Fitbit turns operating profit in Q3, sees smartwatch, healthcare traction

Featured

Fitbit turned a third quarter non-GAAP profit as smartwatch revenue now consists of 49 percent of sales, its healthcare business gains momentum and Europe, Middle East and Africa (EMEA) delivers growth.

The company remains a work in progress, but CEO James Park noted that Fitbit is keeping its focus as it transforms its business. Much of Fitbit's transformation depends on using its platform to impact health outcomes.

The company reported a net loss of $2.1 million, or a penny a share, on revenue of $393.6 million, up from $392.5 million a year ago. Non-GAAP earnings were $10 million, or 4 cents a share. Wall Street was expecting Fitbit to report a loss of a penny a share on revenue of $381.2 million.

While the company didn't break out its healthcare business it did say third quarter sales were up 26 percent.

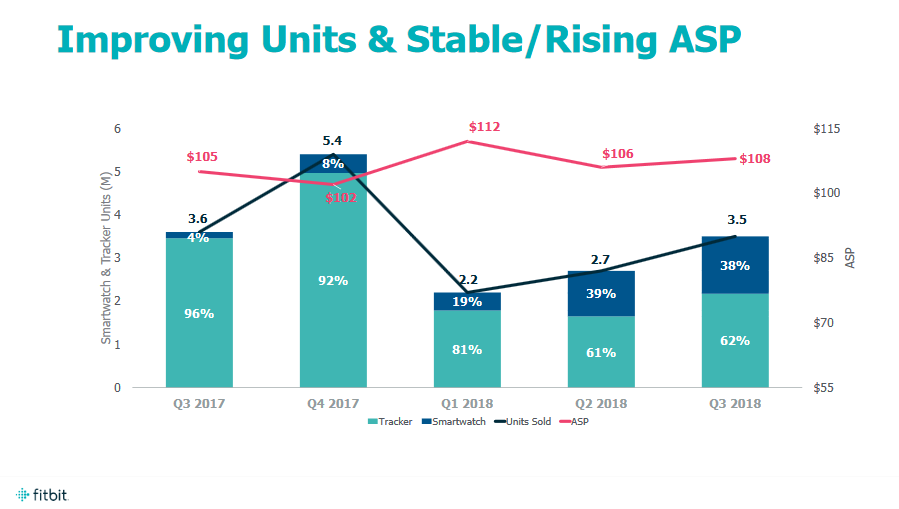

Park noted that Fitbit is the No. 2 player in smartwatches as its Versa is well received. The Fitbit Charge 3 is a device that blends trackers with smartwatches. Overall, Fitbit sold 3.5 million devices in the third quarter, down from 3.6 million a year ago. Average selling price for Fitbit's wearables was up 3 percent to $108.

Fitbit's challenge, however, is competing with the Apple Watch and Apple's healthcare ambitions.

Also: How Apple Watch saved my life | How to run your business from your smartphone TechRepublic

Park said on a conference call:

Our health solutions business grew 26% year-over-year, a significant achievement as we continue to add to our portfolio of more than 1,500 customers and 100 health plans clients...Historically, Fitbit Health Solutions has focused on selling devices to enterprises as part of their wellness offerings, and we built a small but successful business doing this. As obesity rates and the incidence of chronic disease that are largely lifestyle-based increase and health care costs skyrocket, we feel an opportunity to work more closely with the health care ecosystem to help drive behavior change at the population level and bend the cost of care. This created the opportunity to diversify our revenue into more durable higher-margin opportunities. The acquisition and integration of Twine Health and the launch of Fitbit Care will be key to our success as we go deeper down this path.

He added that Fitbit has one of the largest sleep databases and the company sees more opportunity via sleep tracking improvements. "Fitbit will continue to work towards clinical validation and regulatory approval of its software for use in detecting health conditions such as sleep apnea and atrial fibrillation," he said.

Fitbit Health Solutions is less than 10 percent of revenue, but Park said the business is gaining traction. Devices will play a role in Fitbit Health Solutions, but revenue will ultimately come from healthcare reimbursement dollars from payers.

Park, however, did add that Fitbit is planning on more transparency for its healthcare business in 2019.

Fitbit delivered a solid outlook. It projected fourth quarter revenue of $560 million with non-GAAP earnings of at least 7 cents a share. For 2018, Fitbit sees revenue of about $1.5 billion with higher average selling prices for its devices, but lower sales.

In the third quarter, EMEA sales were up 17 percent to $104 million. International revenue was up 10 percent to represent 42 percent of Fitbit's total revenue.

Also: Fitbit ships more than a million Versas since launch, fastest selling Fitbit ever | Fitbit Charge 3 review: Comfortable activity tracker backed by a powerful fitness platform | Fitbit launches Fitbit Care platform for health care plans, expands Humana partnership | Fitbit Versa review: Finally, a smartwatch that can make Fitbit proud

The company added that 58 percent of third quarter activations came from new buyers with the remainder representing repeat buyers. Fitbit also said that 55 percent of active users viewed Fitbit Feed.

Fitbit's results landed the same day as rival Garmin, which also makes trackers and smartwatches.

Garmin, however, is much larger. Garmin reported third quarter earnings of 97 cents a share on revenue of $810 million, up 8 percent. Garmin's fitness division delivered sales of $190.19 million, up 14 percent. Garmin's smartwatches are included in its outdoor division with wearables in its fitness unit.

Also: Garmin challenges Fitbit with advanced sleep monitoring | CNET: Best smartwatches for 2018

Garmin said that it saw strength in the wearable category. Garmin upped its 2018 guidance calling for revenue of $3.3 billion with non-GAAP earnings of $3.45 a share. Garmin had projected 2018 non-GAAP earnings of $3.30.