Did HP save Palm with acquisition? Or did it save itself?

At first glance, HP looks like a savior for coming in and saving Palm from its inevitable demise.

After all, it's no secret that Palm has been struggling to gain traction despite the standing ovation it received at the unveiling of WebOS and the Palm Pre at CES 2009. But the world of mobile has gone through quite a bit of change in that time - iPhone became an even hotter seller; Android hit the scene hard with a lineup of devices and carrier partners; Microsoft's Windows Mobile 7, as well as Research in Motion's Blackberry 6, are just about ready for prime time. And, globally, devices with a new Symbian smartphone OS are expected before year's end.

OK, so Palm needed HP. But what about HP? What did it need?

Also see: iPhone growth magnifies global smartphone potential

Obviously, it needed a smartphone strategy. The company, which has largely relied on Microsoft to power its devices in the past, was pretty much a non-player in the smartphone game. How much longer was HP going to be able to hold out as a smartphone player, given the growth potential there? Sure, as an innovator, HP could have gone back into the labs and started working on the hardware - and maybe even a mobile OS that it could shape and mold - to get in the game. But how long would that have taken?

And then there's the tablet/netbook game. A mobile OS - tweaked from one that powers smartphones to one that powers tablet PCs - was something else that HP needed if it was going to break away from the delays and licensing restrictions imposed by Microsoft.

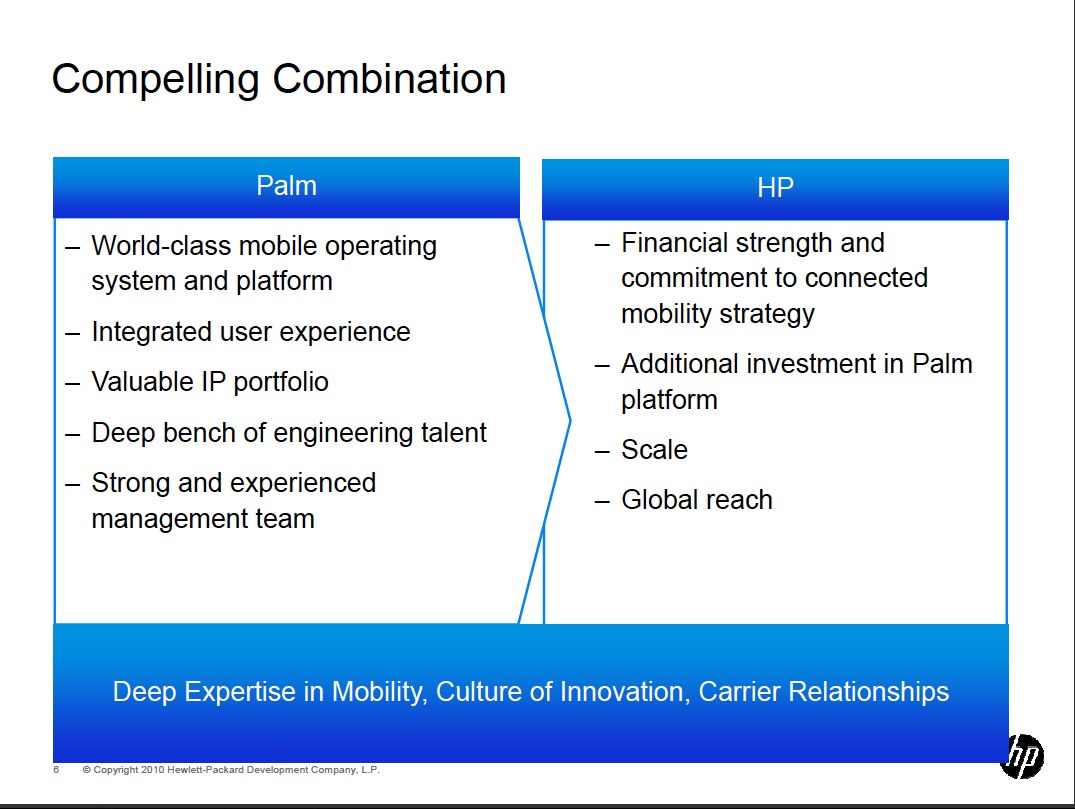

In essence, that's what it got - hardware, software, engineering talent and carrier partners, among other things - with the $1.2 billion it's dropping to get Palm.

Sure, there are naysayers who will argue that HP paid too much for a company that was in over its head and desperately in need of a buyer. Forrester Research Mobile analyst Charles Golvin, for example, said that HP was right to jump into the mobile game - but was wrong to do so by acquiring Palm. He said:

Palm could be valued for its brand, its intellectual property, its platform, or its people. HP doesn’t need the Palm brand; the IP helps an existing player not a new entrant; we don’t think the WebOS platform is viable long term in the face of its competition; and HP could sweep up Palm’s people individually at a much lower price. HP needs a strong presence in mobile, but Palm doesn’t deliver that.

Maybe there's something in Silicon Valley's water that makes me see things in another light, from the glass half-full perspective. There's a can-do spirit within Silicon Valley that isn't always apparent to those who aren't actually here. Palm is a company that's been sold, revived, split in half and brought back together against all odds. HP has gone through its share of internal turmoil, as well, but has maintained its brand equity through it.

Maybe it's not just the spirit but also the competitive drive - and possibly some personal vendetta - that makes these two Silicon Valley brand names want to go after and beat one of the other iconic names in these parts: Apple.

In a blog post that examines the HP-Palm deal, analyst Rob Enderle notes how hard feelings and memories of being scorned has created a common "Beat Apple" mentality. He writes:

Both companies have a deep desire to beat Apple, because Apple has consistently made fools of both firms. This creates a common goal that should keep the resulting combined company focused. And HP doesn’t require the massive gross margins that Apple needs to survive given the firm and potential pricing advantage as well. If HP can engage Apple in a price war the same way it did with Dell, Apple would be at a severe disadvantage. But first they need a truly competitive product.

Beating Apple will not be easy - Apple has a huge headstart and great momentum. Done right, though, HP could become a mobile contender almost overnight. Enderle continues:

HP has tablet and smartphone display technology in-house that I spoke of previously, an eBook reader, and a set of media management tools that are potentially unmatched in the market out of their lab. Along with the Palm IP, these tools could give them an incredible advantage, if they can execute. That “if” has proven to be a formidable barrier for anyone, including HP and Palm, when it comes to competing with Apple.

To hear HP executives talk about the acquisition, there's definitely optimism in the air. With some emphasis in his voice, HP VP Todd Bradley said on a conference call yesterday that the company plans to "invest heavily" in the development of the mobile business and will "go aggressively" to market. The company expects to see "solid growth," as well, he said.