Gartner: Weak back-to-school sales in US brought down Q3 PC shipments

Weak US back-to-school sales pulled down PC shipments domestically and worldwide in Q3 of 2017, according to a preliminary assessment from Gartner.

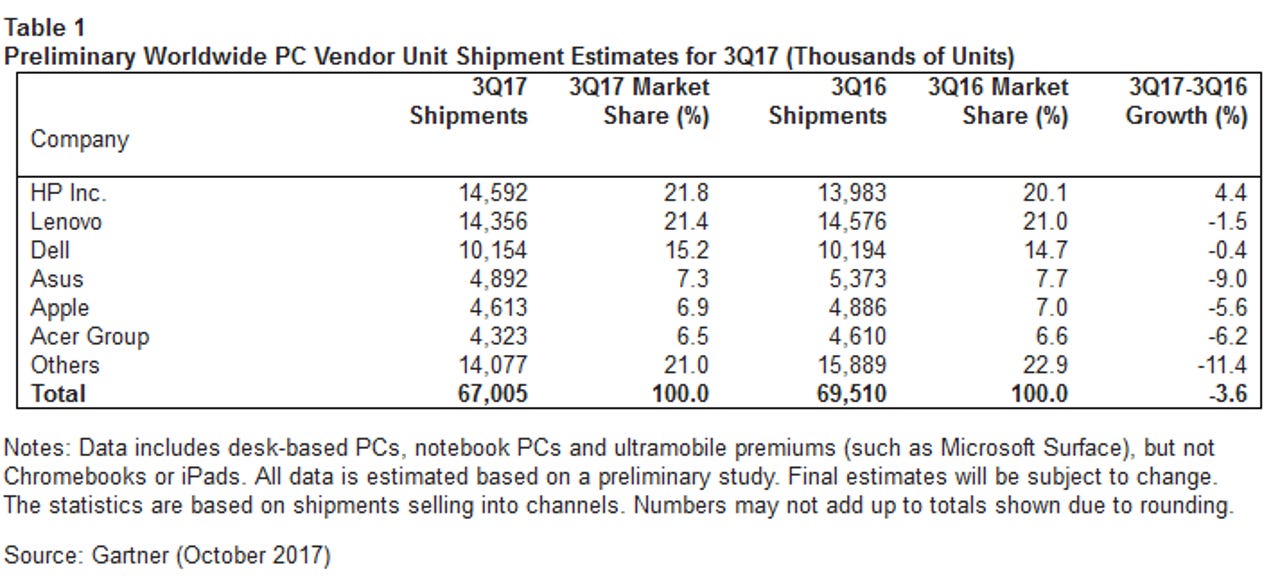

Worldwide PC shipments totaled 67 million units for the quarter, representing a 3.6 percent year-over-year decline. This marks the 12th consecutive quarter of declining PC shipments, per Gartner.

IDC produced similar raw figures, tallying 67.2 million units shipped in the third quarter of 2017. IDC said that translates into just a slight year-over-year decline of 0.5 percent.

In the US, according to Gartner, shipments were down 10 percent year-over-year, totaling 14.7 million units. This offset the stabilizing PC markets in key regions like EMEA, Japan and Latin America.

Gartner data includes desk-based PCs, notebook PCs and ultramobile premiums, but not Chromebooks or iPads.

"Weak back-to-school sales were further evidence that traditional consumer PC demand drivers for PCs are no longer effective," Mika Kitagawa, principal analyst at Gartner, said in a statement. "Business PC demand is stable in the U.S., but demand could slow down among SMBs due to PC price increases due to component shortages."

DRAM shortages were particularly worse during the third quarter, Gartner said, compared with the first half of 2017. Gartner expects the shortage to continue through 2018.

IDC delivered a more positive assessment, reporting that the US market only contracted by 3.4 percent in Q3, with total shipments coming to 16.6 million. IDC says that back-to-school promotions actually helped boost results.

"Despite the overall contraction, Chromebooks remain a source of optimism as the category gains momentum in sectors outside education, especially in retail and financial services," Neha Mahajan, IDC senior research analyst, said in a statement.

Additionally, IDC reported that the components shortage actually improved this quarter and did not significantly slow down production volumes. Still, it acknowledged that higher component pries and inventory limited shipments in some markets.

Both IDC and Gartner show HP as the top vendor in Q3, with Lenovo close behind. While their shipments were similar, HP has been on an upward trend, while Lenovo seems to be losing steam. Gartner concluded that Lenovo is putting more emphasis on profitability than market share gain.