Eat your heart out Spotify: Here is one digital music service that actually makes money

June has been a big month for Stingray Digital, a profitable digital music service out of Montreal, Canada that you've probably never heard of but should for a number of reasons.

(Stingray)

The company recently announced fourth-quarter ended March 2016 net income of $3.2 million (CAD) on revenues of $25.7 million (CAD), bringing the annualised total of both to $13.9 million (CAD) and $90 million (CAD) for the year ended March 2016. While revenues increased 26.7 percent for the year, net income rose a whopping 110 percent.

Consider recent figures of Spotify -- one of the leading music streaming services today. It has posted a consecutive, ballooning string of losses from 2009 that reached a staggering $194 million for 2015-16, despite growing by some 80 percent to $2.18 billion. Despite this sea of red on its income statement, Spotify apparently told its investors that "in many ways, [2015] was our best year ever". Observers of the business model have widely thought the business model of the music streaming site to be "unsustainable". Of course, Spotify isn't alone in posting these unenviable numbers as other music streaming sites have either experienced similar fortunes or have shut shop entirely.

Featured

So the only natural question to ask here is what exactly is Stingray doing that these other music services aren't?

If you've ever wandered into a grocery store or a mall or a hotel in Canada, chances are that the music you hear being piped through the company's audio entertainment system is thanks to Stingray, a purveyor of music that includes paid music channels on cable TV that reach some 400 million subscribers in 152 countries, as well as customised sales for businesses. The company claims that every TV watcher in Canada houses its products on their cable systems, making it one of the most highly penetrated services in the country today.

In the last year, ever since it went public, the company is going on an international acquisition spree to continue to boost those numbers. This month, it snapped up four of Bell Media's specialty services, Juicebox, MuchLoud, MuchRetro, and MuchVibe. Towards the end of last year it added a massive customer base to its kitty by gobbling up Swiss-based television station iConcerts. This brings Stingray some 250 million lucrative, mostly-Chinese subscribers who are fans of the company's live music stations and whose wallets will instantly give Stingray at least 10 percent of its revenue stream.

(Stingray)

It is now swimming purposefully towards other markets in the Middle-East, Asia, and Africa where TV, not the internet, is still a dominant form of entertainment and reach for the majority of the populations.

When you consider how many people are pulling the plug on their cable subscriptions and migrating to Netflix, this business approach appears to be a very unusual bet, but a potentially brilliant one when you consider the stable revenue pool Stingray has from its business clients. Meanwhile, even though Spotify's customers swelled to 89 million this last year, only around 28 million were paid subscribers and that cohort isn't growing fast enough.

Plus, Spotify forks out 85 percent of its revenues towards royalties and the rest in hosting and human resources costs, leaving a large wave of red ink on its P&L statement. By contrast, apparently Stingray pays a modest amount to musicians since it is a non-interactive service and not an "on-demand" one like its streaming brethren.

Of course, this is not to say that Stingray may not get stung by its own business model. After all, the gravitation towards the internet in emerging markets is happening faster than they may expect. India, for instance, has largely bypassed the PC revolution and has leapfrogged into a smartphone one, which is where most of the populace will discover the internet. How Stingray morphs into the emerging world of phone-fuelled media consumption will determine how well it does in the long run. After-all, Kodak was still a hot company in the late 1990s before being rendered obsolete by the digital camera while Fuji found new life in discovering new business models.

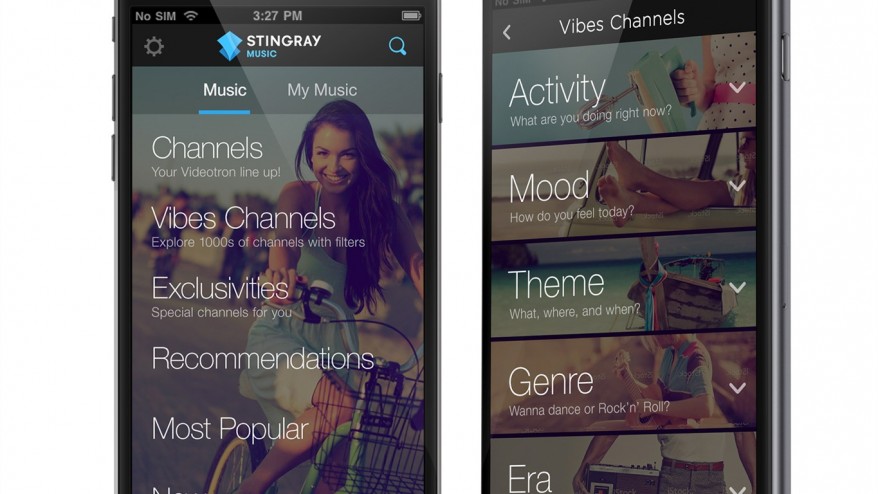

There's some evidence that Stingray is cognisant of this. Last year, it launched a commercial-free mobile phone app called Stingray Vibes for the commercial market. Here, it is wading into similar waters as Spotify but it has done so with its existing backbone of stable revenue along with an identical, less-sexy, non-interactive, continuous content strategy that it transported over from its TV channel business, and probably allows it to incur far fewer costs than its other on-demand brethren.

In a world where VCs continue to plonk down huge amounts of money to make bets on ambiguous plays in the constantly evolving world of digital business, Stingray offers one last delicious irony: Players like Spotify and Apple churn out their playlists and recommendations using algorithms. Stingray has a stable of 100 music experts that curate song lists into a vast repertoire of hand-picked genres for both its TV as well as its newer streaming business.

It's yet another peculiar contradiction that helps this music service provider sing all the way to the bank.