Does a shift to subscription mean better ERP?

I've been scratching my head over Forrester's The State of ERP in 2011: Customers Have More Options in Spite of Market Consolidation report. Larry Dignan focuses on the key finding that:

The enterprise resource planning (ERP) market is heating up in 2011, but despite more on-demand offerings from SAP and Oracle’s Fusion upgrades, two-thirds of companies say they will stick with the status quo for their business applications.

There are problems with Forrester's analysis from both a buyer and seller perspective. Simply shifting from one business model (license plus maintenance to subscriptions) does not sound like any fundamental change in the market. In fact the more one reads the report, the more it sounds like 'same old, same old.' That's curious in a market where the leading vendors tout 'innovation' as their current watchword.

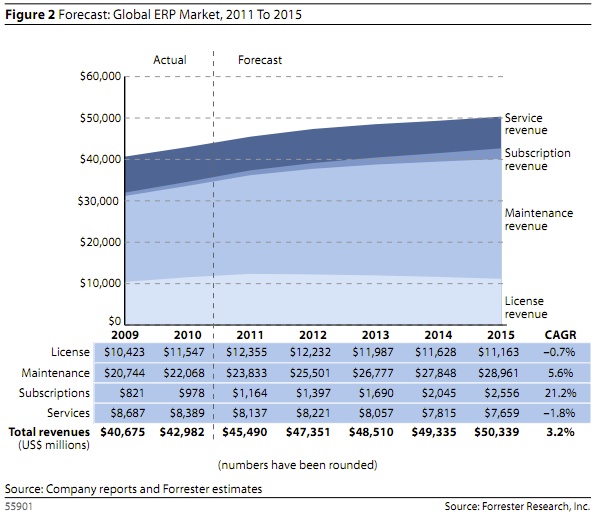

At one level you can argue that innovation can be defined by changes in the way buyers pay for the services they receive but to me that's more a sop for Wall Street and of limited, if any value, for Main Street. That is confirmed in how Forrester sees the overall growth in revenue. Over the next few years they believe subscriptions rise by 21.2% CAGR, maintenance grows at 5.6% CAGR, services at 1.8% CAGR while license fees drops by 0.7% CAGR. Net - net Forrester sees a meagre 3.2% CAGR growth through 2015.

If you accept my argument then Wall Street should be very worried. A total market $5 billion increment over four years doesn't come close to revenue projections SAP is putting in the market, let alone allowing for any real growth at Oracle, Microsoft, Infor and others. And all of that before we take macro economic inflation into account. Forrester's assertion that much of the subscription growth goes to Oracle and SAP does not give much hope for emerging SaaS players like NetSuite and Workday. Contrast that with NetSuite CEO Zach Nelson's statement at the recent NetSuite earnings call (PDF download):

"At the end of Q4, we felt we were hitting the tipping point in ERP as customers large and small began to move from pre-web client/server solutions to NetSuite's cloud-based offering. Our great Q1 reinforces that this mass migration from legacy Microsoft Dynamics GP/Great Plains and SAP is accelerating in 2011."

At the CRM end of the functional market, it also begs the question how Salesforce.com moves from $2 billion to $3 billion in revenue. In Forrester's analysis, even Salesforce.com's recent stellar rise would be implicitly crimped unless it massively expands the CRM footprint. Trade analysts are pinning their hopes on Social CRM. I think they're mostly smoking dope.

Another problem comes in Forrester's analysis of maintenance spend. It argues:

Maintenance revenues accounted for 51% of total ERP revenues in 2010 and represent a reliable, high-margin income stream for vendors. Clearly, however, the rising costs of maintenance remain a major source of customer dissatisfaction and could increase the percentage of customers not renewing their vendor maintenance contracts. Customers that question the value of maintenance service bundles are likely to consider other options, including moving to a lower-cost ERP system or moving to third-party support or self-support.

Despite Oracle's masterful ability to manage maintenance in customer accounts and SAP's ability to keep its customers paying, the threat from third parties, while minimal today is very real going forward. If anything, Forrester's analysis should sound alarm bells to everyone. If, as a buyer, I am convinced by Forrester's analysis, then where the heck do I find money for true innovation when the lion's share of my budget will be going to keeping the lights on?

In soundings I've taken among investment and trade analysts, I get the strong sense customers are thoroughly tired of being tethered to a vendor model that leads to less rather than more innovation. Not only does it constrain IT's ability to contribute to growth it effectively marginalises IT's ability to be anything more than a plumbing group. If that sounds alarmist then I only have to listen to colleagues like Frank Scavo and Vinnie Mirchandani. They believe IT departments no longer have the means to innovate for growth. It is hard to argue against that when you see business growth led technology innovation coming from outside traditional IT departments.

Does Forrester's assertion that 'a wider choice reframe app strategies' offer hope? I don't think so. If anything it represents little more than a moving of the chess pieces rather than checkmate with the emphasis upon continued cost reduction - something the incumbents are resisting today but which has to come in the future.

But over arching all these arguments I wonder whether SaaS/cloud based solutions are delivering any radical value. At least in the enterprise. Is it truly possible to innovate against Pacioli's double entry accounting mantra, HR admin/payroll or SFA? The answer is yes but it sure ain't happening in the enterprise.

In a recent conversation with Brian Richter, UK leader of Mamut, he made the observation that: "In the past we used to see innovation trickling down from enterprise vendors to the smaller shops. Nowadays we seem to be seeing things go the other way." I see that all the time. It is leading tiny vendors like FreshBooks, Xero, Liquid, KashFlow, FreeAgent, Twinfield, BrightPearl and some 50 other upstarts in the UK alone to scooping up market share from Sage. These vendors are also finding fresh markets among the 'shoe box' accounting types that are incapable of maintaining double entry. While their collective revenue is barely a fleabite in Forrester's matrix, they point the way towards much simpler methods of automating business process that is rarely seen in the enterprise. Can any of these break out into the broader market? It is possible but not in Forrester's timeframe and not without considerable capital inflow.

There is a flipside to Forrester's analysis. Are they factoring in growth among emerging markets like China, India, South America and certain of the African nations? If so then will it, as they assert, go primarily to SAP and Oracle? I have no hard evidence but in listening to Phil Fersht at Horses for Sources, I get the sense those markets will not go the traditional in-house route. Instead they are more likely to go straight to an outsourced model that depends upon cloud players offering a lower long term cost promise.

If that's the case then it can only come from either an acceptance by the current market leaders that volume replaces license and/or an as yet unseen emerging cadre of new players that can truly disrupt the ERP market. I see little appetite from SAP/Oracle/Microsoft in changing their models. Even a combined NetSuite/Workday/Plex/Salesforce.com simply don't command enough market mind share to (currently) take their place. Will those tiny players I reference above emerge in Forrester's timeframe? Unlikely.

Whichever way you cut Forrester's analysis it makes a depressing picture. Is it any wonder then that many of my colleagues look out upon ERP and despair of its ability to drive value? When viewed through that lens, it is hard to argue otherwise.