Business

EBay ties up loose ends, delivers solid Q2 as PayPal set free

EBay also sold eBay Enterprise for $925 million as it prepares to separate from PayPal.

EBay has tied up the loose ends and is prepared to set PayPal free starting Friday.

Meanwhile, eBay is selling its eBay Enterprise unit for $925 million to a private equity firm ahead of the PayPal spin-off. Permira Funds and Sterling Partners were the primary buyers. The deal is expected to close in the second half. Permira also counts Informatica and Freescale as portfolio companies.

Even with those various moving parts, eBay delivered a solid second quarter. The sale of eBay Enterprise was one of the many items to ponder in the company's final earnings report with PayPal. On Friday, PayPal will be spun off as an independent entity. EBay Enterprise, which used to be GSI Commerce, was acquired by eBay for $2.4 billion in 2011.

EBay Enterprise is a competitor to Amazon's fulfillment business for third party sellers and had customers such as Toys R Us and Dick's Sporting Goods. However, both companies are defecting from eBay Enterprise to better integrate their physical and digital sales channels.

In a recent earnings conference call, Dick's executives said owning their own e-commerce infrastructure would allow them to scale better. Currently, eBay Enterprise collects a percentage of revenue.

EBay's second quarter report excludes $300 million in eBay Enterprise revenue. The company also took a goodwill impairment charge of $786 million.

As for the second quarter, the company reported second quarter earnings of $682 million, or 56 cents a share, on revenue of $4.4 billion. Non-GAAP earnings were 76 cents a share. The company said its results were hampered by a stronger dollar, but PayPal and eBay Marketplaces delivered better revenue fundamentals.

For instance, eBay Marketplaces saw second quarter revenue fall 3 percent, but in constant currency sales would have been up 5 percent from a year ago.

With eBay's loose ends tied up, all eyes go to PayPal, which recently acquired Xoom and its remittance business. PayPal is expected to be better equipped to compete with Apple Pay, Google Pay and a host of other rivals as an independent entity.

Among the key highlights from the earnings conference call:

- PayPal CEO Dan Schulman said that PayPal has been able to invest in technology due to the spin-off. He said:

The separation has given PayPal the opportunity to invest heavily in our infrastructure setting up state-of-the-art networks and data centers to give PayPal a competitive edge. This was no small task and our technology teams deserve a tremendous amount of recognition for this achievement. At the same time, we continue to push forward the transformation of our technology platform. We have made great progress and are approximately two-thirds of the way through this three-year initiative. We have re-architected much of our back-end infrastructure and consequently have sped up payment processing by up to 50% in the past year and reduced time to push code live to site by more than half. We are a fully agile software development shop, now one of the largest in the world. And being agile allows us to innovate more quickly, integrate more effectively and introduce new products or deploy new markets faster than ever.

- EBay CEO Devin Wenig said:

Looking towards the second half, we will be launching a new experience across mobile channels that we are really excited about. This experience is built upon learnings from our iPad app, a more engaging discovery-based experience for buyers that also builds on our simplified mobile selling experience. This release will unify the mobile experience across our platforms and it will enable a consistent user experience and faster product iteration.

- Wenig also added that eBay will invest in its selling tools and acquire more small and medium-sized businesses. "My goal and that of the entire leadership team is for eBay to be the best global marketplace and a great, enduring Internet business. EBay was founded with a purpose driven ethos which has fueled our company and our brand," he said.

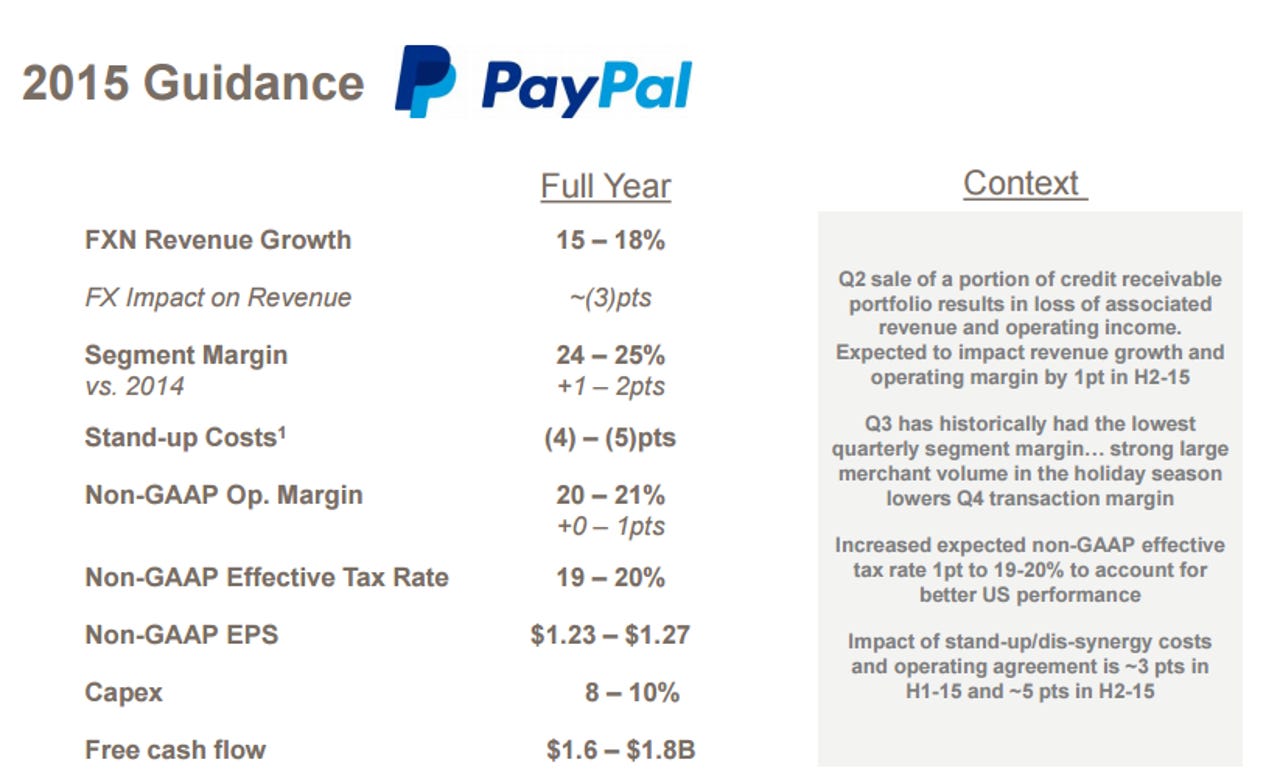

Going forward, PayPal said it expects its 2015 revenue to grow 15 percent to 18 percent on constant currency with non-GAAP earnings between $1.23 to $1.27 a share.

EBay will see revenue growth of 3 percent to 5 percent with non-GAAP earnings of $1.72 a share to $1.77 a share.