Forrester: 2009 IT spending will be anemic with a 2010 bounce

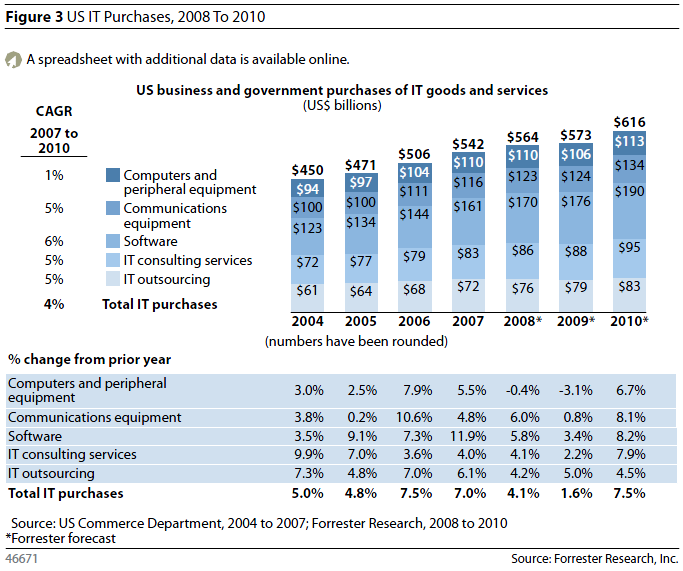

Forrester Research on Tuesday revamped its IT spending forecast and projected a growth rate of 1.6 percent in 2009, down from 4.1 percent in 2008. Given the state of the economy flat to any growth should be construed as good news.

In many respects, Forrester's take is very similar to what Gartner outlined in October. The message: Prepare your IT budget for Armageddon, but unless your company suddenly decides to stop sending out invoices and running its business you'll need some technology spending.

Forrester analyst Andrew Bartels writes (my emphasis added):

The question for the US tech market is no longer whether the US economy is in recession — instead, it is how long and deep the recession will be and how much damage will it do to the tech sector. Forrester is still a relative optimist, believing that the recession will last into mid-2009, with declines in real GDP of as much as 3.6% on a quarterly basis. This kind of decline in the economy will pull growth in US business and government purchases of IT goods and services down to 1.6% in 2009, from 4.1% growth in 2008. The weakening of the US tech market was already evident in the Q3 2008 data, which showed US revenues of large vendors down by 2%. Computer equipment purchases are already in decline. Growth is slowing for purchases of network equipment, software purchases, and IT consulting and outsourcing services. Continued declines in purchase are in prospect for computer equipment purchases in Q4 2008 and the first half of 2009, with little or no growth in communications equipment and IT services. Software growth will slow to as little as 2% in coming quarters. Still, we do not expect to see the 15% to 20% declines in tech purchases that happened in the 2001 to 2002 tech downturn.

I count that as good news. However, let's look at some of the underlying assumptions in Forrester's take. Among Forrester's key points:

There will be a revival in IT spending in late 2009 that will carry into 2010. Much of this spending will be in hardware upgrades that were put off, but the 2010 surge will carry across all sectors. In other words, the tech spending recession will end in the third quarter of 2009. In 2010 IT spending will be almost 8 percent.

See this chart for the summary (click to enlarge):

Reality check: How does anyone know that the back half of 2009 will be the end of the downturn? IT budgets are likely to be month-to-month affairs and it's a stretch to make an assumption about 2010 today. Forrester is betting that an Obama stimulus plan coupled with interest rate cuts, lower gas prices and a better credit market will fuel a rebound in 2009. All of that is possible, but not a slam dunk by any stretch.

Here's a look at Forrester's IT forecast by industry (click to enlarge):

Reality check: Some of these forecasted declines look tame. For instance, the financial services industry is forecast to fall 4 percent. Just based on consolidation and excess IT gear purchased by defunct banks you could argue for a larger decline. I also have a hard time seeing flat IT spending by the retail sector.

Other odds and ends under the IT spending hood:

- Small vendors will fare better than large ones. Is this the end-game for large vendors that have lived by squeezing more revenue from existing customers?

- Computer equipment will fall 3.1 percent in 2009, but bounce back in 2010. The rationale: Cloud computing, virtualization and storage will drive demand. Communications equipment spending will slow to 0.8 percent in 2009. CIOs will put off network upgrades if they can.

- Software will continue to do well, but slow in 2009. Forrester reckons that Sun's software division has momentum as does Microsoft and Symantec. Software spending is expected to grow 3.4 percent in 2009.

- IT consulting and outsourcing services will decline. In 2009, Forrester reckons that these once immune vendors will hit the wall.

Overall, I view Forrester's take through a glass-half-full lens. That said, I'm not so sure about some of the underlying assumptions about the economy's turn.

Also see: State of the enterprise tech economy