales are mostly in-fill sales. You remember these sales, don’t you? They’re like those customers who had previously bought most of the ERP suite but now need the CRM (customer relationship management) modules.

Gaining Market Share - When a vendor is getting all-new customers for its existing products, then that’s a bit more newsworthy. This means that the products are appealing to new buyers and these just aren’t the existing customers. That means the products are still fresh and delivering competitive advantage. Alternatively, this market momentum could also signal that the software vendor has a great sales and marketing organization or is buying its way into ever greater market share. Wall Street likes this quadrant but a vendor can’t stay here forever as its products will age and lose their market appeal or luster.

Re-enlistments – These are the customers who are re-affirming their commitment to the vendor. They are choosing to upgrade their applications to the all-new application suite, new platform, etc. These firms are making a major financial commitment and their decision to do so is not trivial. Re-enlistment scenarios often occur with major technology platform changes (e.g., going from client-server architecture to Web 2.0 applications).

Hot Space - The top right quadrant is the really high-interest zone. This is where all-new products are attracting all-new customers. This stuff is red-hot! It’s the kind of software that makes the customers of other software vendors abandon their old products and switch to the new stuff. When you think of this quadrant, don’t just think of replacement technologies. Think about the products you bought for the first time. Think about your first cell phone, spreadsheet program, MP3 player, etc.

I want to hear more Hot Space stories. They are undoubtedly more interesting than the other stories and they are really rare. If a vendor has been around a while and has 1000 customers, probably 900 are in the Still Market Relevant quadrant. The rest are scattered across the three remaining quadrants with fewer than a dozen or two in the Hot Space quadrant.

Over the last few years, the numbers of customers and stories in the Hot Space has been in decline and, worse, as a percentage of total customers, experiencing a very real decline.

Innovation in ERP, for example, has been so bogged down in technical infrastructure changes (e.g., middleware/SOA platform changes) and business model changes (e.g., from on-premise to SaaS (software as a service)) that real value-adding, business-relevant improvements to products are far and few between. Look at the ‘amazing’ value that business analytics hasn’t brought in to date. Analytic applications are still crunching internal transaction data. The lack of imagination and innovation here is an embarrassment to the technology sector.

When a software vendor comes knocking on your firm’s door, ask them to segment their customer base along the lines of the four-quadrant picture above. Then, only ask them to describe the value derived and experience of these all-new customers buying all-new solutions. If they struggle with this exercise, this vendor is selling you yesterday’s technology. Your users will love this old-time solution the vendor is pitching as much as they'd want to buy a newspaper from last week. Even if the vendor has some stories in this quadrant, these may actually reference old technology. Watch out for this. If it doesn’t have sizzle, differentiation and freshness, then it’s old news. Don’t reward vendors for re-packaging an old product in new wrapping. Make them innovate or make them get out of the way.

** UPDATE ** I read the comments many of you post to these blogs. Thanks. A reader of this post raised a couple of points I'd like to clarify. Were a vendor to approach your firm about an existing product, one that has been on the market for a while, am I suggesting you not consider it? No, I'm not but I would caution you that the product you could be considering may be a bit long in the tooth. I wouldn't pay too much for old-tech. But also remember that the vendor that has nothing in the top right quadrant is also a vendor with a limited future. This is an area where the vendor's future sales momentum will occur. Without something to entice new customers into the fold, this firm will be lucky to make in-fill sales to existing customers. So, if you need something now, any product in any quadrant will do. But, if you want a product with a future, find a vendor who is building for the future.