Gartner: 2016 marked fifth year of falling PC shipments

Global shipments of PCs fell for the fifth straight year, according to Gartner estimates.

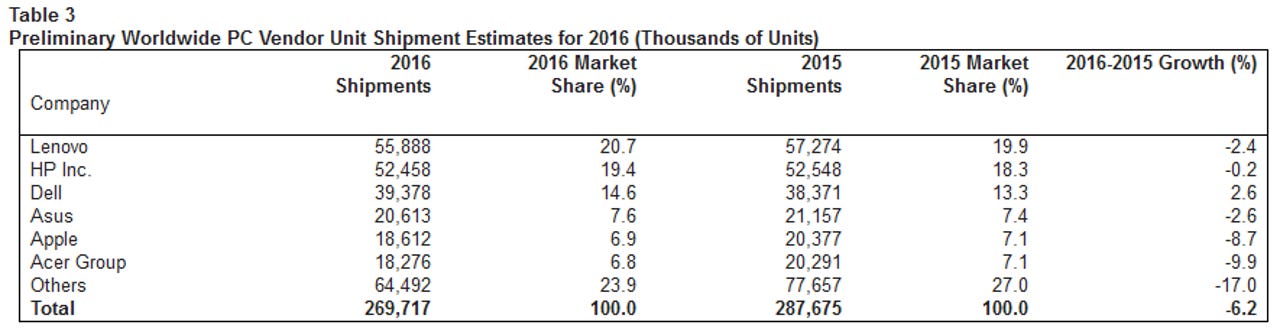

Shipments came to 269.7 million units, marking a 6.2 percent decline from 2015, the research firm said. For the fourth quarter of 2016, Gartner estimates 72.6 million units were shipped globally -- a 3.7 percent decline from Q4 2015.

IDC published similar numbers, estimating that annual PC shipments reached 260 million units, down 5.7 percent from 2015. Global shipments for Q4 came totaled 70.2 million units, IDC said, marking a 1.5 percent year-over-year decline.

Gartner data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads.

The decline represents a "fundamental change in PC buying behavior," Gartner analyst Mikako Kitagawa said in a statement. "The broad PC market has been static as technology improvements have not been sufficient to drive real market growth," Kitagawa said.

However, IDC noted that the market seemed to stabilize a bit by the end of the year.

"The contraction in traditional PC shipments experienced over the past five years finally appears to be giving way as users move to update systems," Loren Loverde, IDC vice president of Personal Computing Trackers & Forecasting, said in a statement. "We have a good opportunity for traditional PC growth in commercial markets, while the consumer segment should also improve as it feels less pressure from slowing phone and tablet markets."

In the US, Q4 shipments reached an estimated 16.5 million units, according to Gartner, which is a 1.3 percent year-over-year decline. IDC also marked only a slight decline in the US market for Q4.

Other mature regions performed best, IDC said, with Japan and Canada extending positive growth from Q3 to Q4. Shipments in the Europe, Middle East, and Africa (EMEA) region remained stable. Latin America, meanwhile, saw a significant contraction.

Lenovo, HP and Dell remain the top three vendors, and all three saw some growth in Q4, according to both Gartner and IDC. Both firms showed Apple coming in the fourth spot, while Asus saw its shipments shrink by double digits in Q4.