How good were SAP's 2011 results?

I was traveling at the time when SAP pre-announced its Q4 and year end summary results but they didn't surprise me. Given the fact price increases for BusinessObjects solutions had fully kicked in, that Gartner estimated that line of business around $2.4 billion at the end of 2010 and SAP could take advantage of a full year of Sybase at what must be at least $1.2 billion, topping out at $18 billion was not that much of a stretch.

There was a slight surprise in SAP reporting HANA revenue coming in at around €160 million, well ahead of its €100 million target. It is not clear how much of this represents a shuffling of the shelfware decks among existing customers, how much of development and services have been counted into this number and how much is genuinely net new deals. The mobile component at €100 million needs further explanation. All Sybase Unwired Platform and/or mobile applications? Answers will have to wait until the analyst call, scheduled for 25th January.

Before continuing, readers might want to know why these relatively small numbers are important. Who cares?

SAP has had a rough few years so the fact it has exceeded overall revenue expectations is a relief for nervous investors and customers alike. The next couple of years will see customers making buying decisions across a swathe of potential partners in circumstances where SAP should be the natural partner of choice.

So how have they really got on? Happy talk aside, a different picture emerges when you take the likely impact of the Sybase and BusinessObjects acquisitions into consideration.

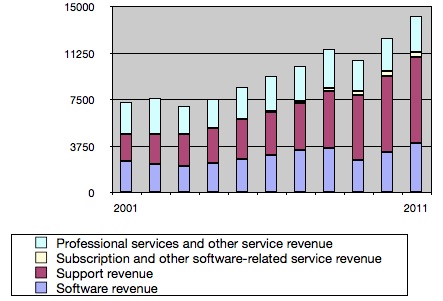

As far as I can tell for 2011, eliminating BOBJ and Sybase produces a notional net revenue figure of €11.1 billion compared to the reported number of €14.23 billion. That is around 4.5% above the 2009 reported revenues. In the overall detail, maintenance represents the standout number.

When you run the same elimination exercise for BOBJ and Sybase, the best position I can find is a flatlining of the core ERP license business. As things stand, it is far from clear whether HANA and mobile solutions will accelerate future growth. Here are some of the challenges I see looking ahead:

How does SAP stem the flow of business to SaaS/cloud players? SAP will argue the upcoming SuccessFactors acquisition provides the first solid plank where the SuccessFactors solution can take advantage of a large untapped market. SAP has done well at upselling in the past but this is not as simple as another on-premise add-on. When I speak with its midmarket customers who are in 'steady state' or upgrading infrequently, almost none of them have heard of SuccessFactors. Opportunity? Perhaps. What about CRM? SAP is taking a different tack, focusing on slices of functionality where there can be quick wins. This could be a large market if SAP can convince its sales organization that $50/month/user is a price worth pursuing.

What about HANA? I give full marks to SAP for hyping HANA to stratospheric levels. Vishal Sikka, SAP executive board member's infectious enthusiasm is genuine. Co-CEO Bill McDermott's touting of a $500 million pipeline remains worrying. SAP should be crushing it in sales but they should still be given credit for blowing out the €100 million promised deal value, albeit with caveats noted above. Now it has to mange the downswing in sentiment with solid use case announcements that go beyond 'feeds, speeds and business intelligence.' Case studies are thin on the ground but CIOs are getting the message. I've met customers who believe HANA is transformational albeit SAP has only scratched the surface. This creates the 'country club' effect that helps SAP knock over sales prospects in a manner similar to the way it drove mega growth in the mid 1990s. SAP's intention to release a HANA-ised COPA application (financial analysis) will do well across much of the portfolio. The $200,000 price point looks attractive. What's needed are a slew of HANA-ised apps where transformative value is either self evident or point towards more than incremental advantage. Right now, much of HANA development is locked up in bespoke systems where it is not clear if SAP will have significant opportunities to productise.

Mobile is a work in progress. Applications that are ready to go are thin on the ground. (Update: John Moy provides a mobile apps map as at 31st January, 2012.) This is disappointing. Every vendor has issues around platform support (iOS, RIM, Windows, Android?) but I would have expected to see much more progress by this point in the cycle. Some customers are sidestepping SAP, preferring to develop themselves. Developers have their own issues to contend with, not least a less than fully formed on-ramping mechanism plus ready access to infrastructure. Even some of SAP's loyalest supporters are up in arms. While there are plenty of good intentions, there are far too many holes in execution. SAP would do well to stop yapping about how it runs the Apple AppStore and concentrate on getting its own ducks in a row.

Collaboration. This is a topic where SAP has a shot at shining. What? When Yammer, Chatter, Jive and a slew of others are already established? SAP has embedded collaborative features in Sales OnDemand that make it an attractive application precisely because you don't have to step outside the application to complete essential tasks. Take that idea into other applications and SAP offers something genuinely differentiated.

Rapid deployment solutions. SAP's latest attempt to put the long implementation cycles and procession of failures behind it may yet yield incremental revenue. I rather suspect it will more likely turn into a Trojan Horse designed to encourage the dusting off of shelfware and so help preserve the maintenance stream. The likely impact is modest at best.

Conclusion. SAP 2011 full year earnings call will be interesting. On the one hand, SAP has done a great job managing Street expectations and generating some excitement among customers. On the other hand, it is relying on an expanded portfolio of solutions to fuel future growth. That could have a substantial sales and marketing cost impact. There is plenty of work ahead but don't be surprised if SAP manages to pull all these threads together into a cohesive whole.