Forrester fuels the SAP maintenance price hike debate

The last few days I've been exchanging email with R 'Ray' Wang, VP and principal analyst at Forrester about the kerfuffle over SAP's unilateral decision to apply a price hike to its maintenance and support fees. Ray specializes in the enterprise market and has special experience of SAP going back many years. On Thursday, Ray delivers a web seminar that describes the issues, lays out the costs and offers possible remedies. I received an advance notification of the slide deck and with Ray's permission, reproduce parts of that presentation.

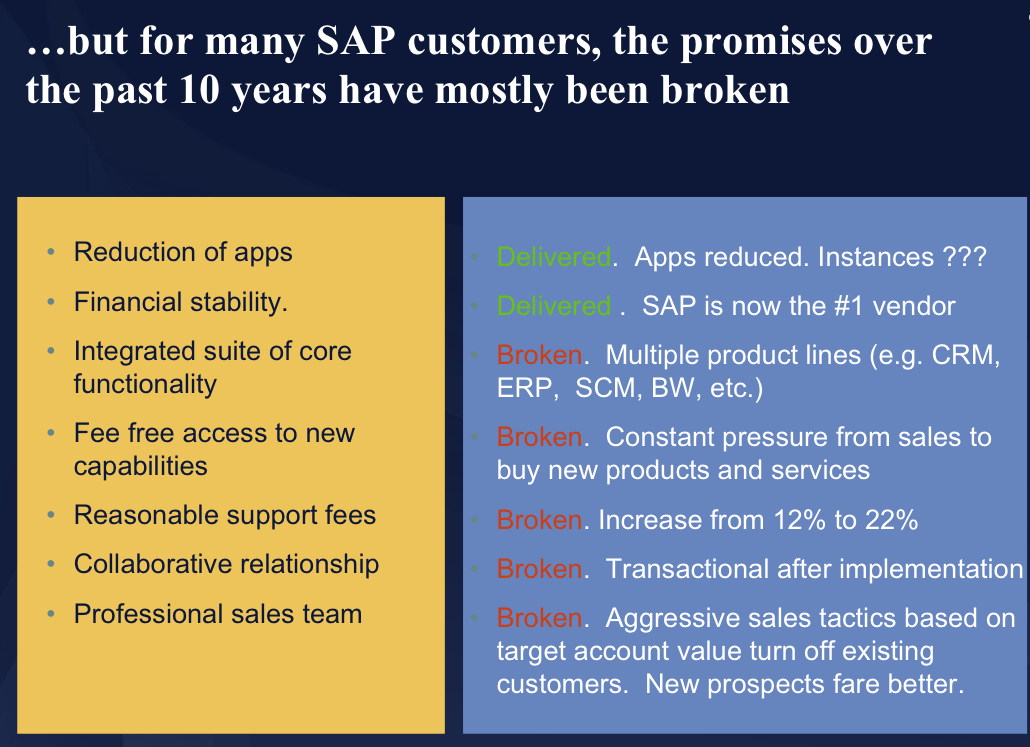

Ray sets the backdrop by describing the partnership vision SAP customers have bought into. That includes:

- SAP would deliver an integrated suite of solutiions

- Maintenance and support fees would be reinvested to fill out the gaps on the product roadmap

- SAP would not 'rape and pillage' the customer like other ERP vendors of the day

He then goes on to show how most of those promises have been broken per the slide below:

Ray confirms what I and others have been saying on the general disquiet about the way SAP is introducing this increase. Forrester interviewed more than 200 SAP customers and as you can see from the next slide, most want a return to the status quo or lower costs:

Ray then goes on to describe what has happened, the rationale behind the price hike, details about how the price hike works, how it impacts different types of customer and then explains why customers remain skeptical.

Many of the reasons for skepticism are well understood. Customers are not receiving value from the support they already receive and ERP upgrade fatigue figure heavily. What is perhaps less well known are the tactics SAP employs. Those of us who have followed SAP for some time are aware that ERP sales is a dirty business but this is the first time I recall a senior industry analyst publicly calling out a vendor in this way. (see slide below)

It's important to stress that SAP is not alone in operating these tactics. Oracle is just as bad although of late it has been far more willing to negotiate on price than SAP. In my view that is because Oracle is building an annuity business based on maintenance revenue that will fuel its promise to Wall Street of securing 50% net margins. Provided it gets any fee, it can charge maintenance where the margin is close to 95%. As I have said many times before, that's an unsustainable model. In today's market, it's also cynical.

Ray concludes with some near and long term action steps that customers should consider. These are summarized per the slide below:

Ray then goes into detail as to the steps that customers might choose to take. Some of these are already underway, including continued press coverage of the issues, continued internal audit on maintenance and support usage and consideration of customers' long term investment strategy with SAP.

One that particularly struck me is the call to "Work with user groups to file an anti-trust suit with the EU and US Justice on the Oracle-SAP duopoly, asking for third party maintenance rights." This is something I had not thought of but makes great sense.

Oracle customers can already get maintenance at around half the existing cost from Rimini Street. Why can't SAP customers enjoy the same? Why should Oracle and SAP continue to gouge customers for very little additional value? It doesn't make any business sense and cannot continue unabated.

Given we are entering a severe economic downturn, I believe SAP has a golden opportunity to solve this problem here and now. It can relent and concentrate on solving the deeper problems that already exist and which contribute to this debate such as:

- An out of control group of implementers that has a license to print money

- An outdated and anal development policy that often drives an 'only made here' attitude to innovation

- A root and branch review of its IP policy that puts barriers in the way of open source development

- A true partnership with its internal influencers and especially the key players in its SAP Community Networks where value goes both ways and is recognized as such

- A drive for genuine business value rather than an obsession with engineering excellence that includes sensible business discussions designed to solve business problems

None of these measures is hard to execute against but it requires a will to succeed and a 'putting the customer first' attitude. It requires a putting aside of personal short term gain at the executive level and a willingness to turn rhetoric into value.

SAP will argue that a turning back would represent a defeat, a reduction in service delivery and a shrinking of its stock price. Nonsense. In today's market, stock prices are meaningless. The only thing that matters is your ability to drive cash flow. SAP could truly differentiate itself as a vendor that is relentless in the pursuit of value delivery rather than being depicted as mean spirited and penny pinching. The market will reward it for delivering because customer loyalty will be enhanced. In short, it will be able to sell more. How far it goes is another matter but zero day is now.

In closing, I'd encourage anyone with concerns on this issue to consider forking over the $250 to gain access to Ray's webinar which takes place Thursday. It is stuffed full of examples and facts that will help customers understand what's happening. As one of the few brave voices prepared to put his analyst neck on the line in favor of customers, Ray deserves all our respect.

All images courtesy of R.Wang and Forrester