Gogo bets open architecture will win over American, other airlines

Gogo CEO Michael Small said that its open architecture with its latest aircraft broadband technology can win over airlines, including American.

American is pondering a jump to Gogo rival ViaSat for some of its fleet. Gogo shares tanked earlier this month on the news. Small, speaking on a fourth quarter earnings conference call, talked about American, the company's 2Ku technology and prospects for the future.

Gogo's 2Ku technology has launched and can hit peak antenna speeds of 70 Mbps. The Gogo 2Ku system uses spot beam satellites and a dual antenna for traffic up and downstream. American uses Gogo's older ATG technology, which uses antennas on the ground to beam access to a plane. Gogo also has a Ku band service that is being installed.

Viasat uses Ka band satellites for its service. Gogo said it's betting on Ku band technology because the investment in satellites and the ecosystem is going toward that spectrum.

The upshot here is that the airline industry has Internet service that has become legacy. And there is an ongoing upgrade cycle for fleets. Carriers will prioritize most profitable routes and planes for better service. The challenge is that these upgrades take time due to installation, integration and regulators. For instance, Gogo projected that 75 aircraft will be installed with 2Ku systems in 2016, but 800 contracts have been awarded. That reality is one reason why Gogo is pitching a system that it believes is more future proof.

In addition, Gogo's biggest challenge is network capacity so the Internet service provider has its own upgrade cycle to a satellite-based approach. Business travelers are caught in the middle with Gogo service that is good on some flights and like dial-up on others.

Small said:

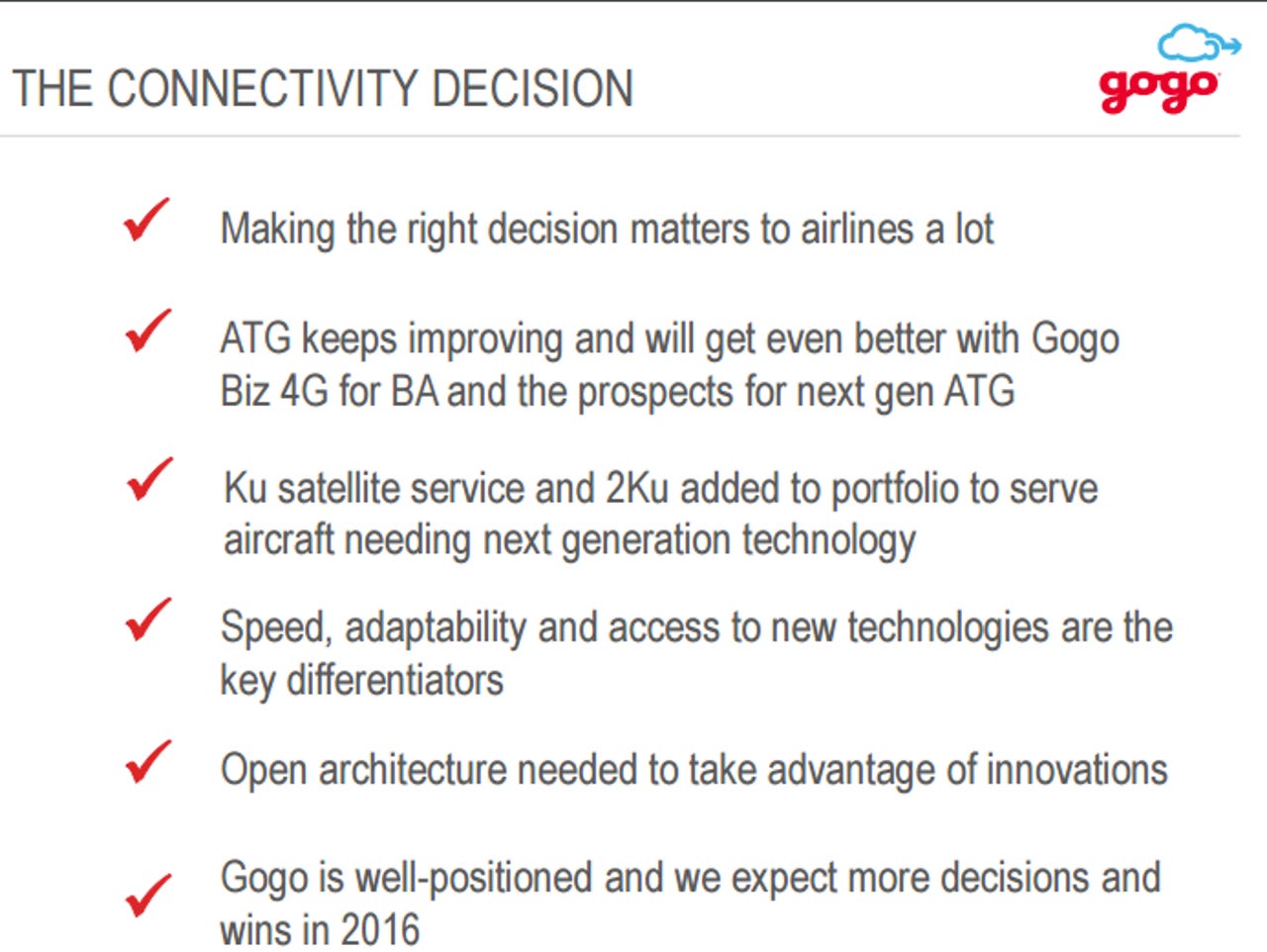

The recent action by American validates what we've been saying for quite some time. Making the right consistency decisions matter to airlines a lot. What really matters to them as they don't make the wrong decisions. Our air to ground technology is still an engineering marvel that will keep improving. I'm extremely excited about our 4G ATG for service aviation and the prospect of next-generation ATG whether that is for through 14G or other spectrums. American's right, first-generation technology which is still more than adequate for certain aircraft, is not cutting its day for some of their aircraft.

Gogo is offering another proposal to compete with Viasat by March 20.

But Small's biggest point is that airlines need to think about architecture and how open technology is when making a buying decision. Airplanes last 40 years and carriers can't get caught up in upgrades every few years to fleets. Gogo's 2Ku technology ties airlines to satellite advances instead of locking them into a networking system.

Small added:

We all know airlines make money by keeping planes in the air, taking planes out of service for upgrades is disruptive and expensive. Meanwhile, airplanes last for 40 years , eons by high-tech standards. Satellites are delivering 250 times the bandwidth just six years ago in that place will not stop. With 2Ku, airlines won't have to keep upgrading intending to changes with satellite technology. The point is, with an open architecture, airlines are tied to satellite technology.

Small said that 2Ku could work even with Google's balloons in the future.

Analysts on the conference call focused on any collateral damage from American potentially swapping out Gogo for some of its planes. Small said clearing up American's lawsuit over its Gogo contract quickly is a priority.

The other wrinkle here is that Gogo's business model will change as airlines upgrade over time. When in-flight Internet access launched, Gogo was a pioneer and controlled everything from the portal to the platform. Today, Gogo is likely to be white label and offer more service tiers.

Small added:

I think the business models on how we want to package it to the airlines may change. It is all about the trend of giving airlines more control and flexibility over time. That is true of virtually any new innovation. You come up with an application that works. Everybody loves it and you realize you have to open this up and let it be the customers way, not our way. And we are moving down that path.

The technology talk from Gogo came as the company reported fourth quarter results and provided an outlook. The company reported a fourth quarter net loss of $33.88 million, or 43 cents a share, on revenue of $137.8 million. For 2015, Gogo reported a net loss of $107.6 million, or $1.35 a share, on revenue of $500.88 million. For 2016, Gogo sees revenue between $575 million and $595 million.