Hewlett Packard Enterprise to spin off IT services unit, merge it with CSC

Hewlett Packard Enterprise said it will spin off its enterprise services unit and merge it with CSC in what equates to a $26 billion IT services giant.

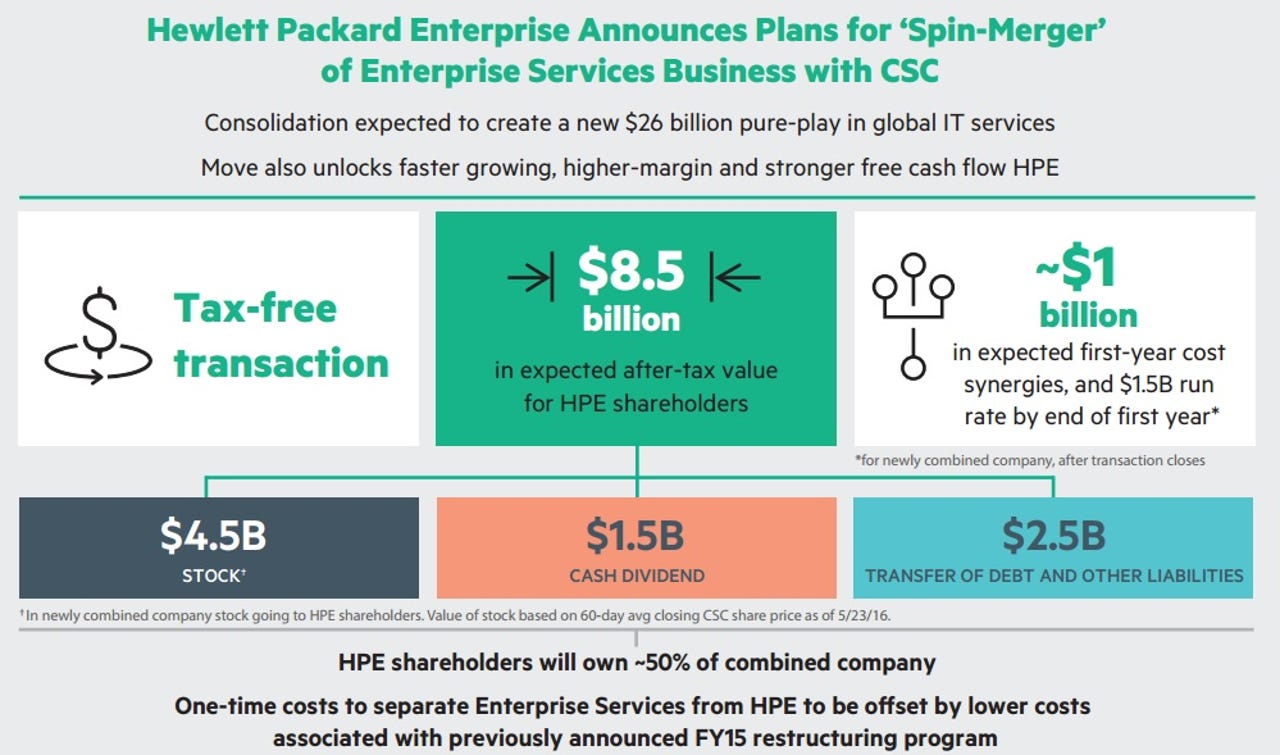

HPE said the transaction will net $8.5 billion for shareholders in a tax-free stock swap that will give them half of the new company as well as a cash dividend of $1.5 billion. In addition, the merger will deliver first-year cost savings of $1 billion in year one and $1.5 billion run rate exiting the first 12 months.

As for customers, HPE said that there are agreements in place to service existing customers. Mike Lawrie, CSC's CEO, will run the new company and HPE CEO Meg Whitman takes a board seat.

The deal is expected to close by March 31, 2017.

What's notable about the deal is that CSC recently split into two companies much like Hewlett Packard did to create HP Inc. and HPE. Dell also unloaded its services unit to NTT Data.

Whitman said in a statement that the spin-off and merger will enable a pure play IT services outfit to thrive. The pared down HPE will focus on cloud and data center infrastructure. On a conference call, Whitman said HPE's services business is stronger than it has been in recent years. "ES is on track for its long-term goals," said Whitman. "The new company will have greater agility and top notch management team."

The new services company will have annual revenue of $26 billion, more than 5,000 customers around the world with employees in multiple regions. The idea is to bring CSC's industry know-how to HPE's scale. On the cloud front, HPE's enterprise services unit counts Microsoft Azure as a partner. CSC is paired with Amazon Web Services.

Will focus help?

HPE's services unit delivered fiscal second quarter revenue of $4.72 billion, down from $4.82 billion in the same quarter a year ago. The services unit delivered earnings before taxes of $317 million for the second quarter.

However, HPE's services unit, the former EDS acquired by the old Hewlett-Packard, has struggled in recent years. Whitman's bet is that the CSC deal will improve focus. Why? HPE won't have to spend time revamping its services unit. CSC is focused on services, but will have to fend off IBM and Accenture before the deal with HPE closes.

Lawrie added on the conference call that the deal provides opportunities to both companies, which have only 15 percent overlap in accounts. "Our two companies have embarked on broad-based turnarounds," said Lawrie. He added that both services units have revamped, focused on customers and cut expenses. "The new company will be a global top 3 leader in IT services to lead our customers in their digital transformations," he said. "We will win against both merged and established players."

In a statement, the pared down HPE will "sharpen its focus on secure, next-generation, software-defined infrastructure that leverages a world-class portfolio of servers, storage, networking, converged infrastructure, as well as its Helion Cloud platform and software assets."

HPE will also focus on its Aruba business as well as the Internet of things, security and big data.

According to the company, HPE's services unit has made a lot of progress. In fiscal 2013, three customers accounted for 65 percent of services revenue. Now no one customer accounts for 10 percent. The company has also revamped its contracts and left low-margin deals.

Yet, the best HPE could get from its services business is stable performance. It'll be up to CSC to grow the business.

Second quarter results

The deal overshadowed a solid quarter that actually delivered revenue growth. The company reported second quarter earnings of $320 million, or 18 cents a share, on revenue of $12.7 billion, up 1 percent from a year ago. Non-GAAP earnings were 42 cents a share.

HPE's results were in line with expectations and revenue was a bit ahead.

As for the outlook, HPE projected non-GAAP third quarter earnings to be between 42 cents a share and 46 cents a share. Wall Street was looking for 48 cents a share.

Whitman said that the second quarter results were "our best performance since I joined in 2011."