Google now baby-steps away from eBay-like auction service

I was just reading Steve Bryant's Ten Possible Consequences of Google's GBuy and I couldn't help but wonder about his omission of the possibility that Google will use the core of the auction technology it has already developed to build its own eBay like auction marketplace for goods and services (non-advertising). Think about it. The building blocks are obviously in place and given Google's knack for surprise drama, how could such a service not be in the works? If you Google "Google auctions," you'll get a lot of hits. But a lot of them discuss the way auctions work with Google's AdWords. Most of the other ones discuss Google's unorthodox initial public offering, which involved an auction. But only a few hint at the idea that Google will or should take on eBay in the mainstream online auction space.

Last October, blogger Aaron Wall speculated that a new Google facility going up in the Phoenix, AZ area might house the team that would bring Google Auctions to fruition. The comments on the blog make it pretty clear that competition for eBay would be a good thing. I have no idea where things ended up with that Phoenix facility (anbody?). Then, there are the 448 people (as of the writing of this blog) that have signed an open on-line petition that asks Google to get into the auction game. That's not as many petitioners as Al Gore is getting to run for president in 2008. Google, by the way, is named in petitiononline.com's third largest petition, bearing the signature of more than 10,000 people. You'll never guess in a million years what it's for.

Personally, I think some competition for eBay would be welcome. I use eBay and there are few things it does that drive me nuts. For example, on an eBay search results page, I often see an extraordinary price for some audio gear that would nicely complement my collection of podcasting gear. But when I click through on certain items, the current prices for them are very different (and much higher) than what's displayed on the search results page. It's clear from the bidding history that the higher price was set long before I did the search. This happens quite often and it's a productivity killer since I wouldn't waste my time clicking through to certain listings if the search results showed me the actual current price.

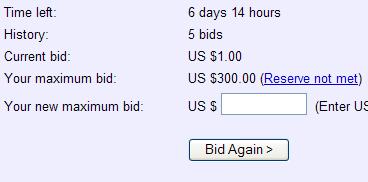

Another eBay feature that rubs me the wrong way is the way my bid for something will be below the reserve price, but above the initial price of the item (set by the seller), yet, for some reason (as shown below), the current bid doesn't reflect my maximum bid. This only seems to happen on items with a reserve price and as best as I can tell, it's either a bug or its a feature that's designed to keep the reserve price secret until a bid exceeds it. But, if you ask me, once people start bidding on an item that has a reserve price, others should be able to see those bids so that they don't waste their time feeding multiple bids into the system (trying not to bid too much while also seeing if they most they're willing to pay is above the reserve price).

Don't get me wrong. I love eBay. It has saved me thousands of dollars and I've even sold a few items through it. But there's clearly room for improvement in the user experience (as there always is with any product or service). Or, to the extent that Google has already re-invented a user interface to browser-based email (using AJAX in its Gmail), there's probably an opportunity to reinvent online auctions.

In his story, Bryant alludes to Yahoo!'s missteps in the the area of online payments and auctions. It's almost as if any attempt to take on eBay in any of its areas of core strengths is something not even Google should be thinking about. Bryant details why businesspeople should be careful about turning too much control over to Google and settles on "cautiously optimistic" for his assessment of the service. "Cautiously optimistic" is a phrase that covers you for any possibility. Regardless of how things turn out, no one can ever say you were wrong if you declared yourself as "cautiously optimistic."

Me, I'm optimistic about competition. There's nothing that motivates a dominant company to innovate like some stiff competition from a competitor with deep pockets (aka: fear). If, on behalf of the users of PayPal and eBay's auctions, competition from Google results in an overall improvement to the online auction and payment space, then it's all goodness. Today, you can imagine how much traffic Google must send eBay's way. Rarely do any of my searches for a product on Google not turn up some links to an eBay auction.

So, it's not very hard to imagine Google sending some of that link love to its own auction service where Google can get a bigger cut of the action (than it can through eBay's participation in Google's AdWords), particularly if it has its own payment service in place. After all, if PayPal is the only other big game in town, it wouldn't make a whole lot of sense to start an auction service and then send the transactional part of the business to your competitor. And, judging by the way users of both AdWords and Google Checkout will get a financial break, Google is clearly interested in the network effects of its reach. So, this (Google Checkout) is a piece of the puzzle that Google is better off having in place than not, should it decide to enter the auction business and further leverage that network effect... a prediction that I'm very optimistic about (read: no caution there folks). How can it not at this point?

Byrant talks a bit about switching and how that might be awkward. First, let's remember that the number of people using PayPal is a tiny fraction of the number of people that will one day be using it, or services like it. So, there's plenty of greenfield opportunity here for Google or any other entry into the market. Second, in terms of switching, I'm a PayPal user and I have taken credit card payments via PayPal which in turn takes a 2.5 percent cut out of my transactions. A 2.5 percent cut that could one day amount to thousands of total dollars. There's a Gulf station down the road from my house that sells gas for a nickel less than everybody else. The line of cars to get that Gulf's gas invariably stretches right out of the station's driveway. People are sensitive to pennies these days. With the right benefits, switching isn't difficult to imagine.

Disclosure: In the spirit of media transparency, I want to disclose that in addition to my day job at ZDNet, I'm also a co-organizer of Mashup Camp and Mashup University. Google, which is mentioned in this story, is one of the sponsors of both upcoming events. For more information on my involvement with these events, see the special disclosure page that I've prepared and published here on ZDNet.